Retired Business Owner Sample File

Razor Academy

Can corporate life insurance help this retired business owner travel the world?

Diane Fergusson

Diane is 55 years old and recently sold her Business, an operating company she owned through her holding company. After paying fees and taxes, she has $4 million of corporate owned investments. Diane is single and has no children. She has worked hard all her life and is now ready to enjoy the money she has made.

“I come from a family of 7 and growing up we did not have a lot of money, so although I want to travel and enjoy my money, I also want to leave it to my siblings and their children.” Diane tells her advisor when meeting for an annual review.

Recently she read an article about how life insurance can be used to create retirement income from her company and reduce income tax at her death. Always open to new ideas, she asked her advisor to explain how this could work for her.

Disclaimer: The results and recommendations outlined in this example are for illustrative purposes only. The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline.

In addition to qualifying for OAS and 85% of maximum CPP she has the following assets:

The only other major asset is her home which is valued at $1,400,000 and is mortgage free.

As part of Diane’s plan, she wants to:

How To Build with RazorPlan:

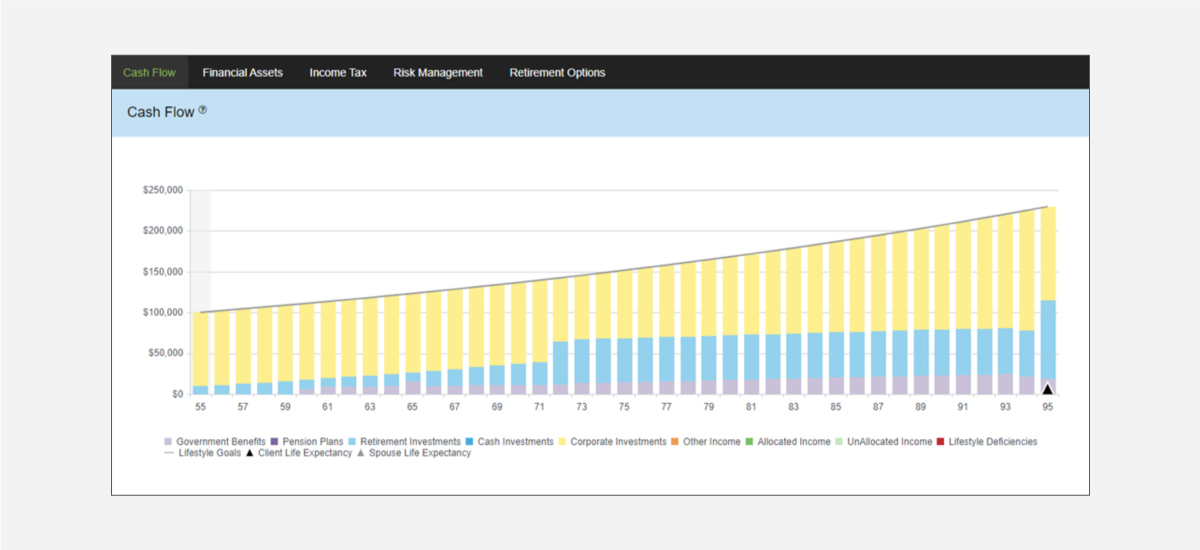

Review the Current Situation Scenario for an outline of Diane’s current situation. Based on her situation without corporate insurance, using the Cash Flow Chart in RazorPlan you can clearly see that she has adequate investment assets to meet her first goal of spending $100,000 / year after-tax.

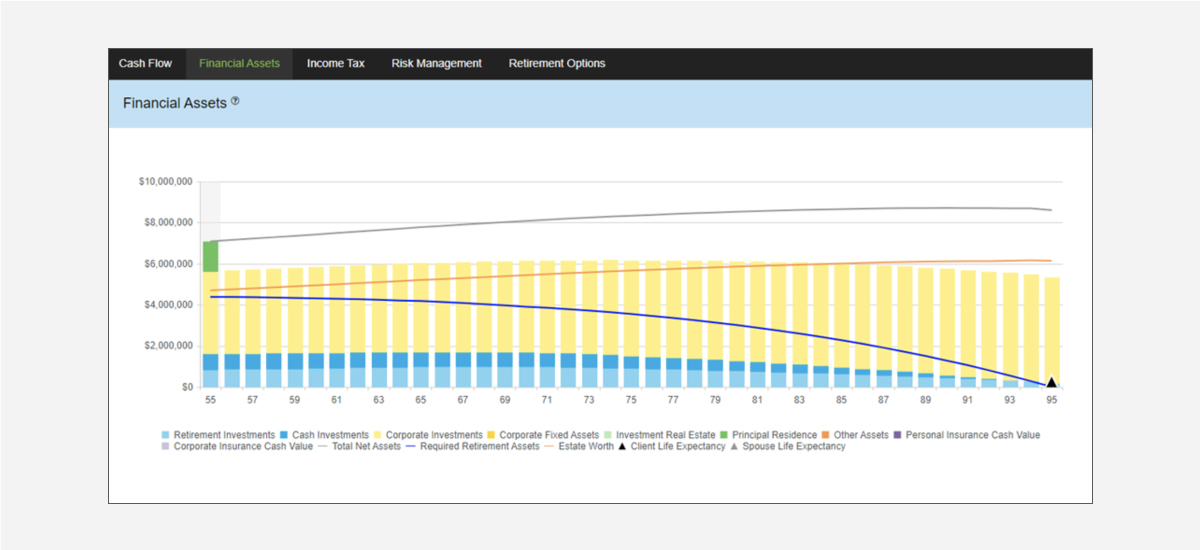

The Financial Assets Chart also indicates that the after-tax value of her estate meets her second goal to leave each of her siblings $1,000,000 ($6,000,000 in total). This assumes that the corporation will be wound-up in the first year after here death using a post-mortem planning strategy of Loss Carry Back to eliminate any double taxation of her corporate assets.

However, even though Diane will have significant assets remaining in her corporation, she cannot achieve her third goal to spend up to $30,000 each year on travel to age 75.

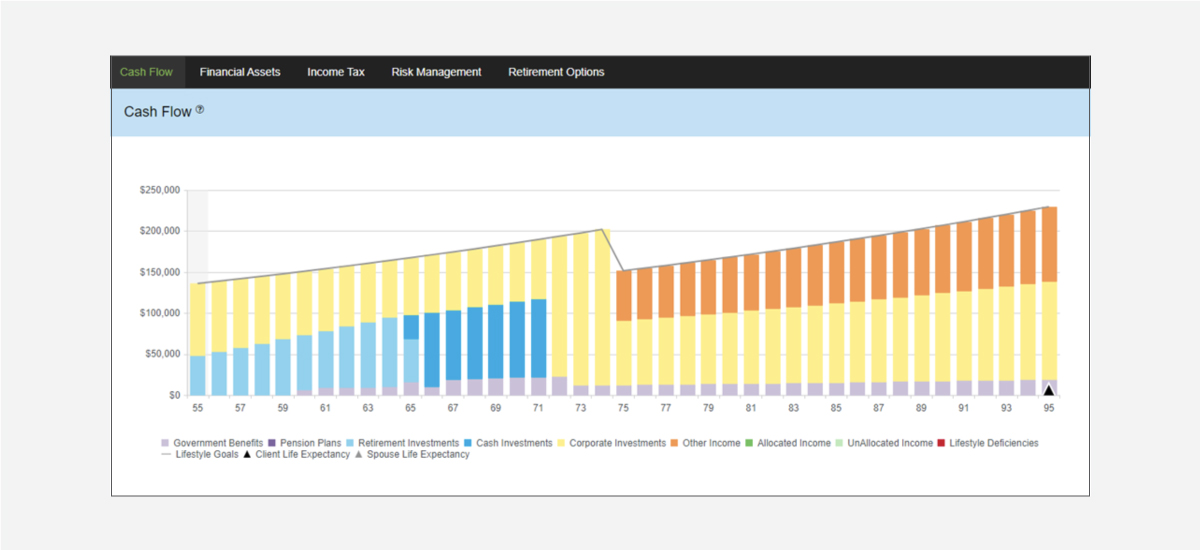

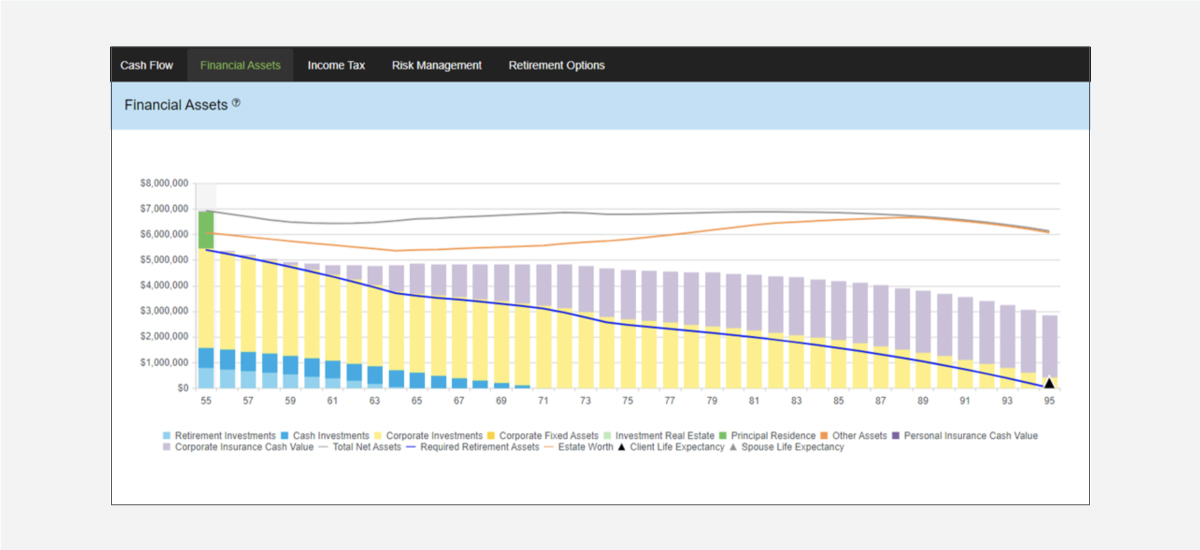

If Diane purchases a Whole Life corporate owned policy for $1,500,000 using a 10 pay premium of $113,580 funded from corporate investments, and using the Corporate IRP Strategy to borrow $60,000 each year starting at age 75 indexed to inflation, she can spend an additional $36,000 each year on travel.

Even with the $30,000 increased spending for 20 years, due to the tax advantages of the Corporate IRP Strategy, Diane can also achieve her goal to leave a $6,000,000 estate.

Although you can’t eat your cake and have it too, with the right planning you can spend your money and leave an estate too.

What other recommendations can be applied to help Diane increase her travel budget even more and leave a $6,000,000 estate? You can create any number of new scenarios to test out your solutions and create a plan that will work for them.