TFSA Auto Allocate

Razor Academy

In finance, Alpha describes a strategy’s ability to beat the market. In financial advice, Advisor Alpha is the excess return created by the strategies you recommend.

In this example, we will calculate the value (Alpha) that maximizing TFSA contributions throughout retirement can have on retirement income planning.

Mary Smith, DOB June 11, 1961

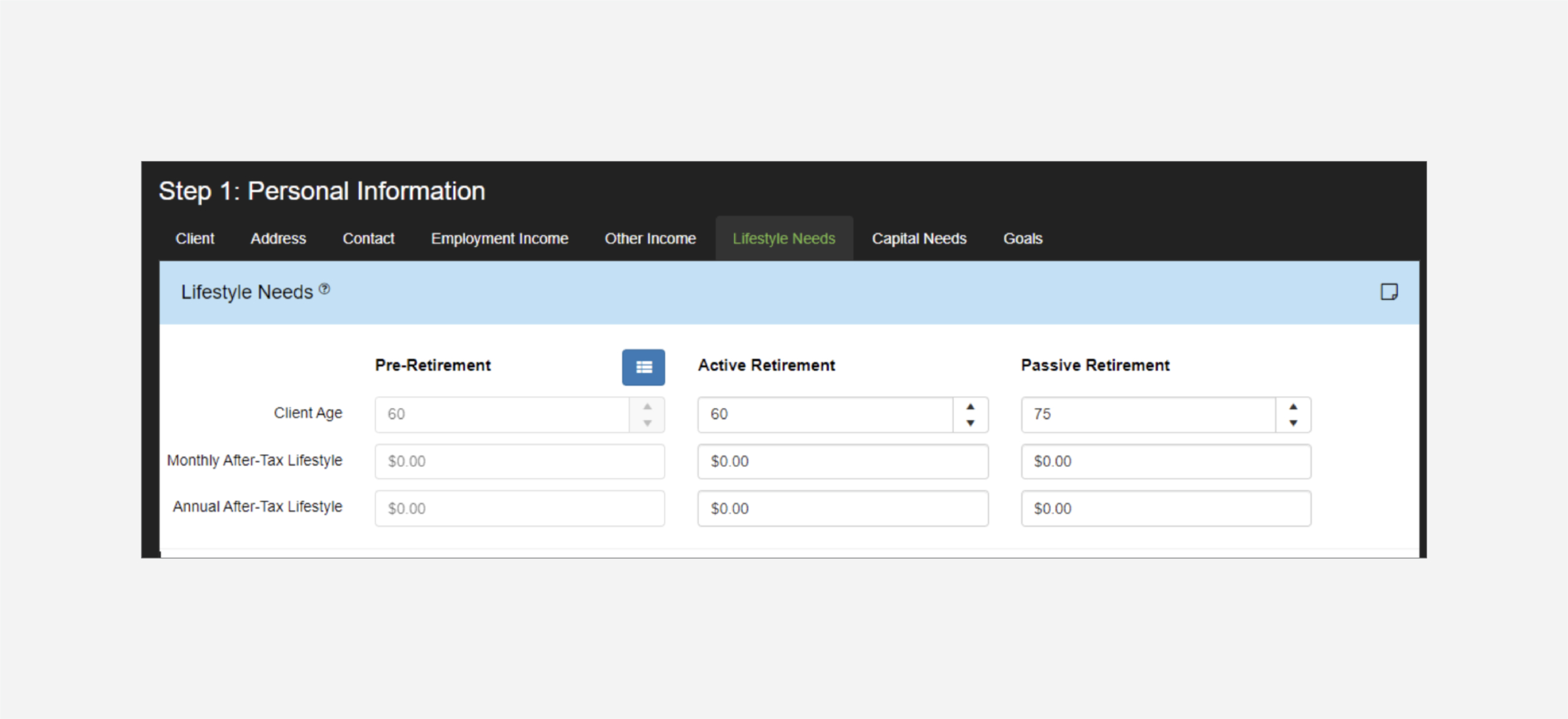

Mary is 60 years old and recently widowed. She has asked you to prepare a retirement analysis whereby she can spend the maximum amount of money possible (Lifestyle) until her age 95.

Disclaimer: The results and recommendations outlined in this example are for illustrative purposes only. The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline.

Comparing the long-term impact that full utilization of TFSA can have on retirement income is easily demonstrated using the TFSA Auto Allocate setting in RazorPlan.

Their assets include the following:

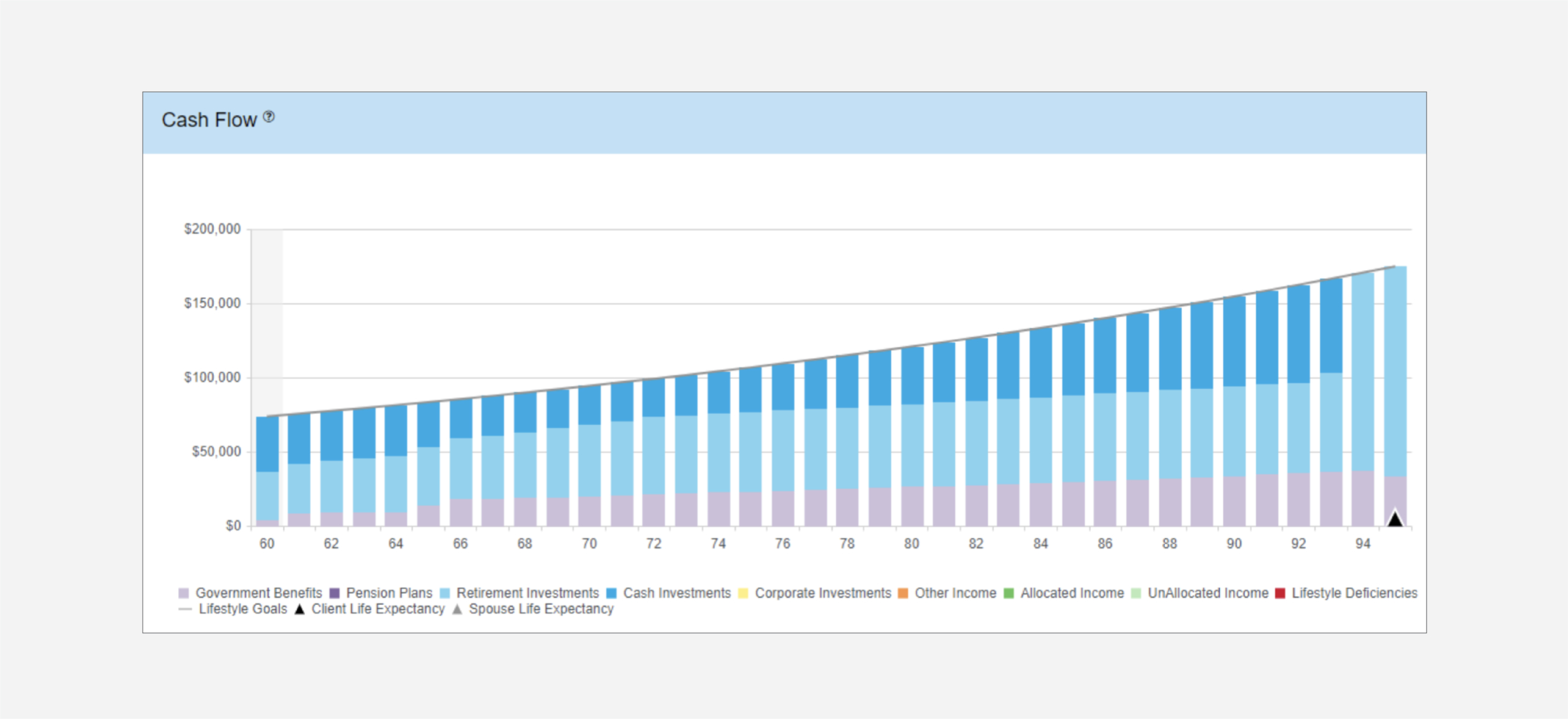

Having solved for maximum lifestyle without contributing to TFSA, we can see in the Cash Flow chart that from age 60 to age 95 there are no lifestyle shortfalls. We can also see the income allocation between government benefits, RRIF minimum, and non-registered withdrawals.

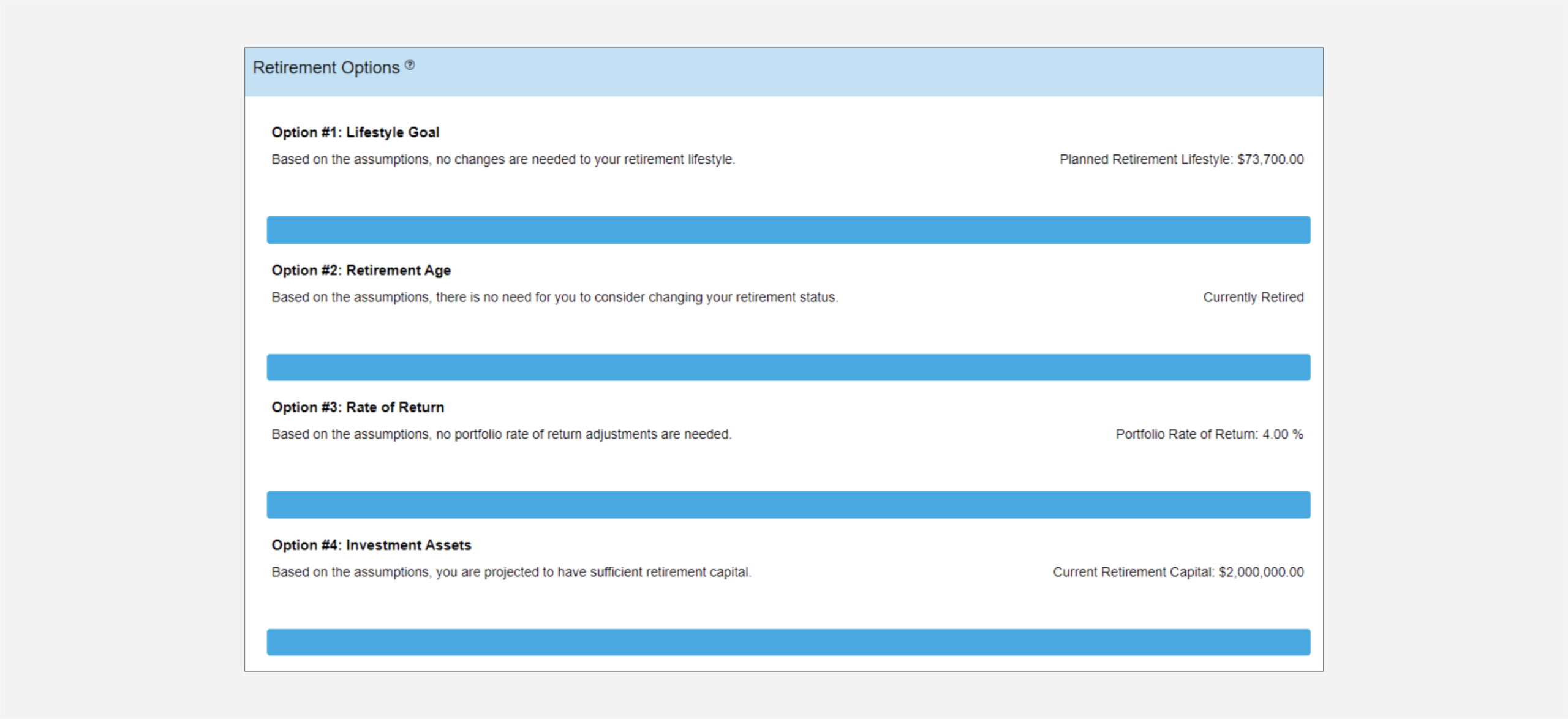

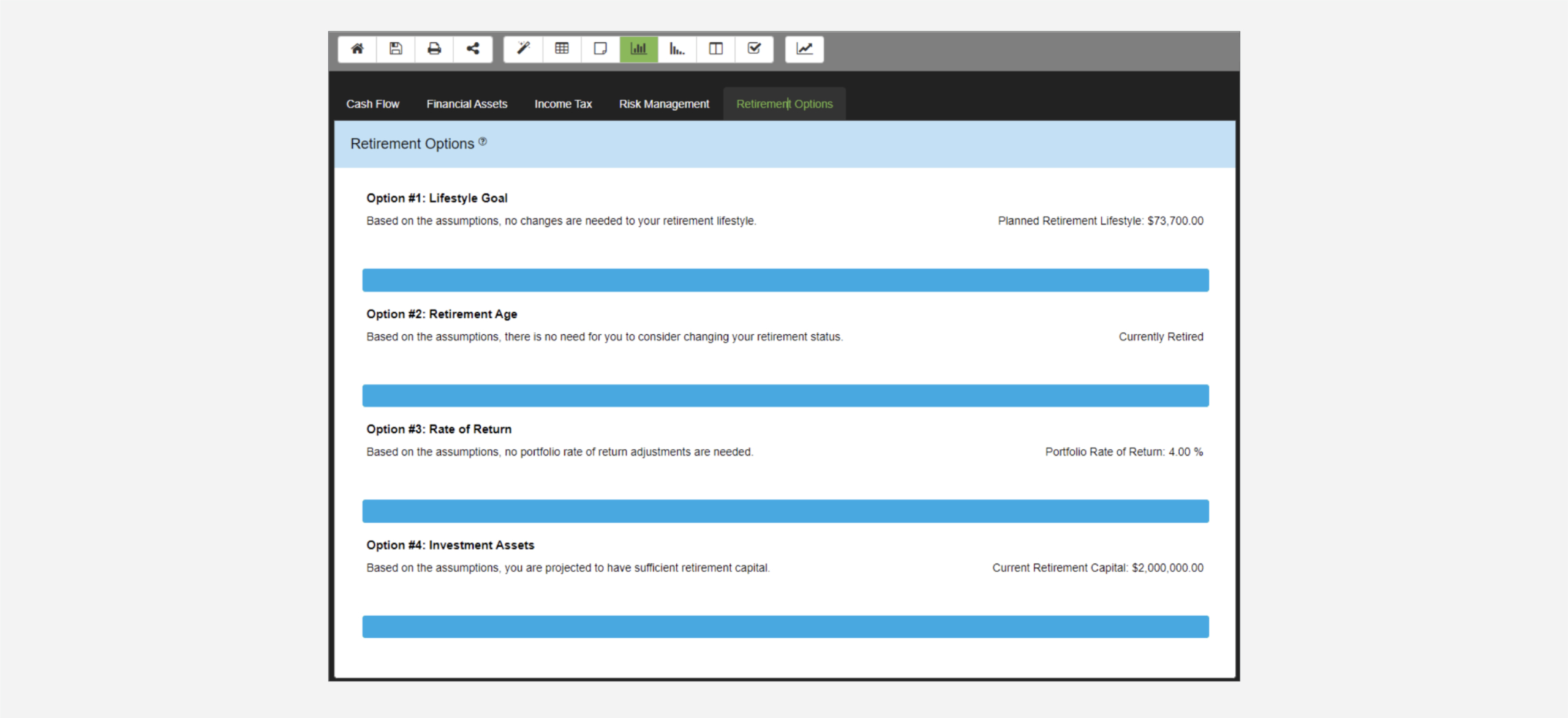

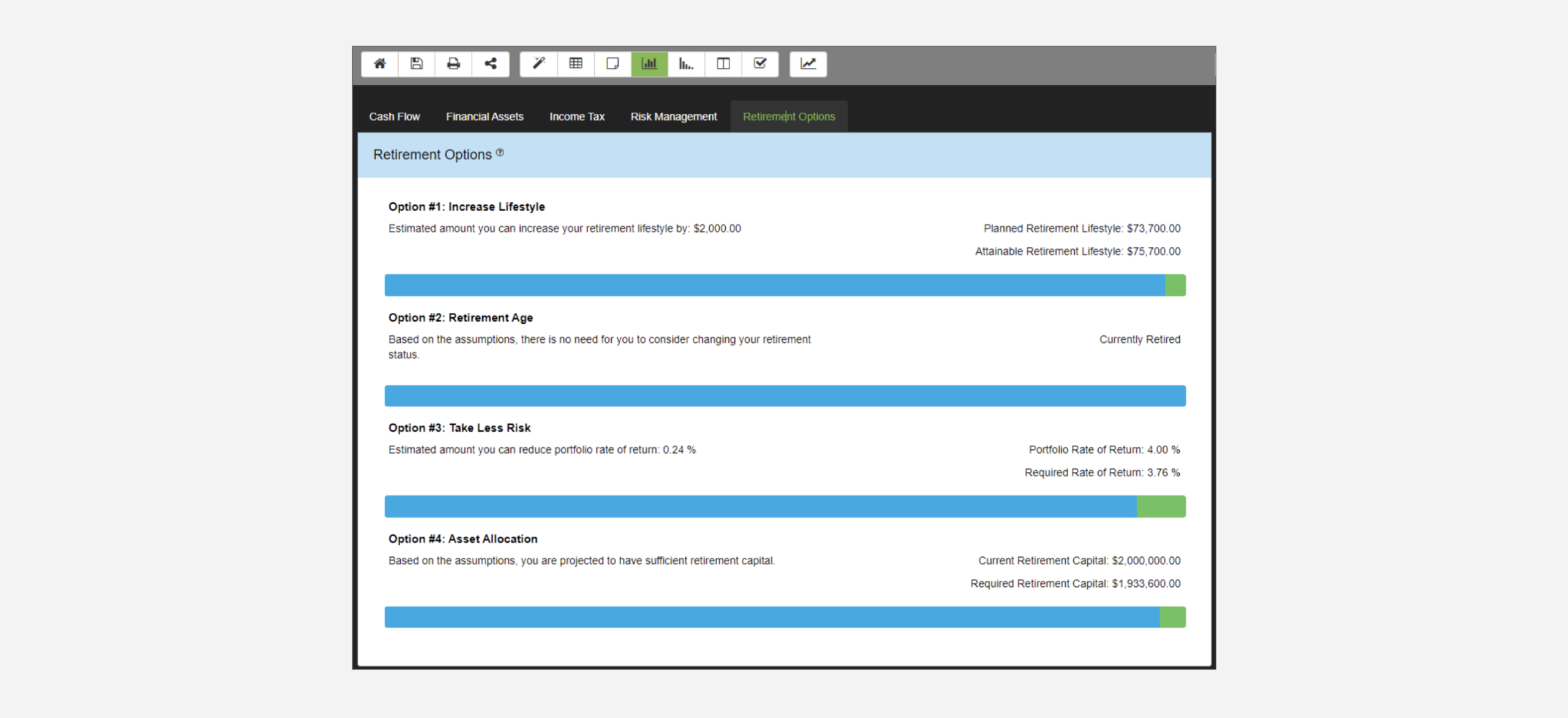

If we review the Retirement Options chart, we can see all 4 retirement options are in perfect balance having been automatically solved by RazorPlan.

Now that we have determined the maximum lifestyle available according to our assumptions, we can choose to automatically re-balance Non-Registered assets to TFSA up to the maximum permitted each year. To do this, we will create a new scenario and set TFSA Auto Allocate from No to Yes.

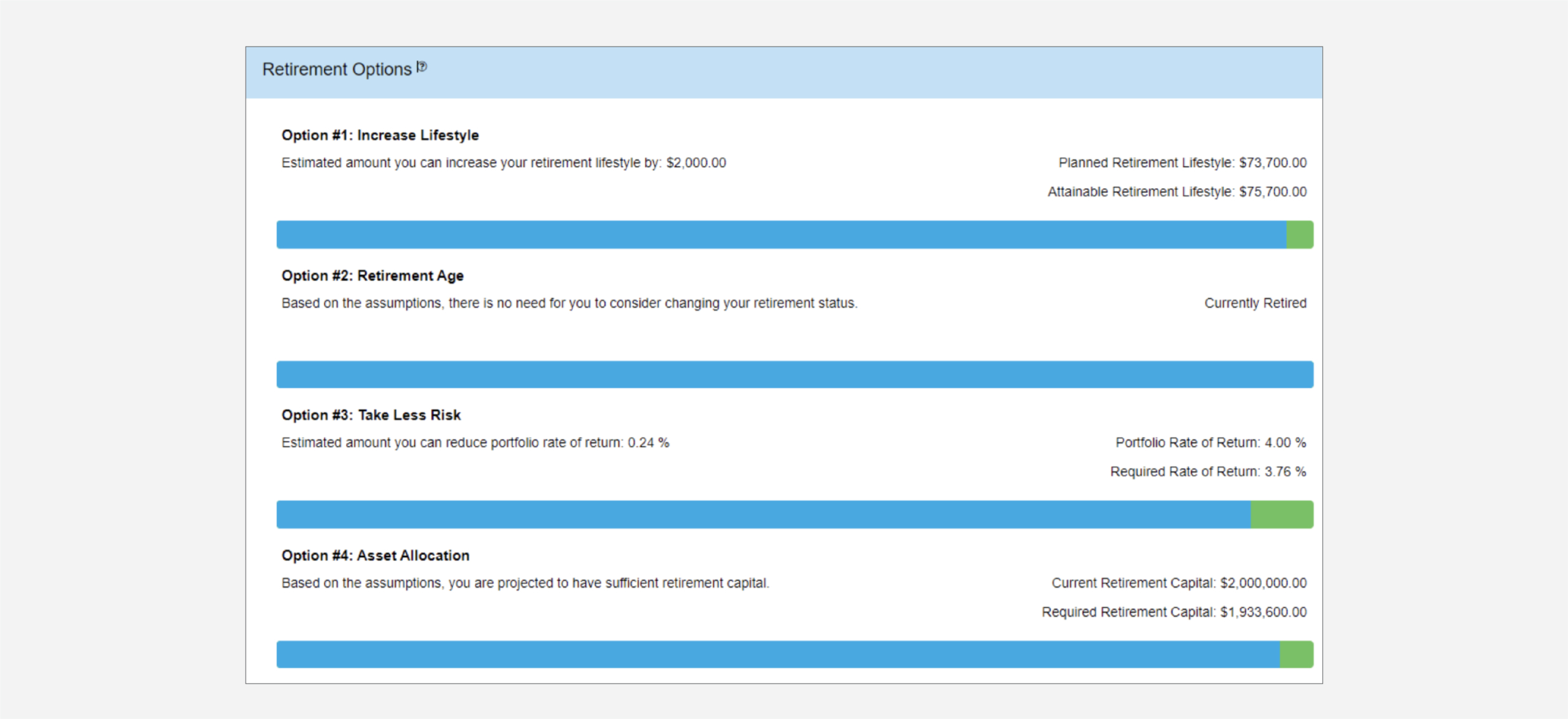

The best way to see the results of maximizing TFSA contributions throughout retirement is to view the Retirement Options chart.

In Option #3 we can clearly see that the tax efficiency of maximizing contributions to TFSA have created a Risk Alpha of 0.24% (4.00% – 3.76%).

This means that Mary could spend $2,000 more each year as seen in Option #1, or spend up to $66,400 in a lump-sum at retirement, as seen in Option #4, and still have enough to meet her lifestyle goal.

How To Build with RazorPlan:

This case is assumed to have the following account level assumptions. To replicate this case as outlined below, be sure to update your Account Settings to match through Your Account. Additional steps may be required if you do not choose to set up your account this way.

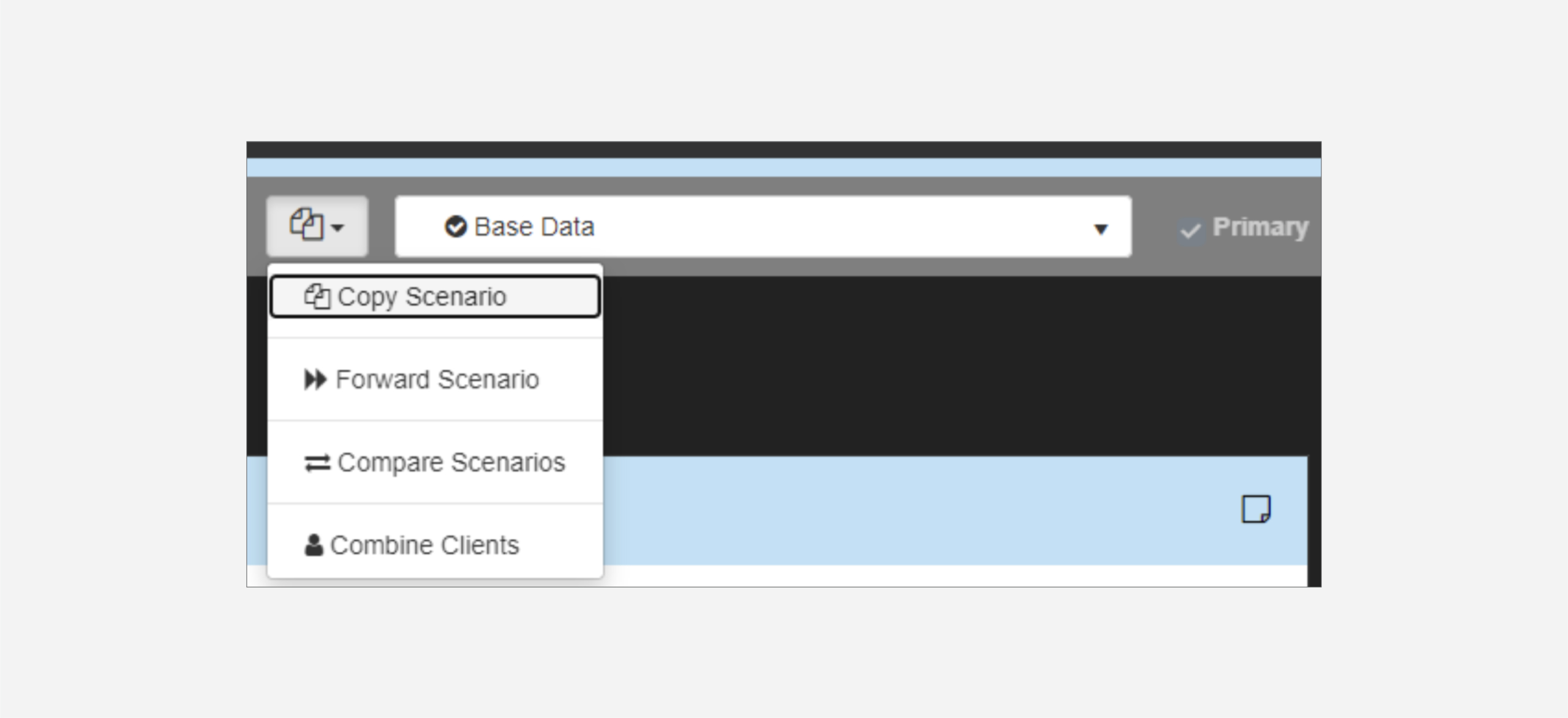

Click the Scenario drop-down menu and select Copy Scenario. Name this new scenario “Maximize – TFSA”. Once created the new scenario will load.

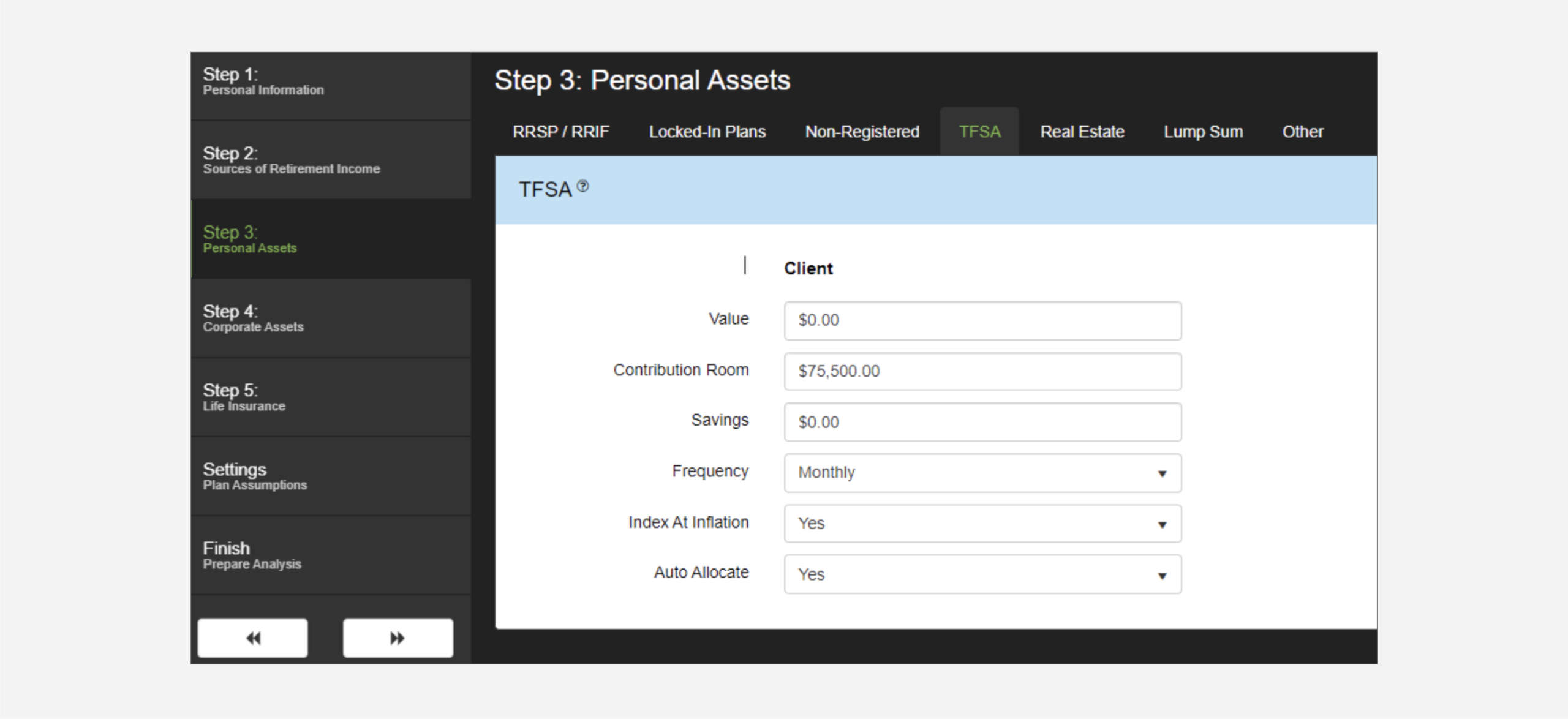

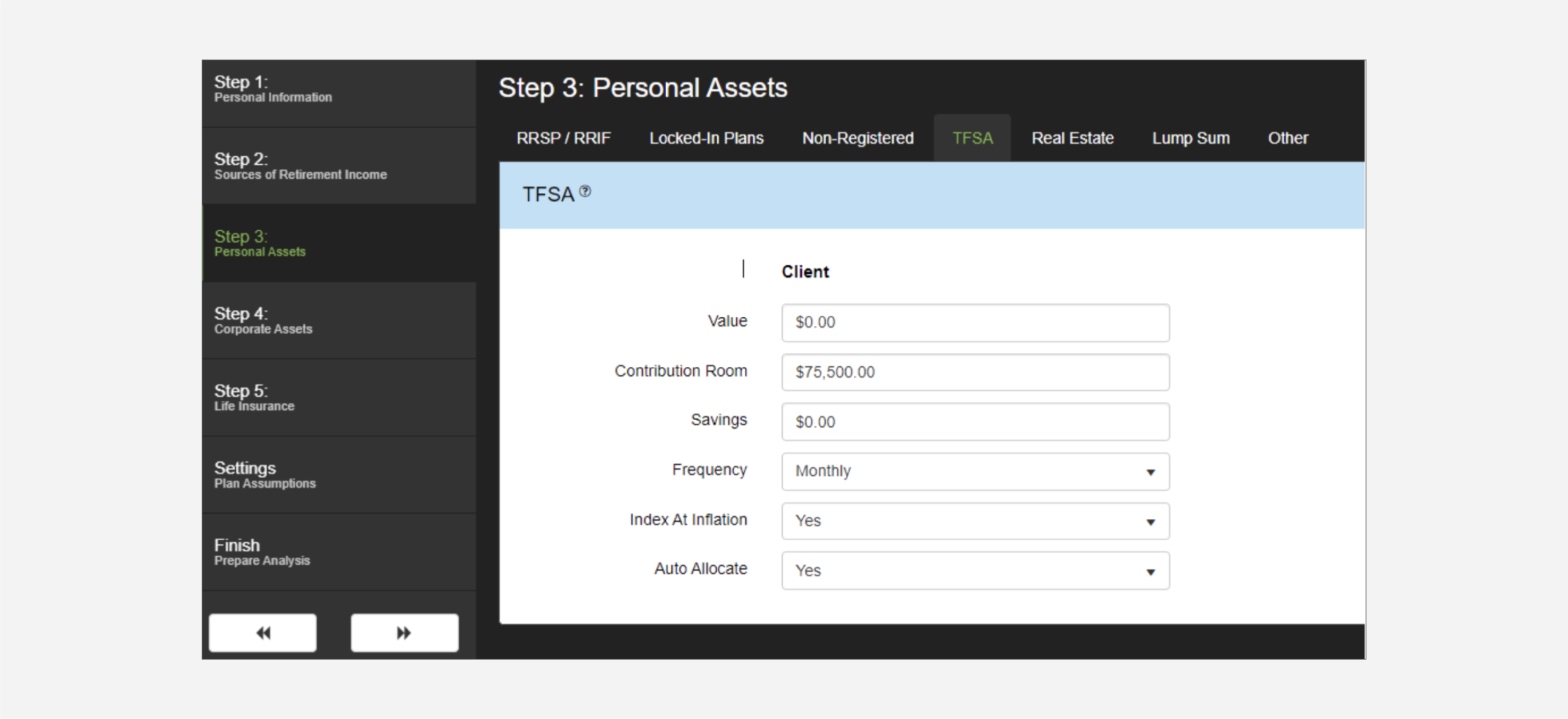

With the new scenario active, go to Data Entry Step 3: Personal Assets and under the TFSA tab, change the Auto Allocate value from No to Yes.

With TFSA Auto Allocate set to Yes, click on the Chart icon on the RazorPlan Toolbar to have RazorPlan re-calculate the analysis and take you to the Cash Flow chart. Next, select the Retirement Options chart to see the value (Alpha) added by the change made.

In this example, the simple recommendation to take full advantage of TFSA contributions throughout retirement, gives the client more options and greater income security.