Early Retirement Sample File

Razor Academy

Can Howard and Shirley afford early retirement and leave an estate for their children?

Howard and Shirley Lee

Howard is 53 and Shirley is 51. Together they earn $250,000 a year and live in Ontario. They have 3 grown children, Tom age 31, Richard age 29 and Harriet age 25.

Last Howard inherited $1,250,000 from his uncle. In addition to the inheritance, together they have $1,000,000 in RRSPs and TFSA of $190,000. They want to know if they can retire early using the income from the inheritance without spending the capital.

“We want to leave my uncle’s money to our kids, if not more. So, any retirement plans we make must preserve the capital.” Howard tells his advisor when they meet to adjust their retirement goals.

Disclaimer: The results and recommendations outlined in this example are for illustrative purposes only. The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline.

In addition to qualifying for OAS and 85% of maximum CPP they have the following assets:

Howard’s financial resources

Shirley’s financial resources

The only other major asset they have is their home which is valued at $750,000 and is mortgage free.

Howard and Shirley want to retire at Howard’s age 55 with $90,000 after-tax income to age 95 and, in addition to the value of their home, they want to leave $500,000 to each of their 3 children as an inheritance.

How To Build with RazorPlan:

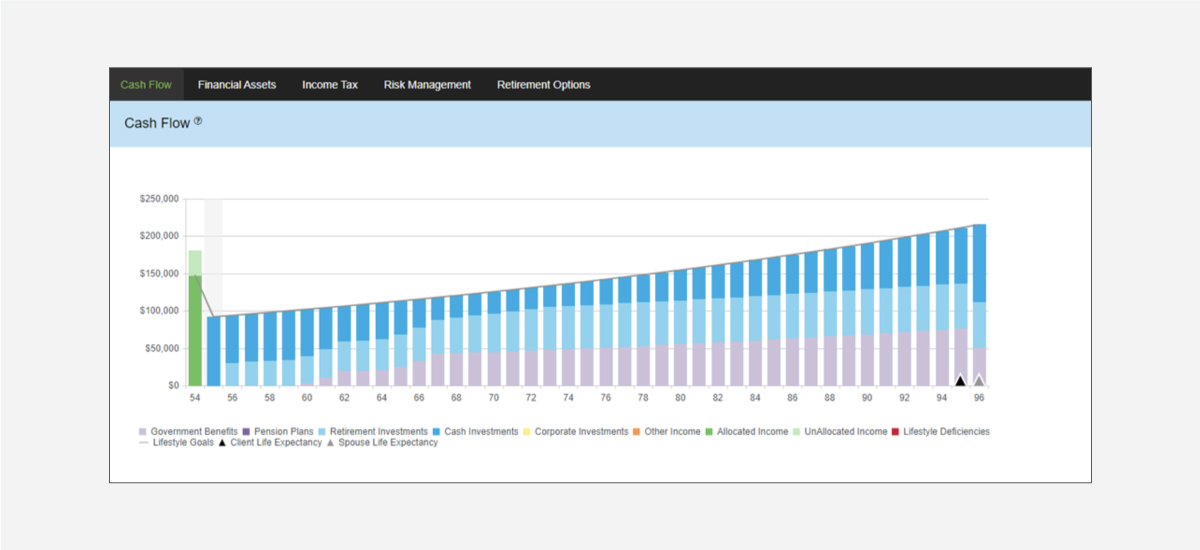

Review the Current Situation Scenario for an outline of their current situation. Based on what they are currently doing, using the Cash Flow Chart in RazorPlan you can clearly see that they will have adequate investment assets to meet their goal of spending $90,000 / year after-tax.

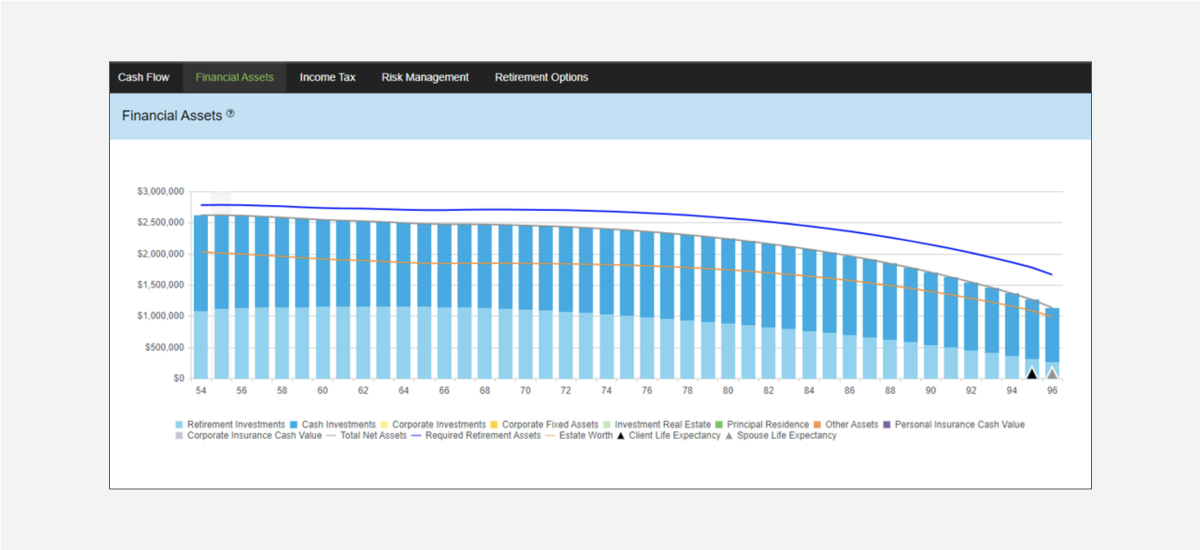

But an examination of the Financial Assets Chart shows that the amount of capital that will be needed (Required Retirement Assets) to provide each child with $500,000 as a cash inheritance, is more that they are projected to have.

A minimum estate value of $1,500,000 was entered through Data Entry / Settings / Set Minimum Value which results in a Required Retirement Assets value that is higher than their available net worth in the final year.

To ensure there is never less than a $1,500,000 Estate Value, they need to make some adjustments to their plan. Their options include:

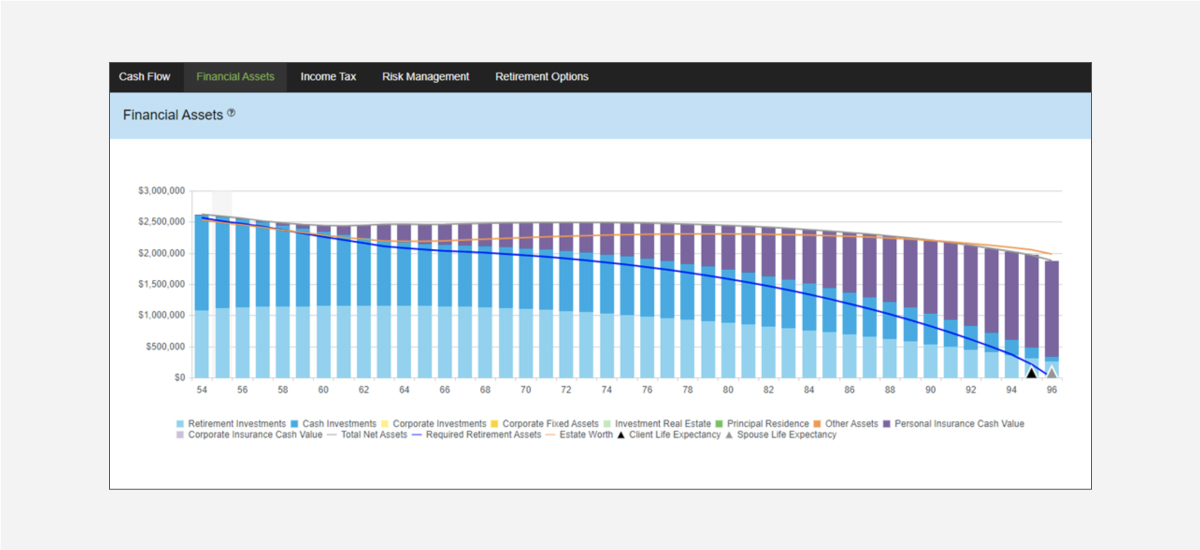

If Howard and Shirley purchase a Joint Whole Life Policy for $500,000 with a 10 pay premium of $29,165 funded from the non-registered investments, then they will be able to achieve both their income and estate goals.

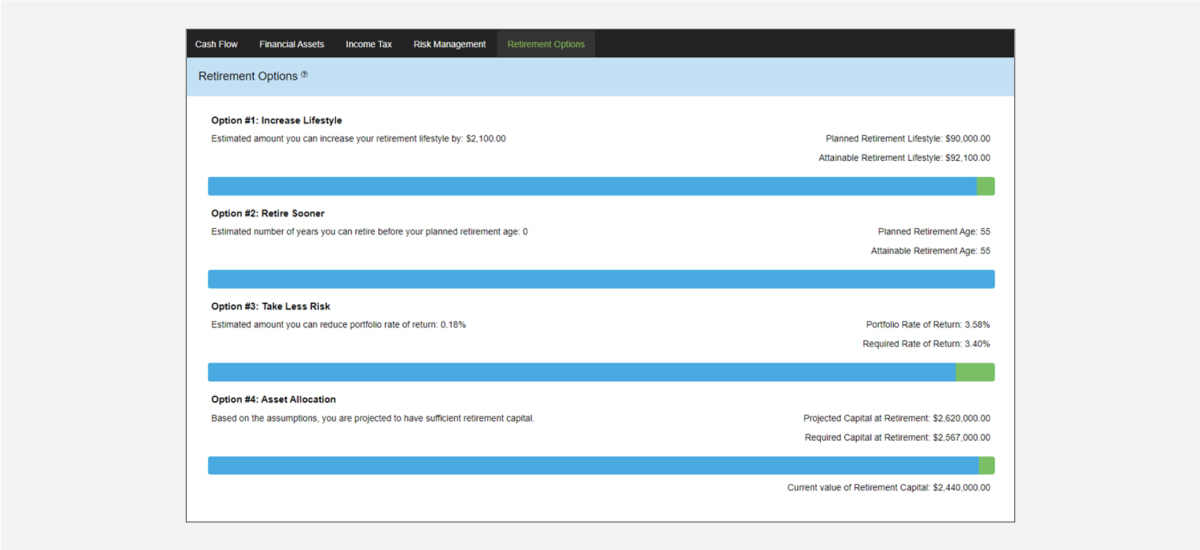

This strategy provides an Estate Value greater than $2 million for all but the final year of the plan. This offers Howard and Shirley additional Retirement Options as illustrated in the chart below.

What other recommendations can be applied to help Howard and Shirley leave an estate of even more than $2 million? You can create any number of new scenarios to test out your solutions and create a plan that will work for them.