4 Common Support Questions

At RazorPlan support we look to provide the assistance needed to not only understand RazorPlan software, but also the client files you are working with.

To help you better understand the program, below are 4 of the most common questions we receive at support. Even if you have not run into these situations before, understanding these items will help you become more familiar with RazorPlan.

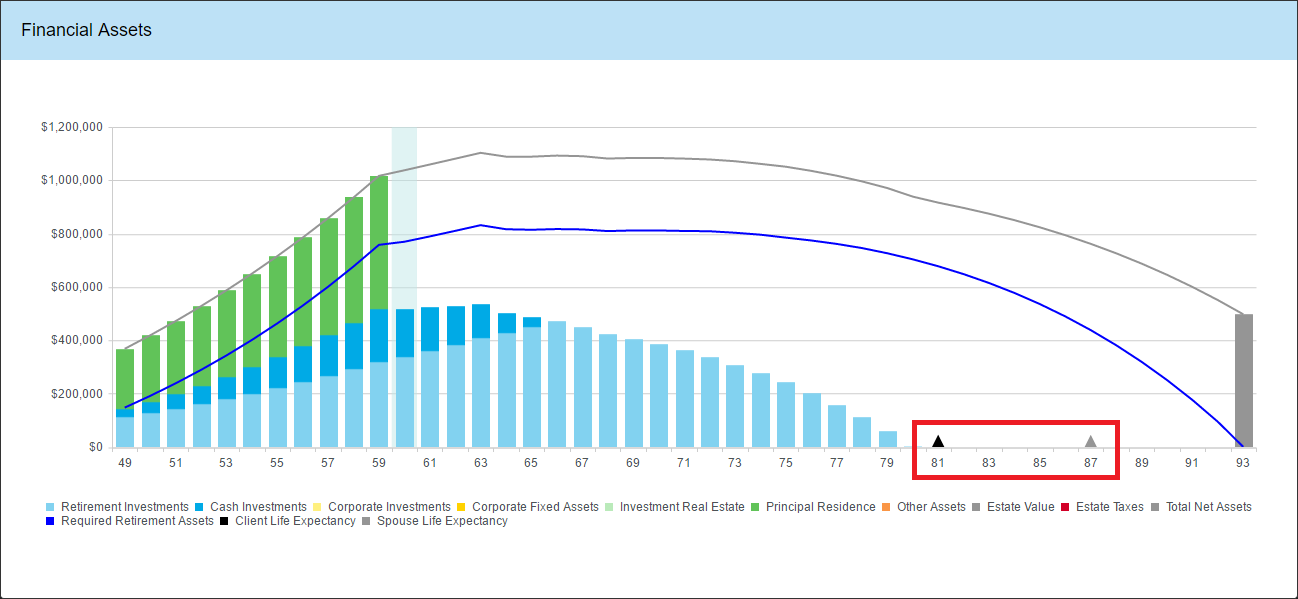

Why Doesn’t The Life Expectancy I Enter Match What Is Displayed In The Charts?

When viewing the charts screen, the statistical life expectancy of the client and spouse are both denoted by triangles as seen in the above image. In this example, the spouse’s statistical Life Expectancy is age 84, however the triangle on the cash flow chart shows age 86. The reason for the difference is due to the nature of the charts themselves. The age on the charts is displayed in the client’s age. The spouse’s statistical life expectancy is in fact age 84, but as the spouse is 3 years younger than the client this displays in the chart as the client’s age 87.

When viewing the charts screen, the statistical life expectancy of the client and spouse are both denoted by triangles as seen in the above image. In this example, the spouse’s statistical Life Expectancy is age 84, however the triangle on the cash flow chart shows age 86. The reason for the difference is due to the nature of the charts themselves. The age on the charts is displayed in the client’s age. The spouse’s statistical life expectancy is in fact age 84, but as the spouse is 3 years younger than the client this displays in the chart as the client’s age 87.

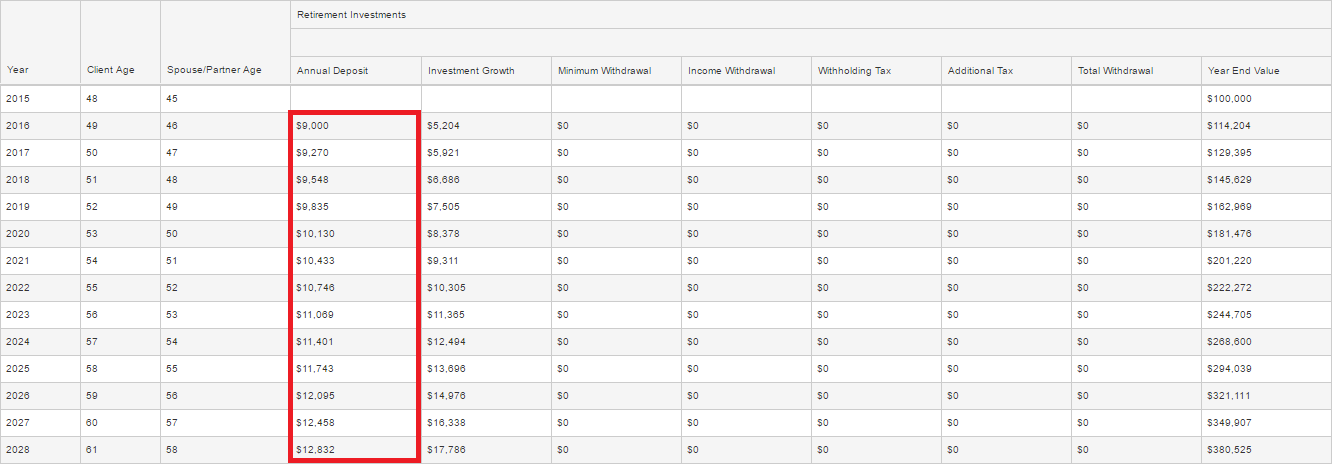

Why Do Deposits Increase Over Time?

RazorPlan allows you to enter a stream of contributions/deposits into various investment accounts. By default the software will automatically increase these contributions with inflation. This will cause the deposit amount to increase each year by the inflation amount entered in Step 5 of Data Entry.

You can see in the above example that because “Index At Inflation” is turned ‘On’ for the client’s RRSP, we can see a yearly increase to the future contributions. To maintain a steady amount of deposits simply select ‘No’ from the drop-down and all future deposits will remain static.

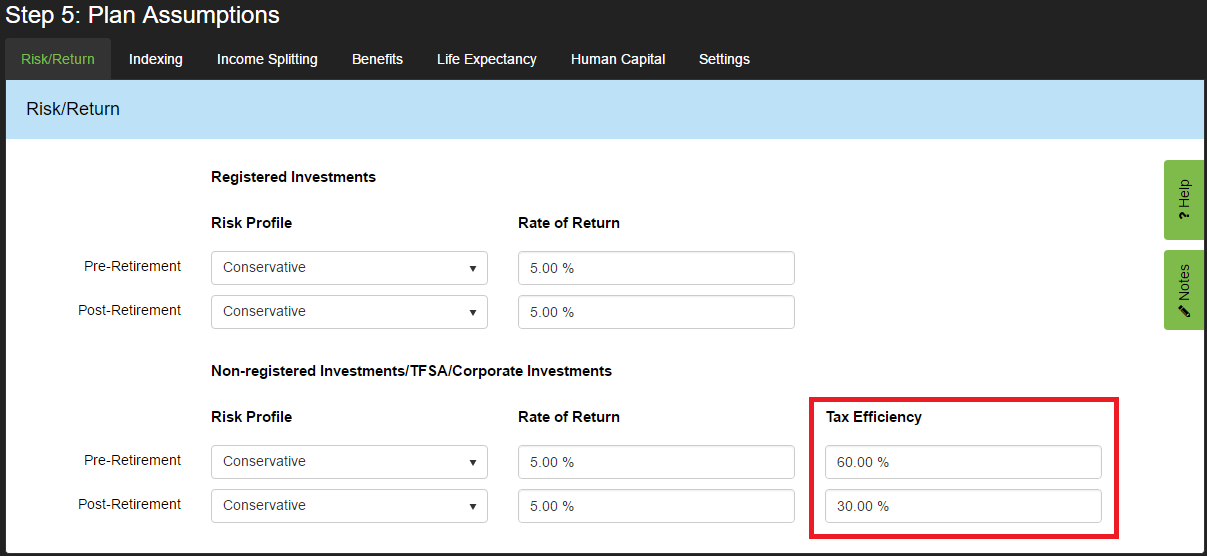

Do I Include TFSA Assets When Estimating My Client’s Tax Efficiency?

Tax Efficiency is Razorplan’s way of handling asset allocation. By grouping together investments and assigning them a Tax Efficiency % you can model the effects of any portfolio allocation without complex data entry.

Tax Efficiency is Razorplan’s way of handling asset allocation. By grouping together investments and assigning them a Tax Efficiency % you can model the effects of any portfolio allocation without complex data entry.

However, Tax Efficiency does not impact any assets held within RRSP or TFSA assets as asset allocation does not impact taxation. Tax in RRSPs will always be deferred until withdrawn and TFSAs will grow tax-free. Because of this, when calculating the Tax Efficiency of a client portfolio, only focus on the assets held within a Non-Registered or Corporate Investment account.

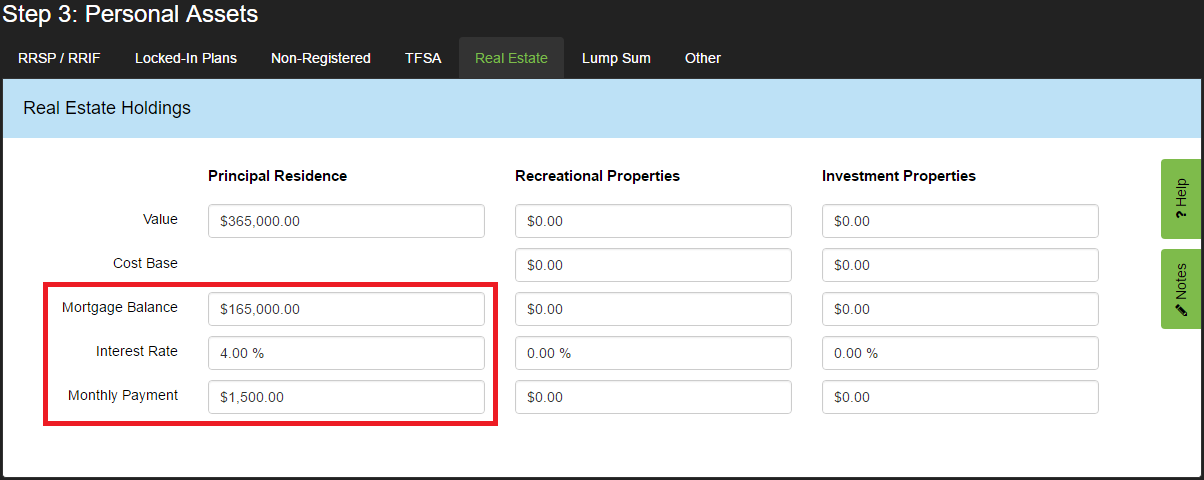

When entering a real estate property, RazorPlan includes the ability to enter a client’s outstanding mortgage balance and payment information. This information will allow the software to track the decreasing mortgage liability over the course of the plan.

When entering a real estate property, RazorPlan includes the ability to enter a client’s outstanding mortgage balance and payment information. This information will allow the software to track the decreasing mortgage liability over the course of the plan.

Leave a Reply

Want to join the discussion?Feel free to contribute!