Collect Data

The 80/20 rule of personal finance states that 80% of a retirement plan is created with 20% of the client’s information. The RazorPlan data entry wizard focuses on the 20%, and is the reason why you can create a financial analysis in under 15 minutes that will engage your client in meaningful discussion. This will allow you to further qualify clients and eliminate wasted time and effort on people that do not recognize the value you provide.

This Client Questionnaire mirrors the RazorPlan data entry wizard and collects everything needed to create a retirement analysis complete with estate projections in just minutes.

RazorPlan Advisor Guide

This guide provide information on using the client questionnaire and program.

Getting Started Video

This short video explains how to get started in RazorPlan and collect data.

Financial Assessment

With 80/20 data entered in RazorPlan, you are now ready to review the Retirement Options chart with your client. The Retirement Options chart analyzes the 4 Primary Planning Options available to the client. These 4 options are the basic changes, or Next Best Actions, needed to eliminate future cash flow excesses or deficiencies. Combined, they will provide answers to the most common questions people have about their retirement:

- Are my goals realistic based on my current income?

- Where should I be invested based on the goals I have?

- How much of my income do I need to contribute to my goals?

- What is the one thing I should focus on accomplishing first?

This Financial Review Checklist will streamline your analysis and help you identify any areas of concern that may prevent your client from achieving their goals, and the next steps that should be taken.

What Matters Most

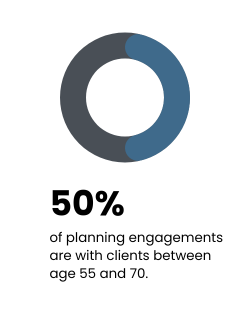

Before you can advise a client on an appropriate decumulation strategy, you need to first understand what matters most to them when spending what they have taken a lifetime to accumulate. Are they most interested in preserving their estate, or maximizing their ability to spend? How long do they need their money to last and what criteria will they use to measure the value of your recommendations? Make the wrong assumptions when recommending a decumulation strategy and you risk costing your client hundreds of thousands in lost wealth over their lifetime.

This Decumulation Checklist will help your client to communicate what is most important to them in this phase of their retirement planning journey.

Decumulation Advisor Guide

This guide outlines how to interpret the results of the Decumulation Checklist.

Decumulation Checklist Video

This short video explains the Decumulation Checklist.

Government Benefits

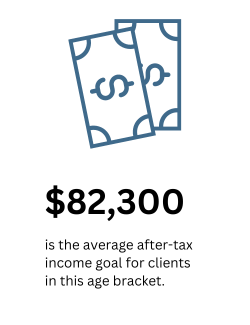

For many of your clients, Canada Pension Plan (CPP) and Old Age Security (OAS) benefits will represent an important source of guaranteed income in retirement. Many people will apply for benefits as soon as they are eligible without much consideration of the bigger picture and the importance of mitigating longevity risk. Optimizing the lifetime value of government benefits is a key component of an effective decumulation strategy, and can help to significantly reduce the chance your client will outlive their money.

This CPP/OAS Checklist will help your clients better understand when and when not to consider applying for CPP and OAS benefits as part of their overall decumulation strategy.

Income Planning

When a client desires more income than their savings will provide, they may want to unlock some of the equity in their home by downsizing. As an alternative, there are strategies that use the equity to create tax-free income without having to move. Commonly referred to as a reverse mortgage line of credit, these products when combined with permanent life insurance create an Insured Retirement Plan (IRP). The home equity line of credit is used to create monthly tax-free income, while the life insurance preserves the value of the estate.

An IRP can be an effective financial strategy, but it is not for everyone. Like any complex financial strategy you need to weigh the pros and cons before recommending it to a client.

This Income Focus Checklist will help to explain to a client how the strategy works, and if it is something they may want to consider.

Income Focus Advisor Guide

This guide outlines how to interpret the results of the Income Focus Checklist.

Income Focus Checklist Video

This short video explains the Income Focus Checklist.

Legacy Planning

When recommending a decumulation plan to a client, there are three key performance indicators (KPI) that should be considered. These include after-tax retirement income, pre-tax investment value, and after-tax estate value. Knowing what your client’s decumulation biases are (see What Matter Most above) will determine which KPI should be used in your analysis. For clients that have a goal to provide an estate for the benefit of loved ones, including a life insurance recommendation as part of a decumulation plan may improve overall results.

An Estate Bond is a planning concept that takes advantage of the tax-preferred treatment of permanent life insurance, but it is not for everyone. You need to weigh the pros and cons before recommending it to a client.

This Estate Focus Checklist will help to explain to a client how the concept works, and if it is something they may want as part of a broader decumulation plan.