Allocate Withdrawals

Razor Academy

To calculate the value added with proper decumulation planning, the Allocate Withdrawals setting in RazorPlan gives you the ability to enter a blended withdrawal priority between Non-Registered/TFSA and RRSP/RRIF assets.

Rebecca and Robert Davis

Rebecca and Robert Davis are both age 60 and have recently retired. With $1 million in investments, CPP & OAS, and Rebecca’s pension, they feel they have more than enough to support their $7,500/month lifestyle in retirement.

Their main concern is how the large tax bill created by their RRSP investments will impact the value of their estate.

Disclaimer: The results and recommendations outlined in this example are for illustrative purposes only. The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline.

To compare the impact that different decumulation strategies can have on lifestyle, taxation, and estate value using the Allocate Withdrawals setting in RazorPlan.

Rebecca and Robert’s financial resources include the following:

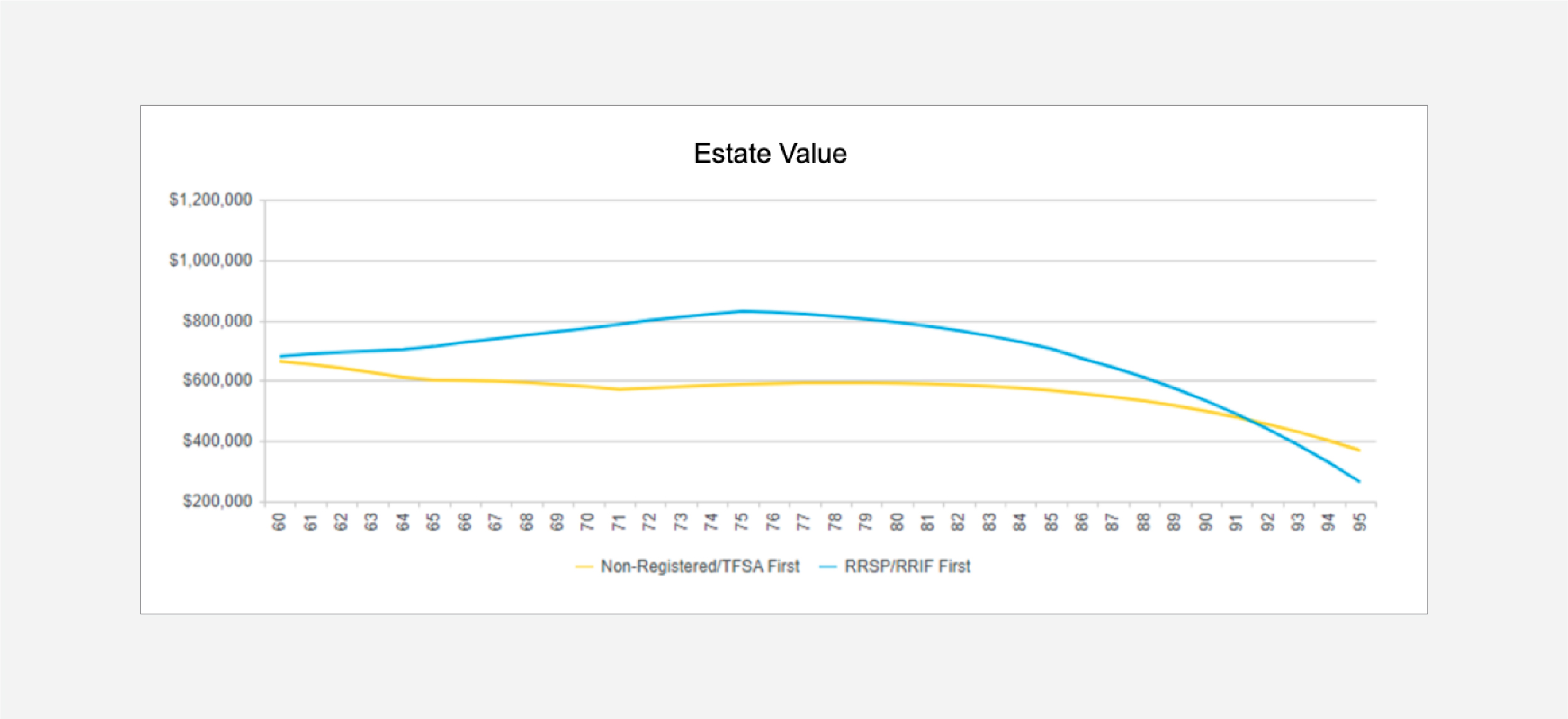

When you compare decumulation of an RRSP/RRIF First strategy to a Non-Registered/TFSA First strategy, RRSP/RRIF First provides a significantly larger estate throughout most of their retirement. Only should one of them live past age 92 does prioritizing Non-Registered/TFSA First provide a larger estate. We can see this comparison outlined below by focusing on the changing estate value throughout retirement. But is this the best strategy to maximize the value of their estate?

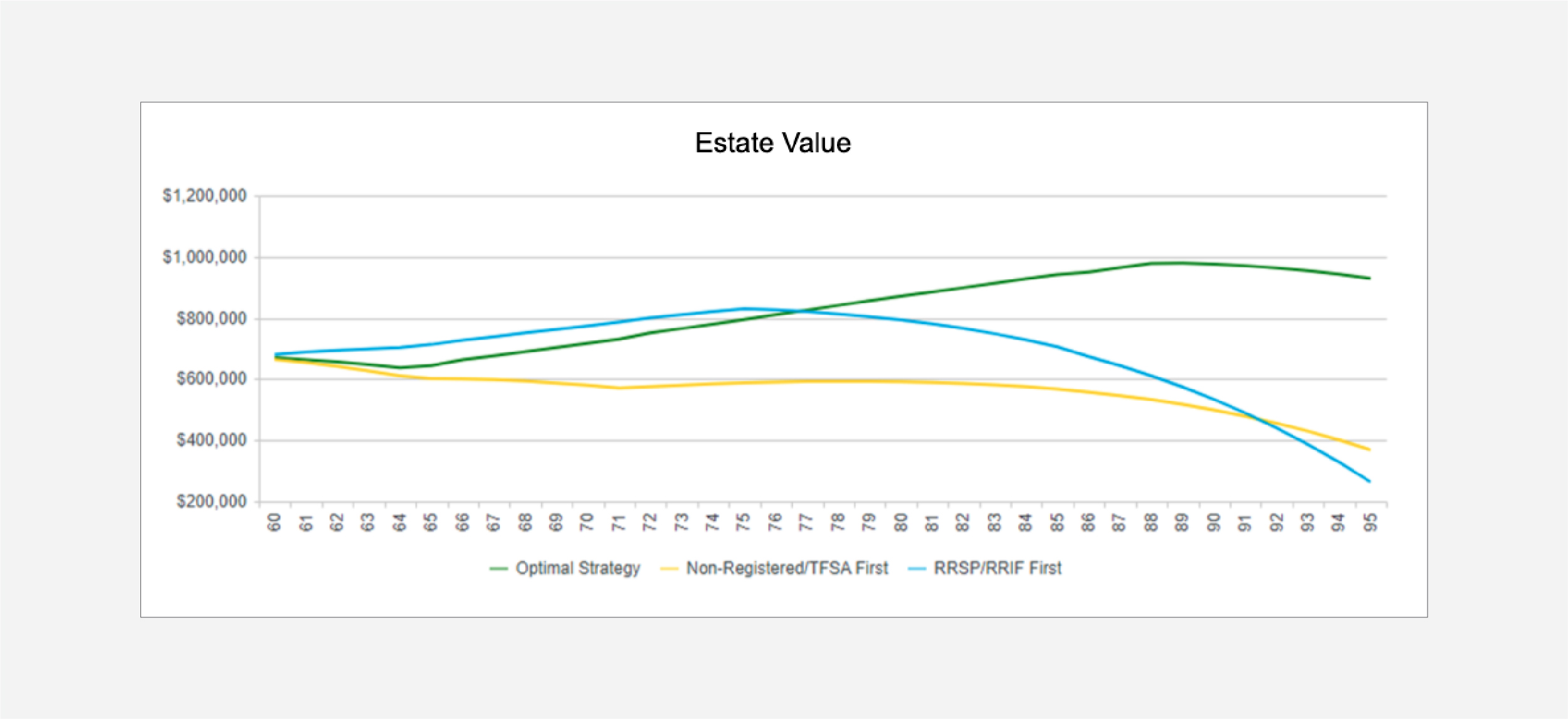

By applying a blended withdrawal priority between RRSP/RRIF and Non-Registered/TFSA assets, we can create greater value than either strategy provided independently. We can do this by making the following recommendations.

Multiple scenarios can be created to test various combinations of this data to identify the optimal strategy.

After recalculating RazorPlan we can see the Optimal Strategy created by our recommendations result in a significantly larger estate starting at age 77 compared to RRSP/RRIF First. This is an increase of more than $665,000 by age 95. The small reduction in estate prior to age 77 is primarily due to replacing CPP income from age 60 to 64 and is something that will need to be discussed with Rebecca and Robert to ensure they are comfortable with this approach.

How To Build with RazorPlan:

This case requires the following account level assumptions set on the Settings tab in Your Account. Results will vary if these assumptions are not set up in your account.

Select Razor Academy from the RazorPlan home screen. From there select “Allocate Withdrawals” and click Download. The sample case will download to your RazorPlan account and automatically open.

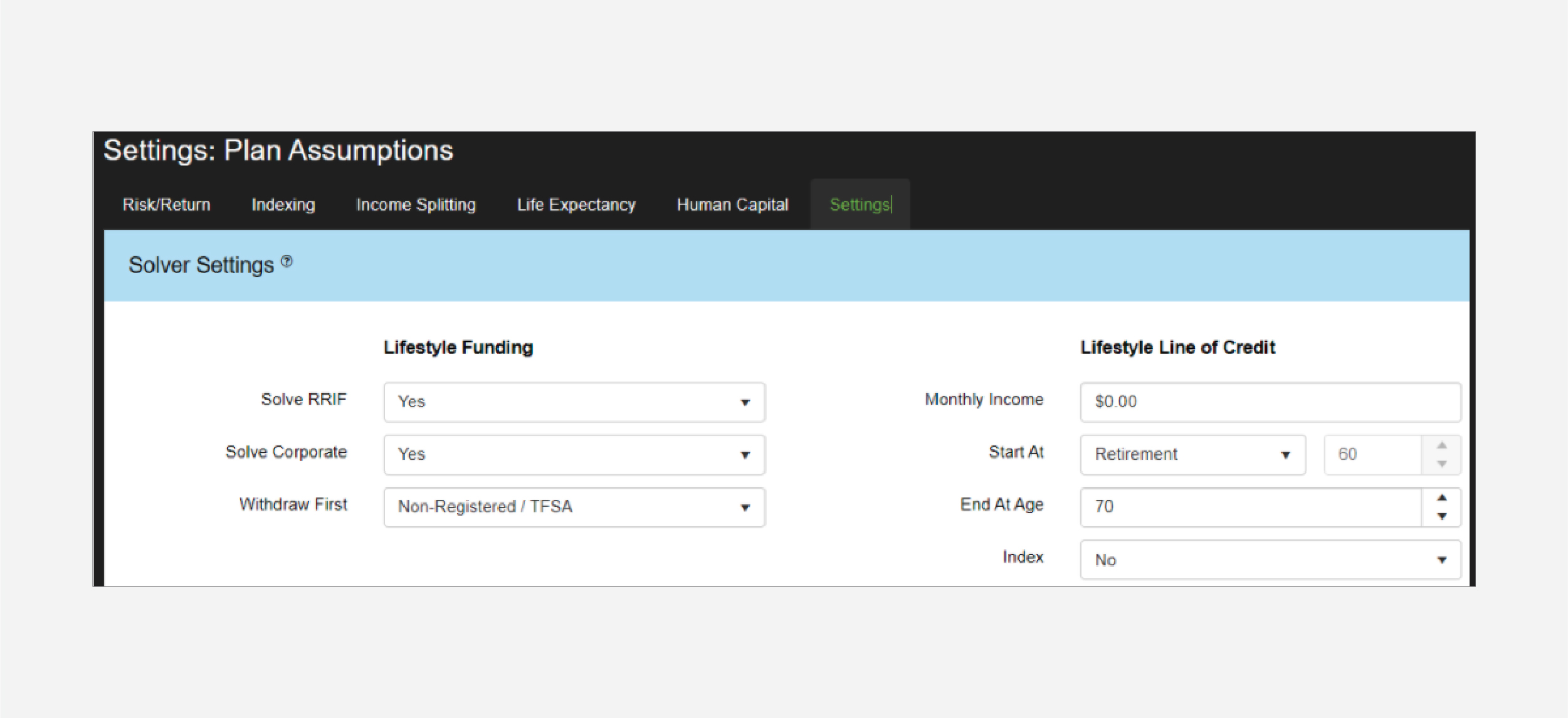

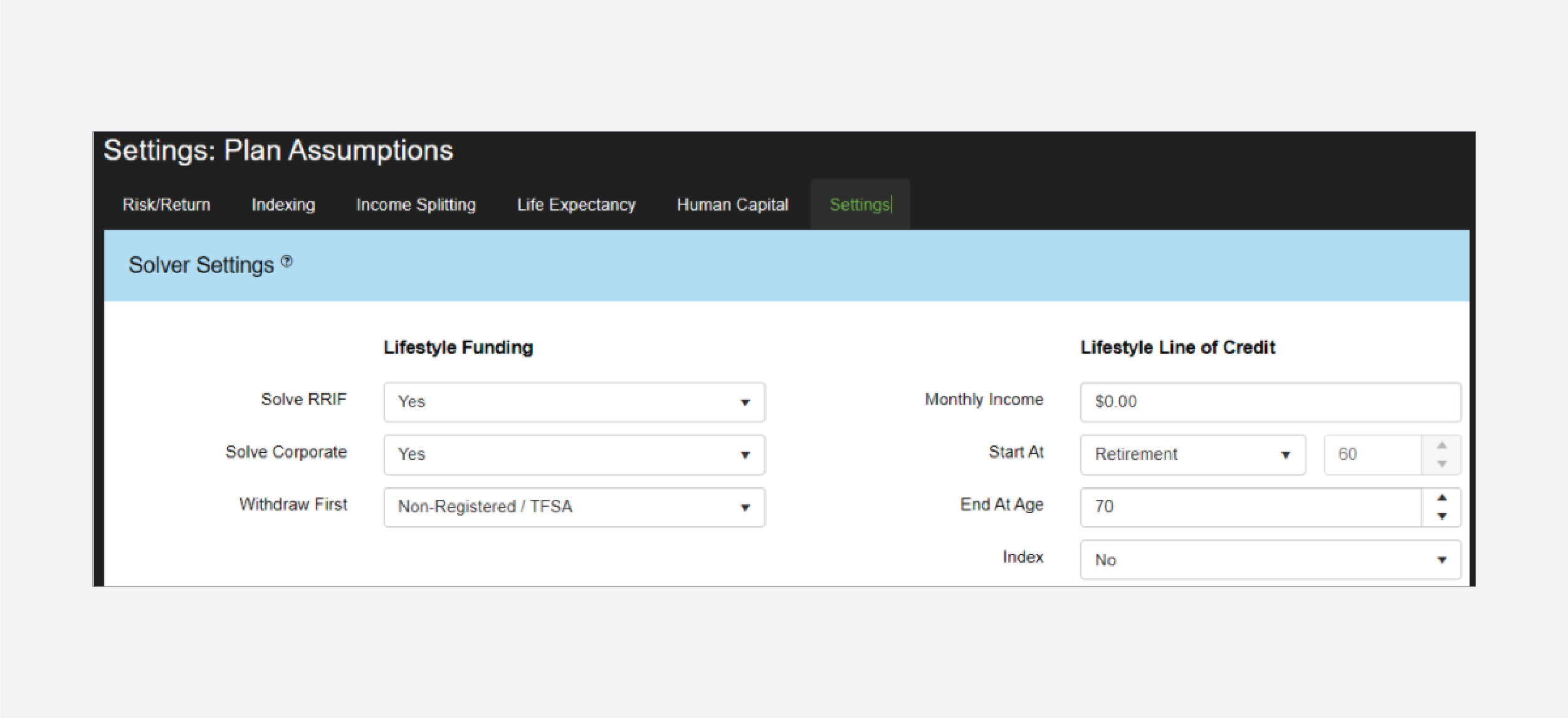

The scenario included in the downloaded Allocate Withdrawals file has been set to decumulate RRSP/RRIF assets first. In Settings you can see that Solve RRIF is set to “Yes” and Withdraw First is set to “RRSP / RRIF”. This tells the software to prioritize the drawdown RRSP/RRIF assets over Non-Registered/TFSA assets. Setting Solve RRIF to “Yes” ensures that the software is able to draw more than the RRIF Minimum when needed.

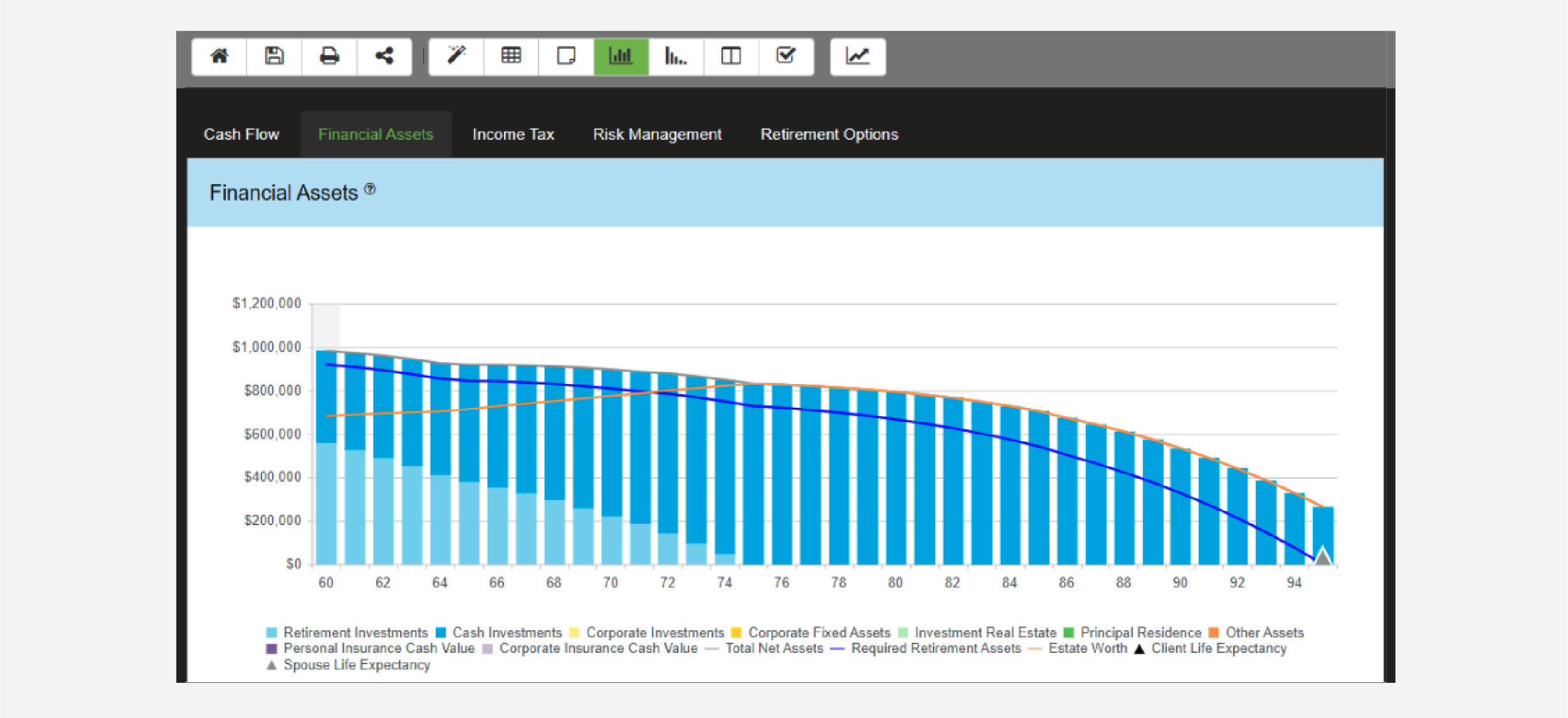

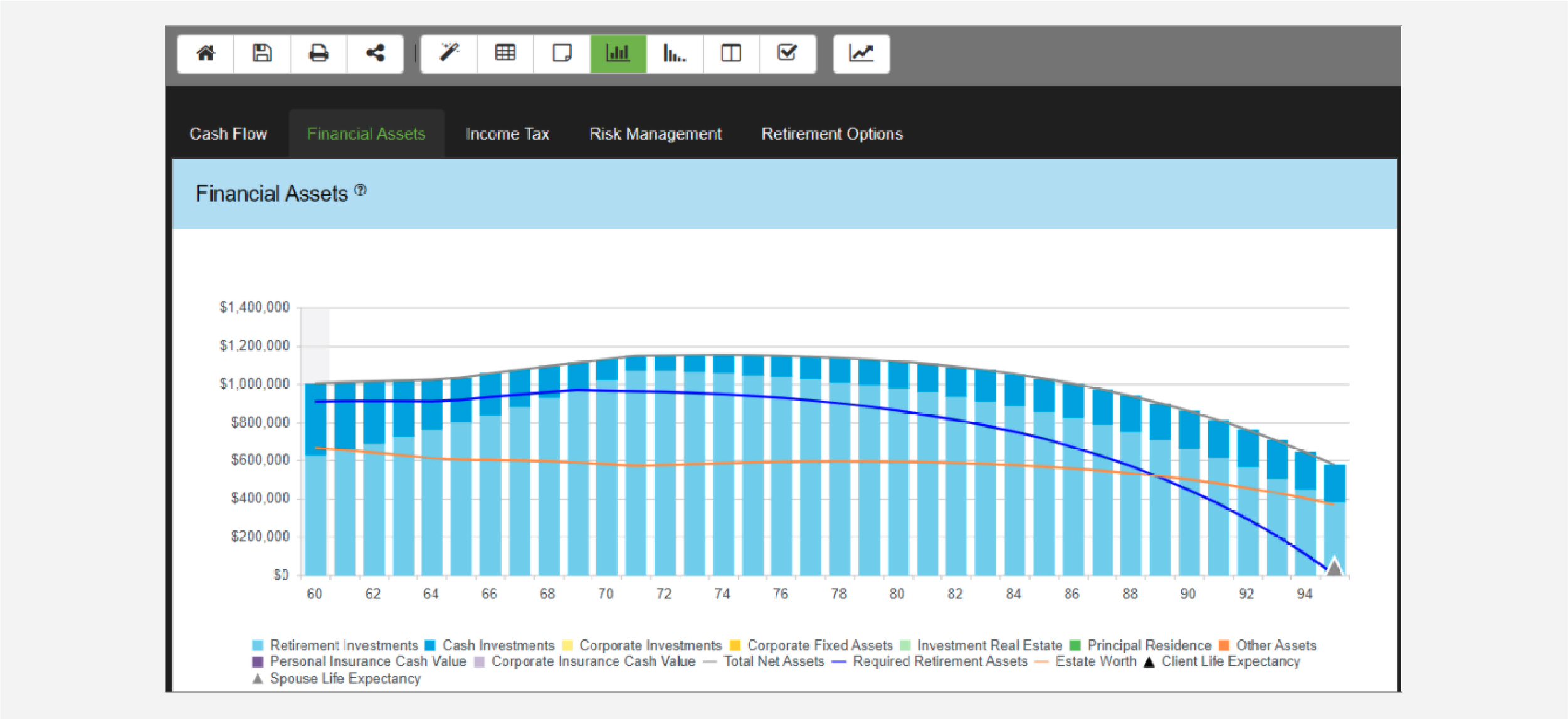

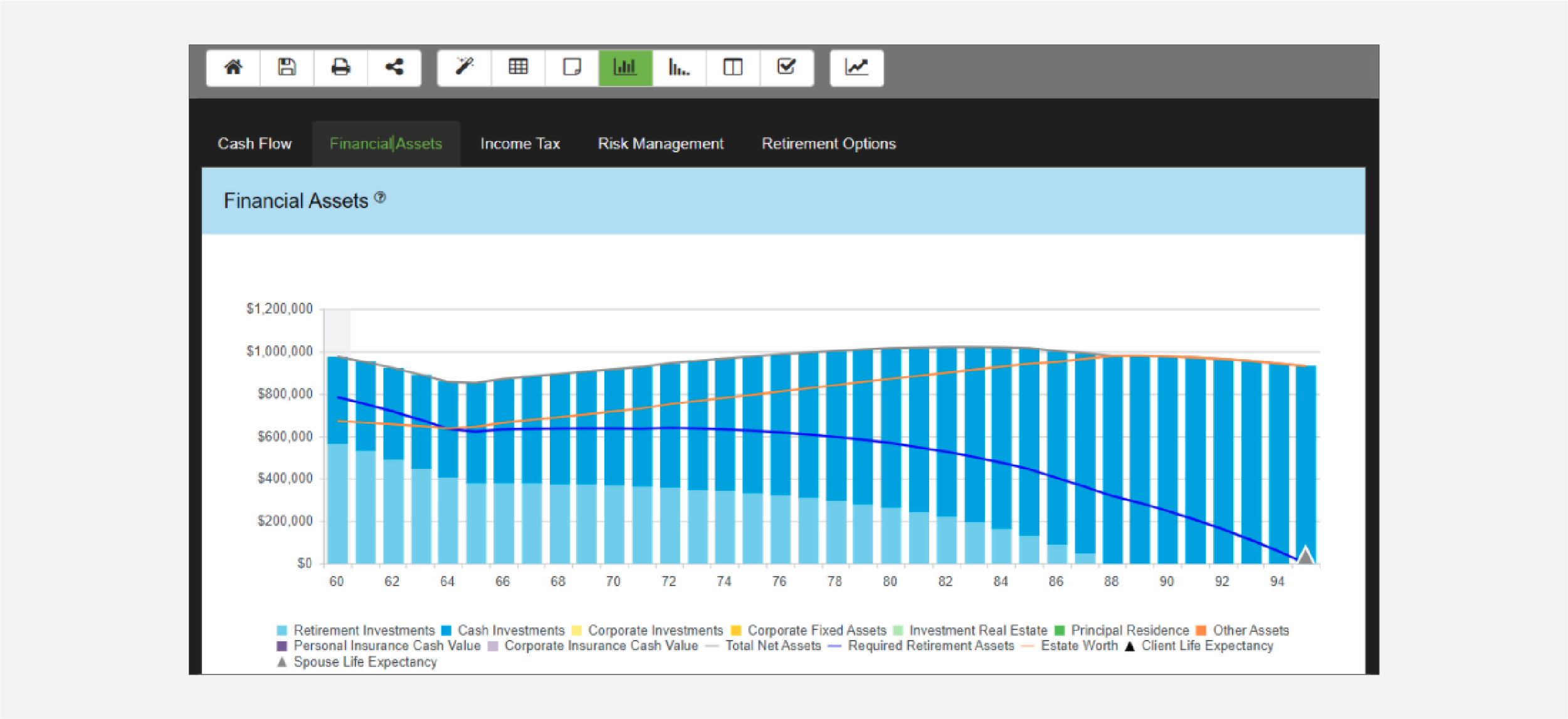

Next view the Charts screen and the software will automatically calculate the analysis. In the Financial Assets tab, the Estate Value is displayed by the orange colored line which rises slowly until age 76 and ends at just over $200,000 by age 95.

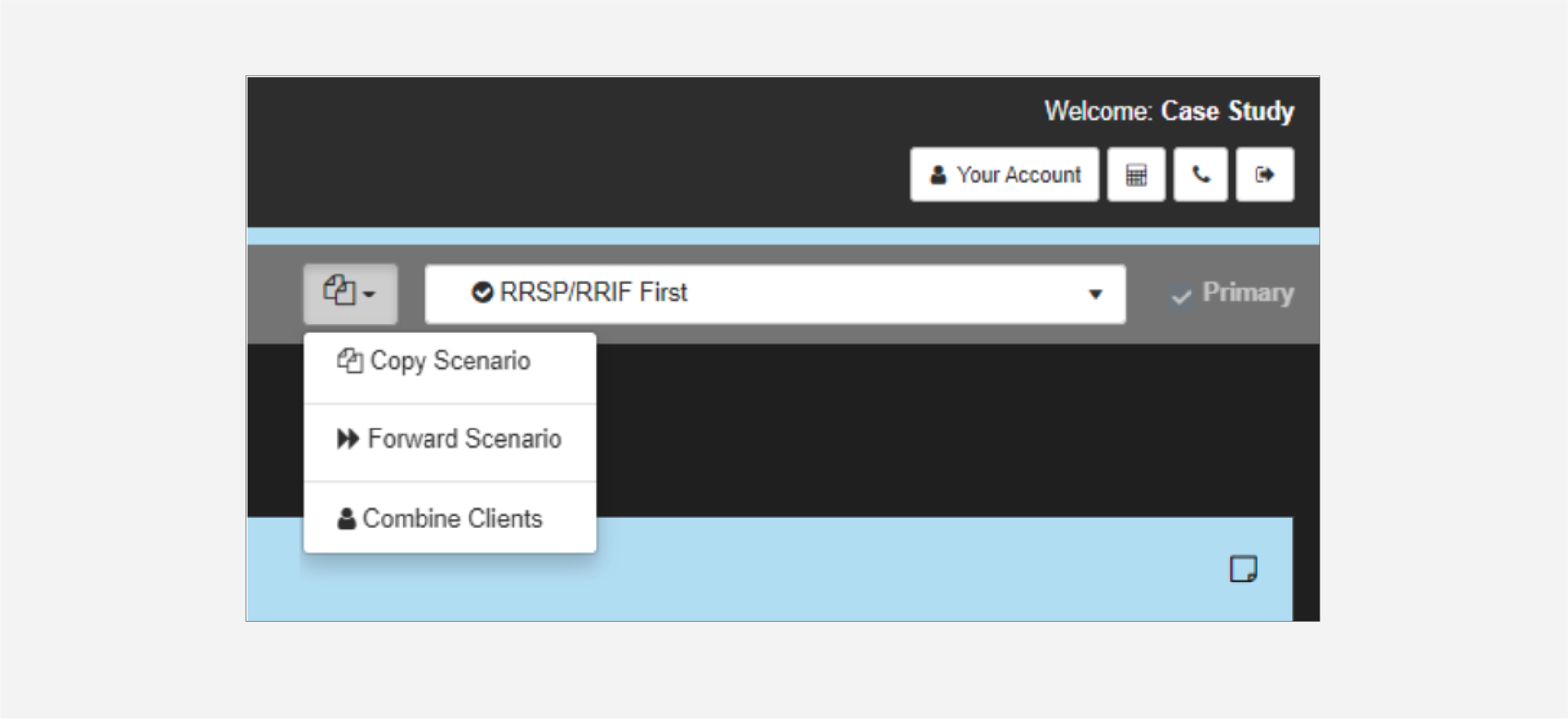

Click the Scenarios drop-down menu and select Copy Scenario. Name this new scenario “Non-Registered/TFSA First”. Once created, the new scenario will load. You can return to the RRSP/RRIF First scenario at any time through the Scenario list drop-down.

Now that you’ve created the new scenario, set Withdraw First to “Non-Registered / TFSA” in Solver Settings as demonstrated below.

With the Withdraw First setting set to “Non-Registered / TFSA”, view the Charts screen and the software will automatically calculate the analysis. In the Financial Assets tab, the Estate Value remains relatively flat throughout the planning horizon, only exceeding RRSP / RRIF First in the last 5 years of the analysis.

Using a simple withdrawal order approach, the analysis confirms that decumulating “RRSP / RRIF” first will provide Rebecca and Robert with the greatest over-all estate value.

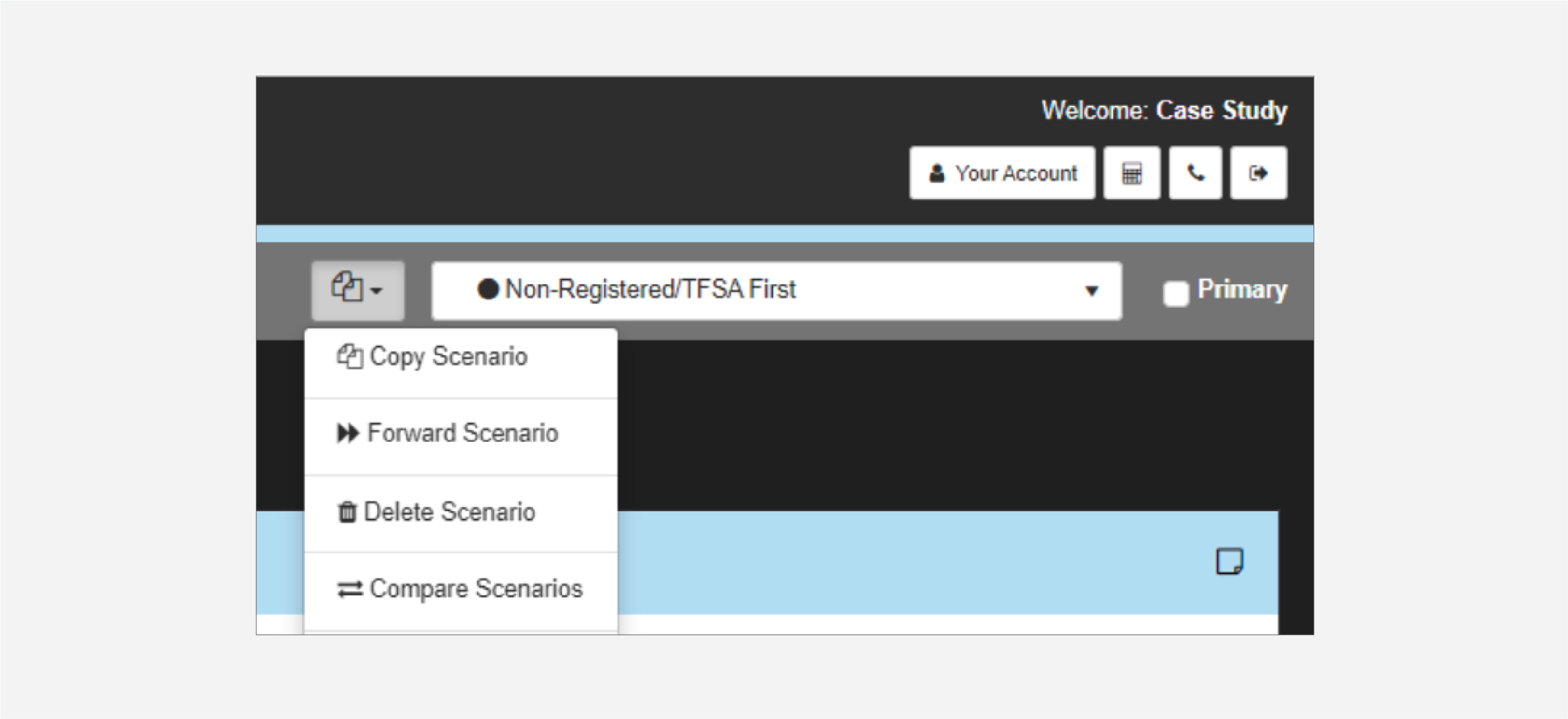

Click the Scenarios drop-down menu and select Copy Scenario. Name this new scenario “Allocate Withdrawals”. Once created, the new scenario will load. You can return to either of the previous scenarios at any time through the Scenario list drop-down.

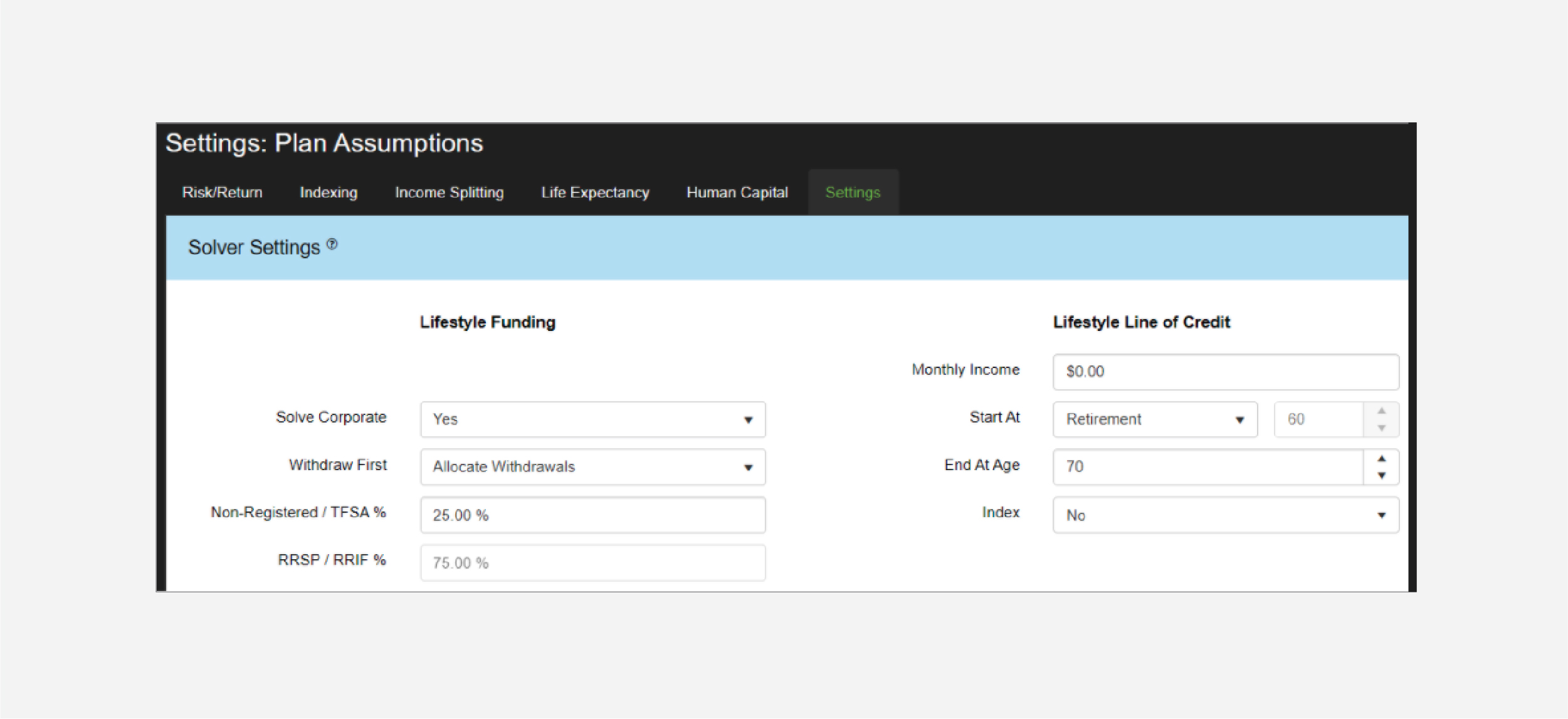

Now that you’ve created the new scenario, set Withdraw First to “Allocate Withdrawals” in Solver Settings as demonstrated below. Once Allocate Withdrawals is selected, you will have the option to enter a split of 25% Non-Registered/TFSA and 75% RRSP/RRIF.

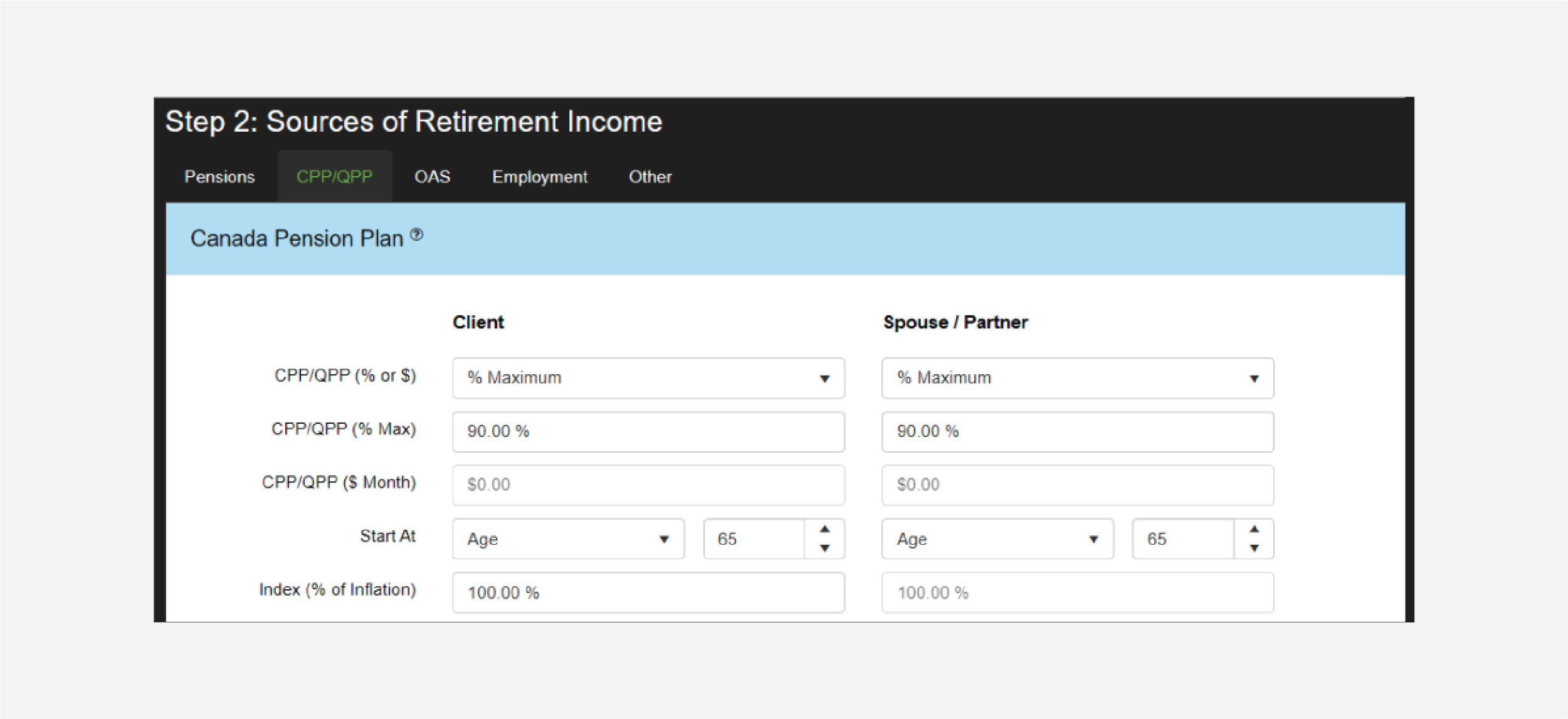

To increase the expected benefit of CPP/QPP, increase the start age from age 60 to 65 for both clients. Additional benefits may be possible if CPP/QPP start age is increased further, but this increase my have a negative impact on future tax or OAS claw-back.

With the Withdraw First setting set to “Allocate Withdrawals” and a CPP/QPP start age of 65, view the Charts screen and the software will automatically calculate the analysis. In the Financial Assets tab, the Estate Value continues to rise throughout retirement, adding more than $665,000 in Estate Value by age 95 compared to the RRSP / RRIF First scenario.

Using a simple withdrawal order approach could potentially cost Rebecca and Robert more than $665,000 in lost Estate Value.

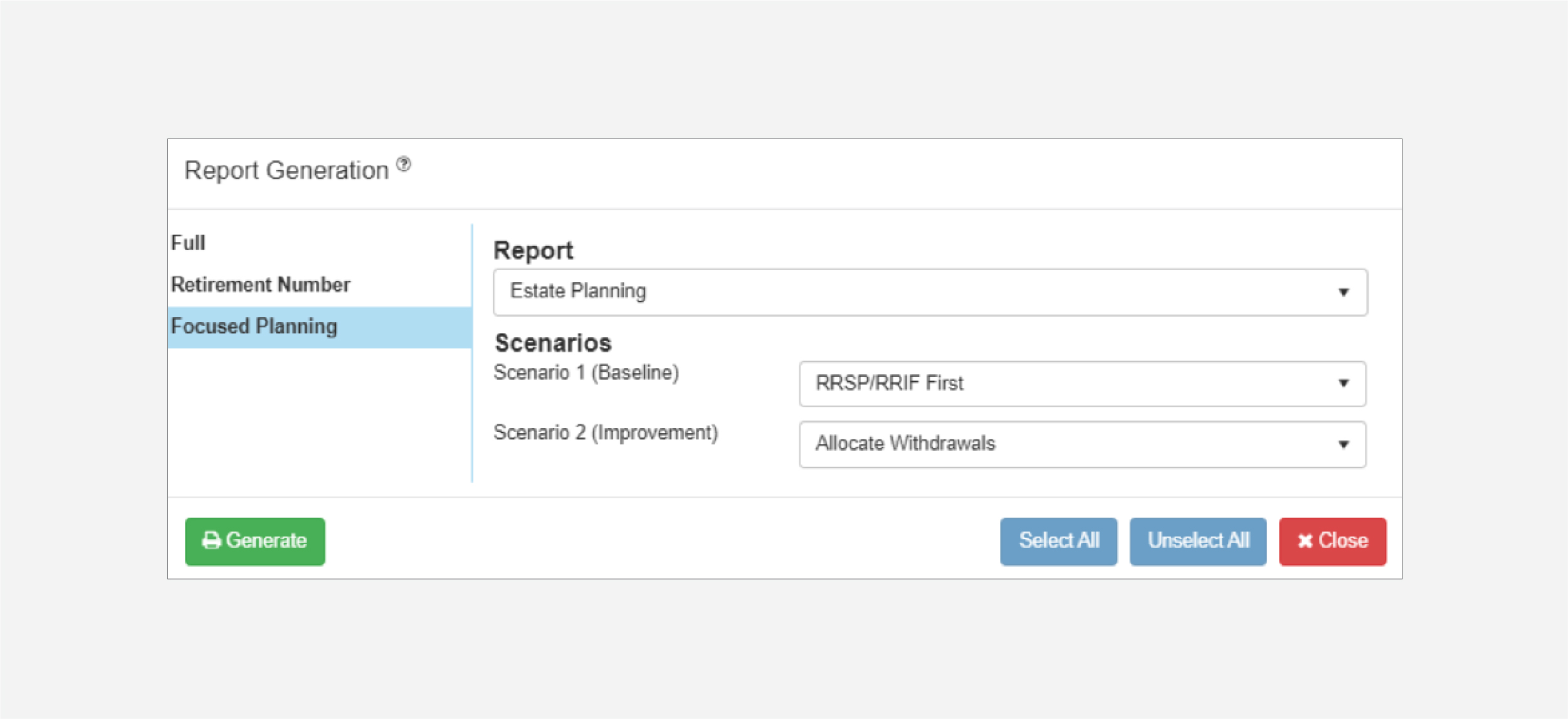

For a client-friendly comparison of each scenario, generate a Focus Planning report. These reports are designed to speak to a specific planning focus and the recommendations you are making.

To generate a Focus Planning report, click the Printer icon from the RazorPlan toolbar and choose Focus Planning. From here you can select the type of report and scenarios to use. For this example, the Estate Planning version will be the most appropriate because of the estate-focused nature of this case.

When selecting the scenarios to use, Baseline should represent your starting point (RRSP/RRIF First) and Improvement should represent your suggested solution (Allocate Withdrawals). After generating the report, you’ll be able to identify both the impact of your recommendations and the value of your advice.