Sandwich Generation Sample File

Razor Academy

Can this “Sandwich Generation” couple afford to buy a vacation property on one salary?

Samantha (Sam) Walsh and Michael Donnelly

Samantha (Sam) is 51 and her husband Michael is 56. Sam earns $350,000 a year and Michael retired 3 years ago due to his health. They live in BC where they support Sam’s mother Donna and their son Chad who has 4 years remaining in medical school.

With $7,500 each month of personal living expenses, $2,500 a month support for Donna and $35,000 a year in education expenses, they want to know if they can afford to buy a vacation condo now for $750,000 and still afford to retire at Sam’s age 65.

“We had planned to buy the condo a few years ago, then Michael had his heart attack and had to retire.” Sam tells her advisor when they meet for an annual review.

Disclaimer: The results and recommendations outlined in this example are for illustrative purposes only. The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline.

In addition to CPP & OAS they have the following:

Sam’s financial resources

Michael’s financial resources

The only other major asset they have is their home which is valued at $1,800,000 and is mortgage free.

Sam and Michael have plenty of income and assets, their plan is to purchase a recreational property and maximize their estate at life expectancy.

How To Build with RazorPlan:

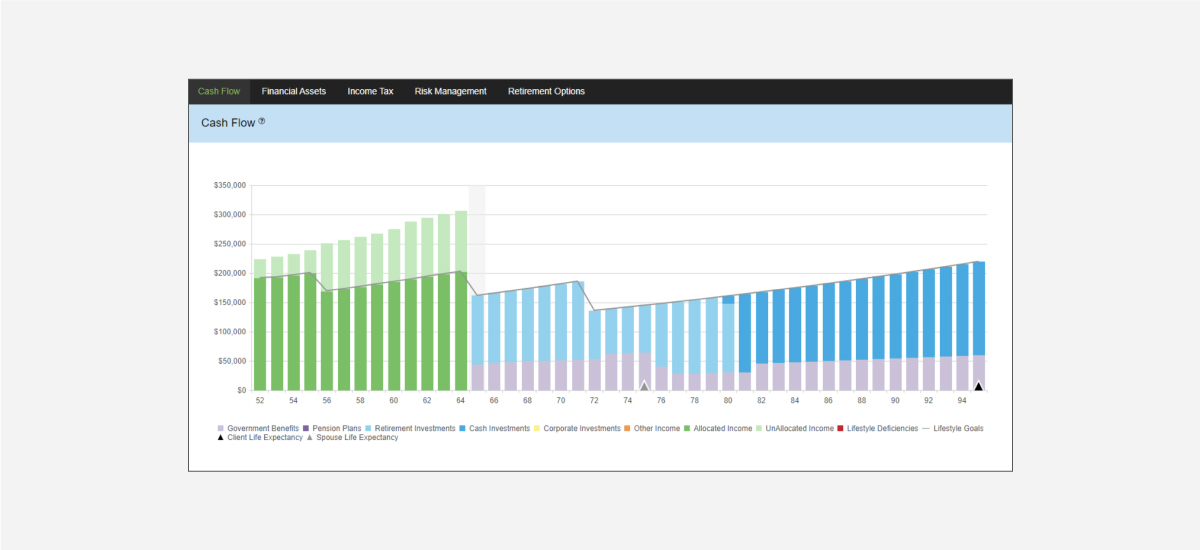

Review the Current Situation Scenario for an outline of their current situation. Based on what they are currently doing, using the Cash Flow Chart in RazorPlan you can clearly see there are 3 future reductions in cash flow.

The first is at Sam’s age 56 when Chad graduates from med school. The second is when Sam retires at age 65 and stops contributing to her RRSP, and the third is estimated to happen at Sam’s age 72 when her mother reaches her life expectancy at age 95. The RRSP contributions are automatically stopped at retirement, the other 2 amounts were manually entered through the Lifestyle Needs Drill-Down.

Based on the above, there are significant excess cash flow amounts pre-retirement (unallocated income) that Sam and Michael could use to finance the vacation condo today using a mortgage line of credit.

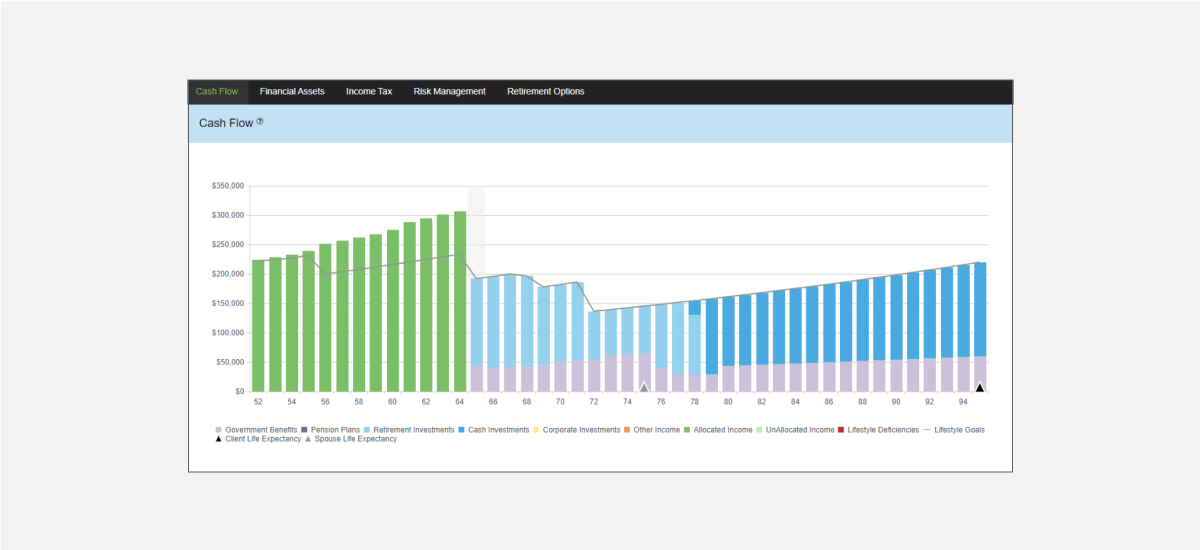

Although Sam could use the non-registered investments she received through an inheritance, they would prefer to use a mortgage line of credit that they already have on their home with the expectation that they pay it off prior to retirement. View the Purchase Vacation Condo – Excess to Mortgage scenario.

Assuming a purchase price of $750,000 fully financed at 3.5% (Real Estate Data Entry), if they apply all excess income (see Current Situation) to the mortgage line of credit (Excess Cash Flow Tool), the vacation condo will be paid off at Sam’s age 69 as illustrated below.

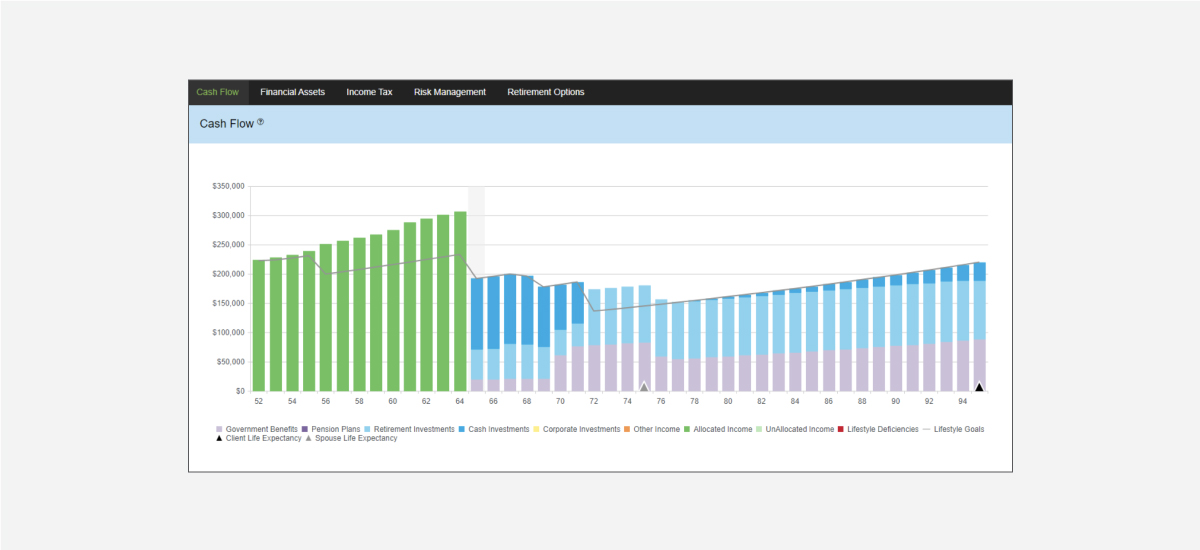

Additional value can be added by better managing income and decumulation in retirement. Their current plan is to draw down on RRSPs first to reduce future taxes payable by their estate. “We thought by drawing from RRSPs first this would reduce tax at death and provide a larger after-tax estate for our son.” Sam said when asked why this is their plan.

Although it can be true that drawing down on RRSP/RRIF investments may result in a larger after-tax estate if you die prior to normal life expectancy, Sam expects to live into her 90s, same as her mother and grandmother. If longevity is expected and the goal is to maximize the after-tax estate value, they should rethink their decumulation strategy. View the Withdraw Non-Registered / TFSA First scenario.

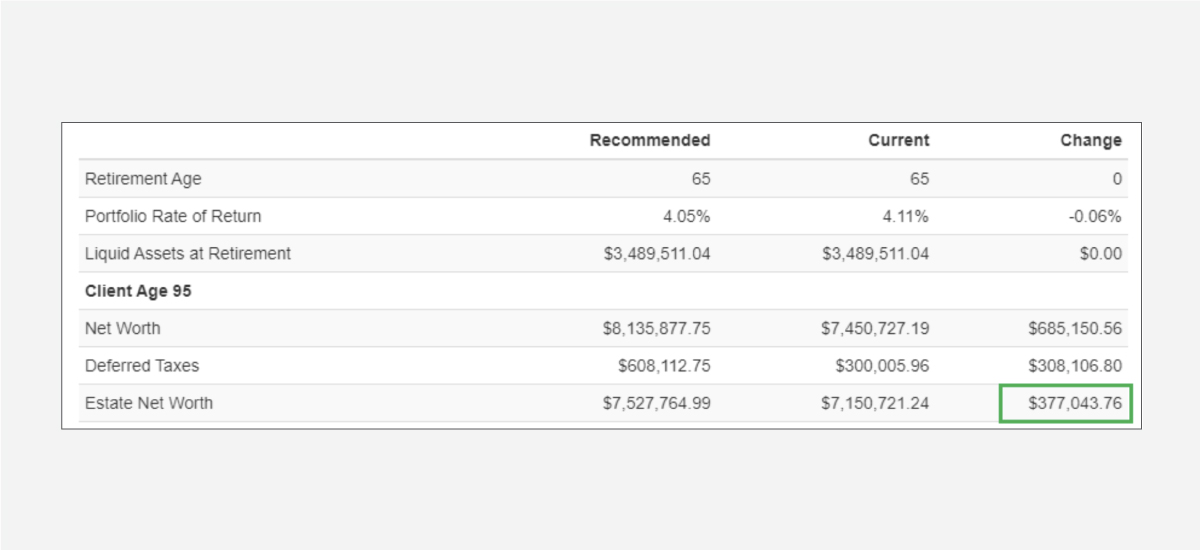

If they choose to withdraw Non-Registered / TFSA first, they can continue to fund their retirement lifestyle objectives and increase their final year estate value. By comparing scenarios, you will see that this change has added $377,043 to their Estate Net Worth at Sam’s age 95.

What other recommendations can be applied to help Sam and Michael maximize the value of their estate? You can create any number of new scenarios to test out your solutions and create a plan that will work for them.