[ Razor Academy ]

Working with scenarios

RazorPlan allows you to add multiple scenarios to each client file to help you illustrate different financial outcomes. The following example will look at creating and comparing scenarios to highlight the impact of your recommendations.

Client Names:

Darren & Melanie Ellis

Client Description:

Darren & Melanie Ellis are nearing retirement and worry that they may not be as prepared as they would like. Although they have been diligent in saving and managing their finances recently, they lack the clarity necessary to feel confident that they are on the right track.

Darren & Melanie have no children and are currently 13 years from retirement. To fund their retirement goals, they will rely on Melanie’s Defined Benefit Pension as well as CPP, OAS, RRSP/RRIF, & other Non-Registered investments.

Strategy Outline:

When reviewing Darren and Melanie’s financial situation, we can discover a lot of recommendations that are easily implemented and provide a lot of value. Scenarios are a great way to test your recommendations and offer the ability to demonstrate the impact to your clients.

Financial Situation Outline:

Their assets include the following:

- A home valued at $365,000 with a remaining mortgage balance of $165,000.

- Darren has an RRSP with a current value of $65,000 and $20,000 in a trading account, no TFSA

- Melanie is expecting pension income of $1,250/month, has $45,000 in RRSPs and $10,000 in a savings account, no TFSA

- They have recently increased their savings to a total of $1,500 per month across all investments

- Darren and Melanie have no life insurance

Disclaimer – The results and recommendations outlined in this example are for illustrative purposes only.

The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline

Problem solution

Current Situation:

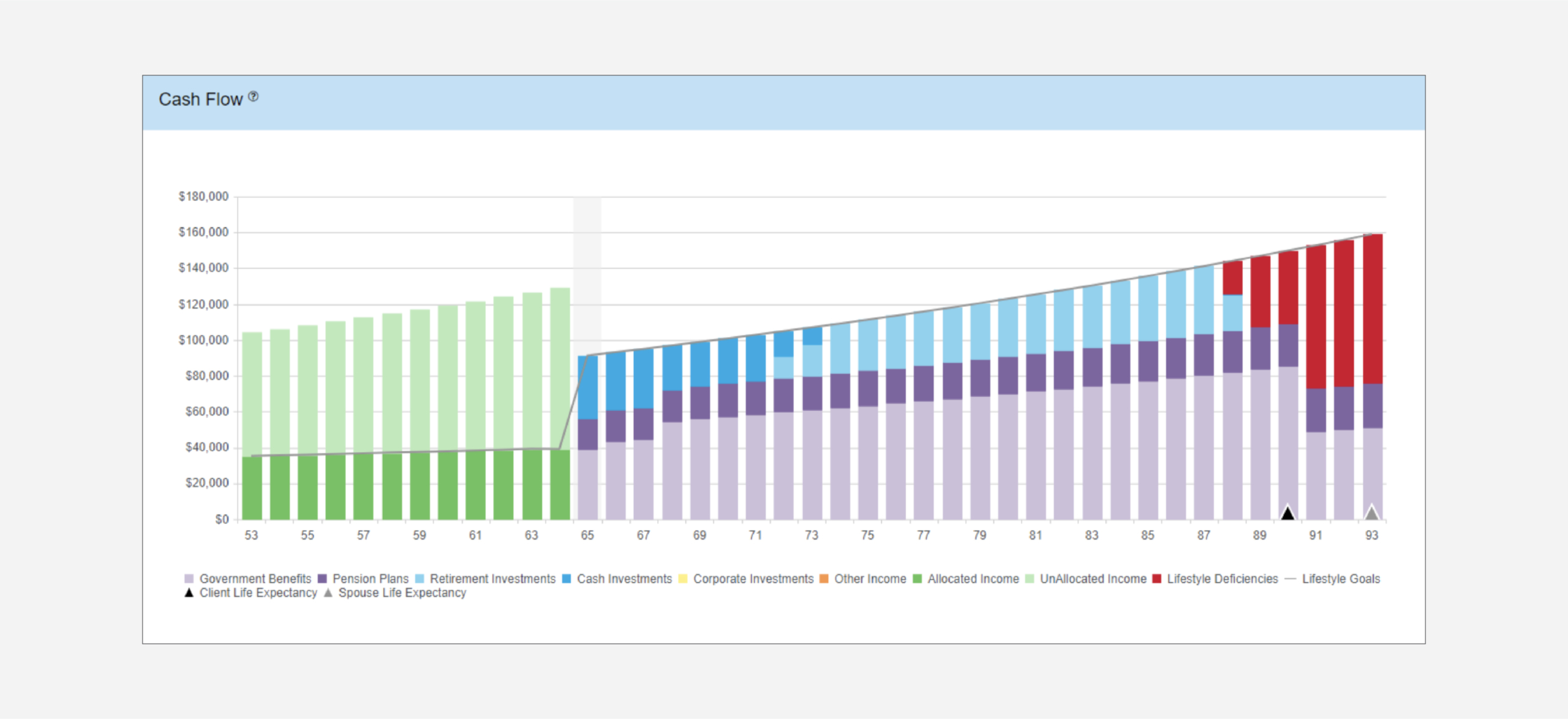

Prior to implementing any changes, the Cash Flow chart shows a shortfall in retirement income starting at Darren’s age 88. This shortfall demonstrates that given our current assumptions and level of savings, Darren and Melanie are not on track to meet their retirement objectives and changes may be required.

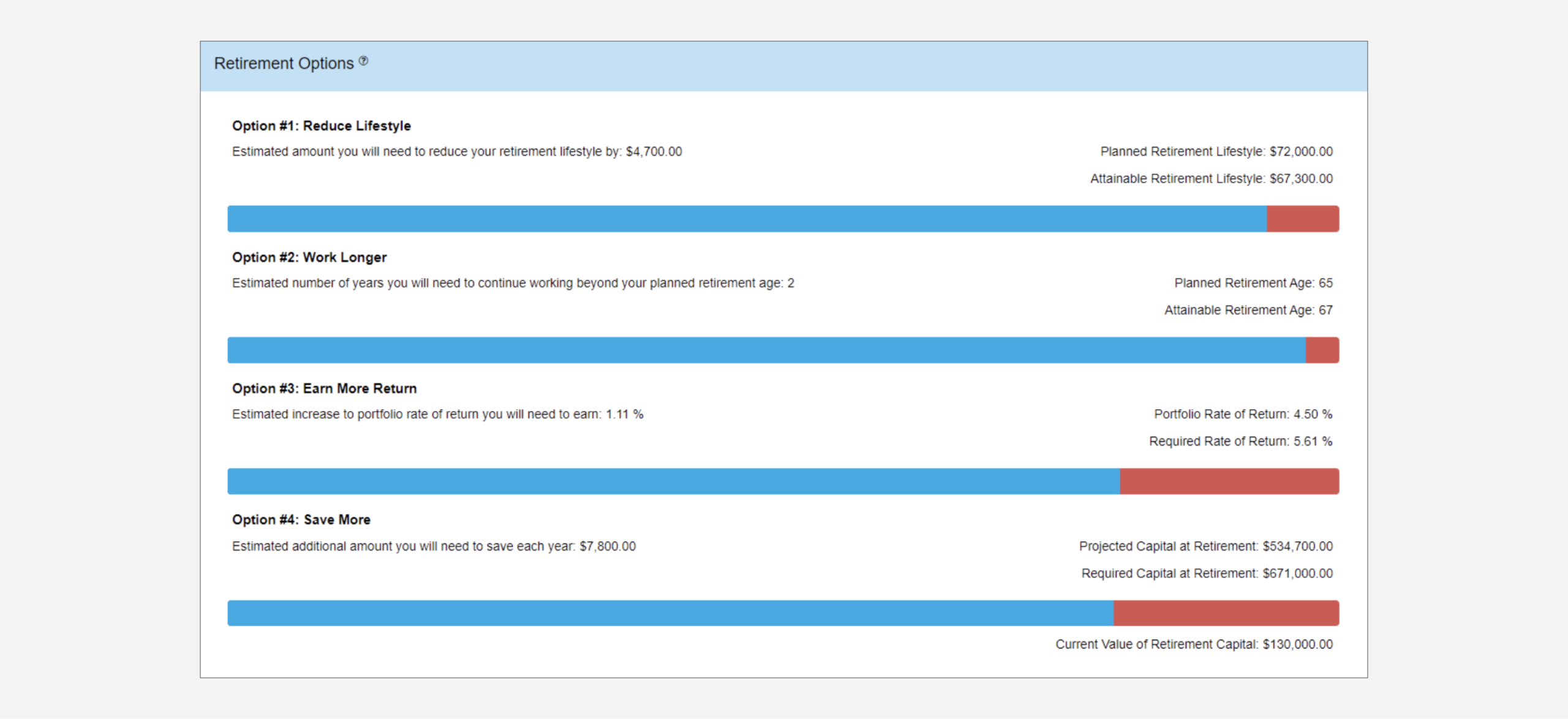

If we review the Retirement Options chart, we can see several directions available to address this shortfall. Each will result in Darren and Melanie altering their future retirement goals or current savings and risk tolerance. However, there may be a better way.

Recommendations:

When reviewing Darren and Melanie’s current situation, we can identify several areas that would benefit from a more efficient approach.

- Darren and Melanie both have non-registered assets but neither is utilizing the available room in their TFSAs. Both should redirect these assets and future savings toward a TFSA.

- Darren and Melanie are healthy and would benefit from the increased lifetime income available by deferring government benefits to age 70.

- The deferral of government benefits would likely increase their tax rate beyond age 70 and could potentially trigger OAS clawback. Converting their RRSP to a RRIF at retirement instead of age 71, they would spread out the tax burden and limit potential future clawback.

- Moving their current investments to a low fee option would result in a higher net return without impacting the clients’ current risk tolerance. Assuming we could reduce fees by 1%, the clients’ overall return would increase from 4.5% to 5.5%.

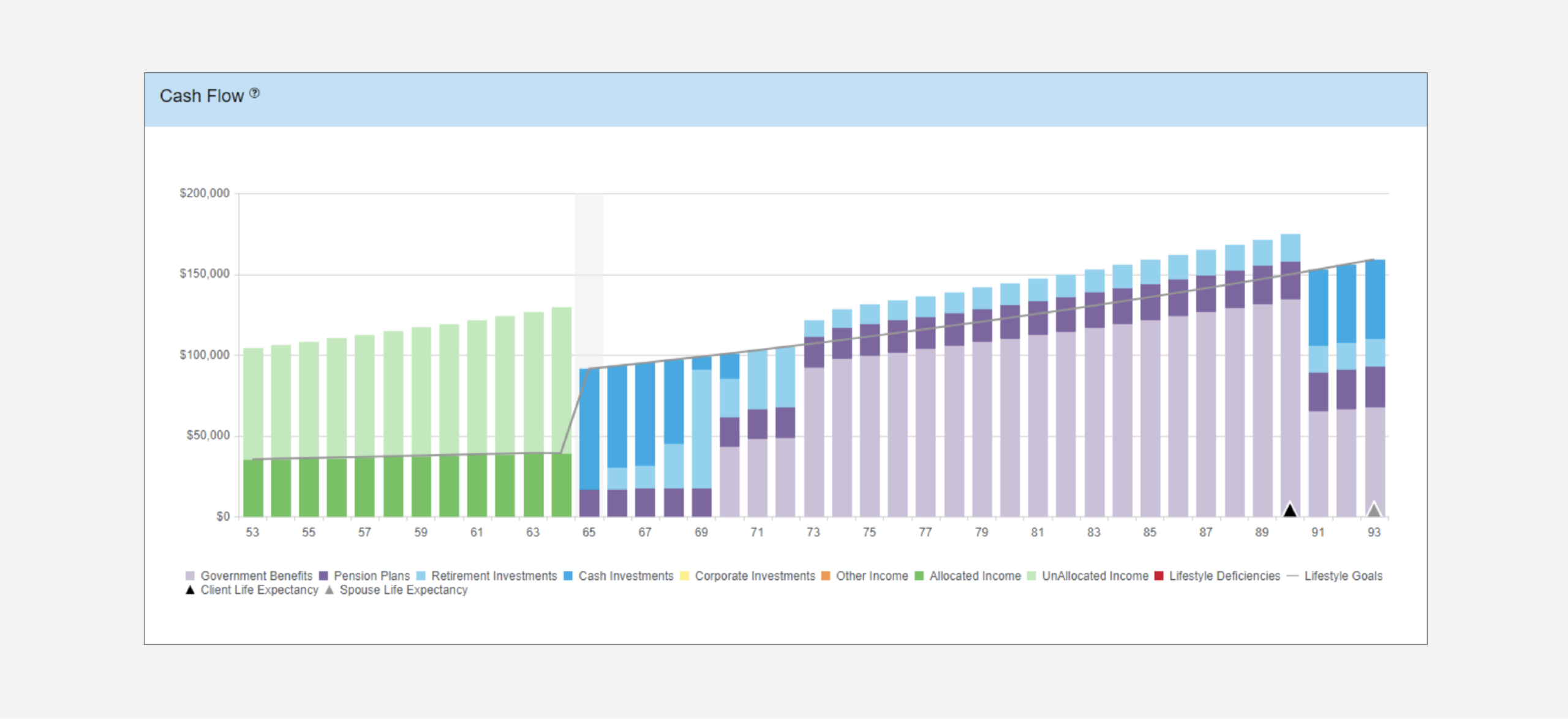

After making these recommendations, we can see the impact in the Cash Flow chart. The clients are now able to fund their lifestyle right through to Life Expectancy.

Additionally, when reviewing the Retirement Options chart you can see that Darren and Melanie could potentially enhance their retirement goals after implementing these recommendations.

Delivering Results

There are different options available within RazorPlan to help you compare these 2 scenarios and highlight the impact of your recommendations.

- Compare Scenarios for an onscreen, lifestyle, net worth, and estate comparison

- Focused Planning Reports for a printable client report and Value of Advice calculation

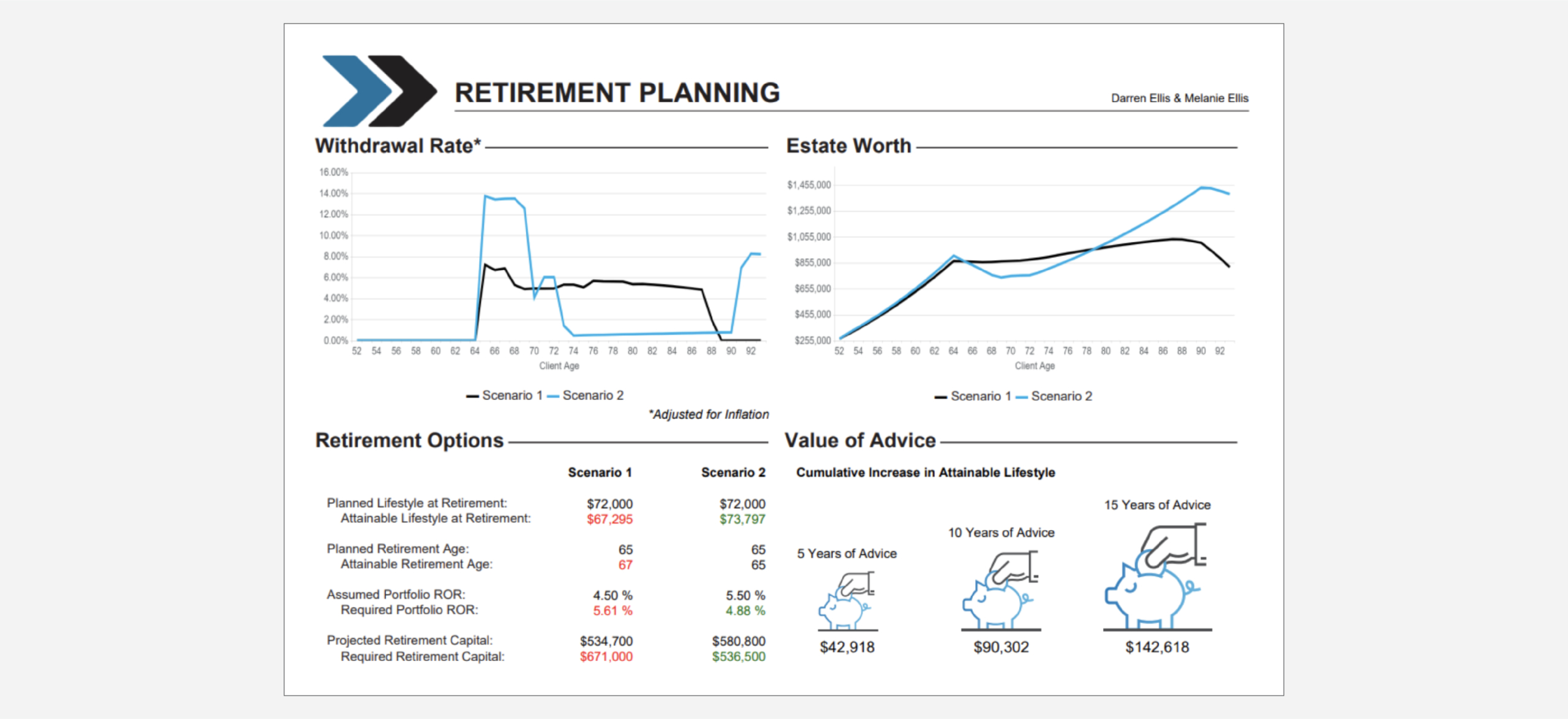

Given that the focus for Darren and Melanie has been around achieving retirement objectives, a great report to use would be the Retirement Planning version of the Focused Planning Reports.

This report will compare 2 scenarios to demonstrate withdrawal rate comparisons, changes in estate worth, and compare the 4 retirement options available. Additionally, it will calculate the value of your advice based on the overall Cumulative Increase in Attainable Lifestyle at various stages of retirement.

How To Build with RazorPlan

Key Assumptions:

This case is assumed to have the following account level assumptions. To replicate this case as outlined below, be sure to update your Account Settings to match through Your Account. Additional steps may be required if you do not choose to set up your account this way.

- Set Stop Income At to Assumed Life Expectancy

- Set Pre-Retirement Cash Flow to On

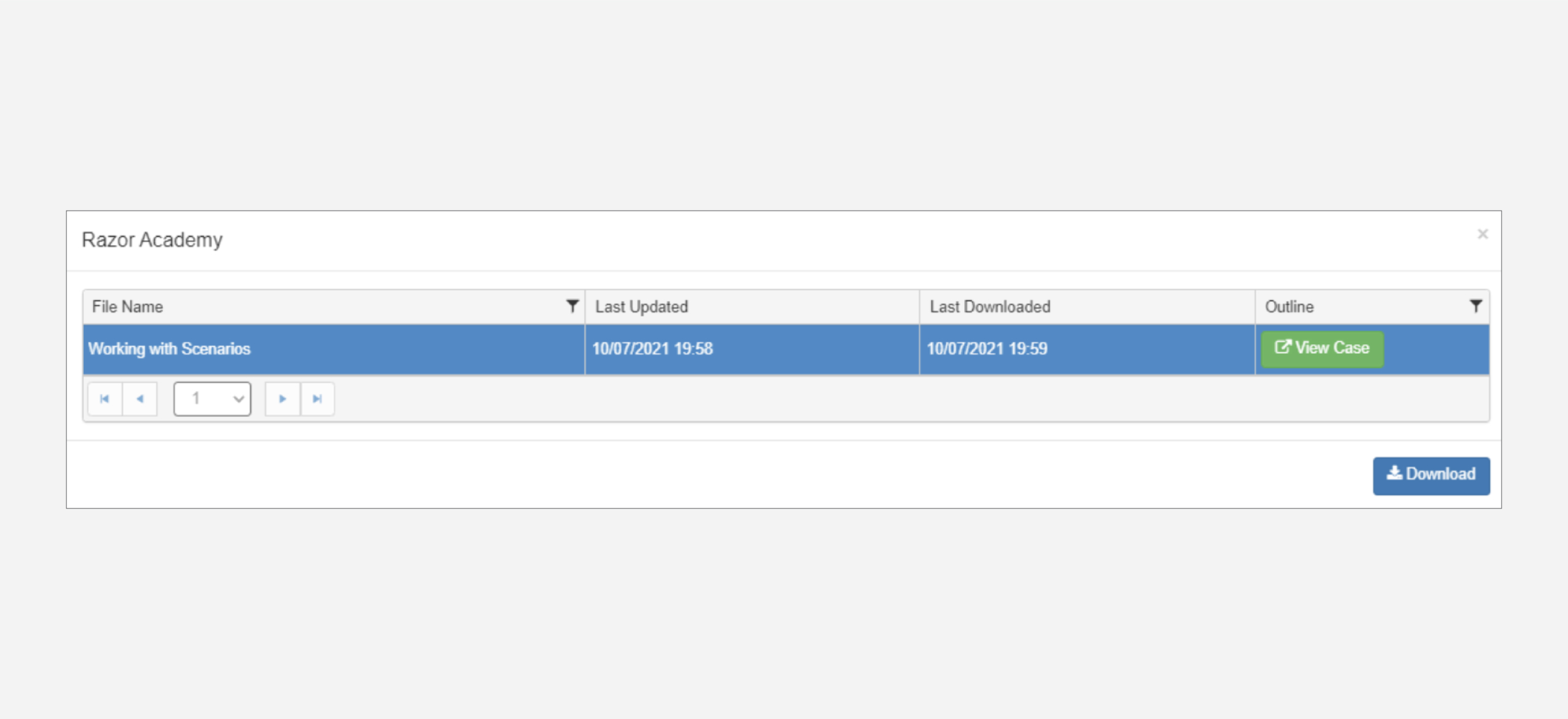

Select Razor Academy from the RazorPlan Home Screen. From there select “Working with Scenarios” and click Download. The sample case will download to your RazorPlan account and automatically open.

Before beginning to work with this client file, it’s important to create a new scenario to retain the original Current Situation data. This will allow you to compare your recommendations and offers the ability to return to the original scenario at any time.

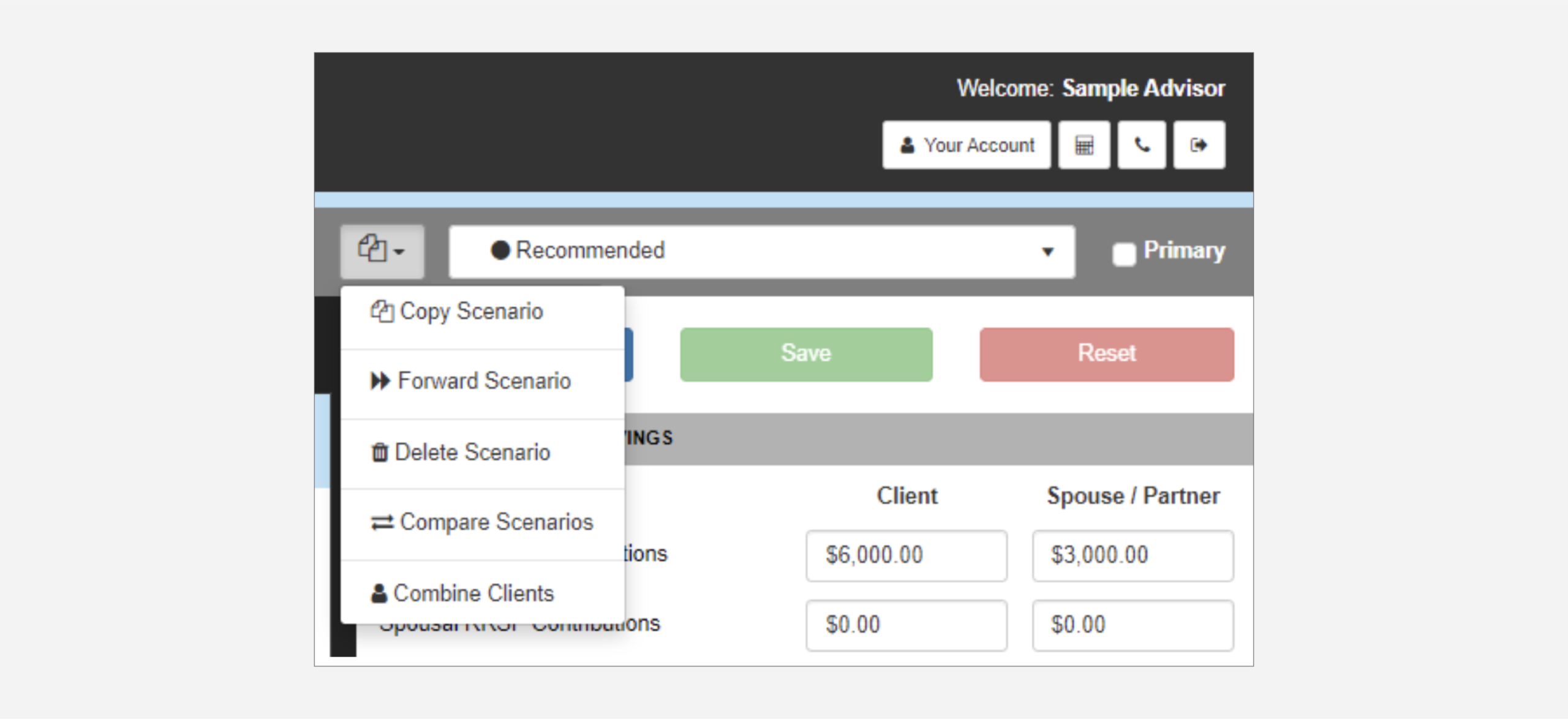

Click the Scenario drop-down menu and select Copy Scenario. Name this new scenario “Recommended”. Once created, the new scenario will load. You can return to the Current Situation scenario at any time through the Scenario list drop-down.

To model the recommendations outlined in this case, make the following data entry changes in the new Recommended scenario.

- Automatically allocate available non-registered assets to TFSA by setting Auto-Allocate to Yes

- Set CPP/QPP Start Age to 70 for both clients

- Set OAS Start Age to 70 for both clients

- Set RRIF Age to 65 for Darren and 62 for Melanie

Increase the ROR for Registered and Non-Registered/TFSA assets to 5.5% for both Pre-Retirement and Post-Retirement

To quickly compare the impact of your recommendations, you can load the Compare Scenarios tool from the Scenarios drop-down menu. This will provide a snapshot comparison of Lifestyle, Net Worth, and Estate Worth.

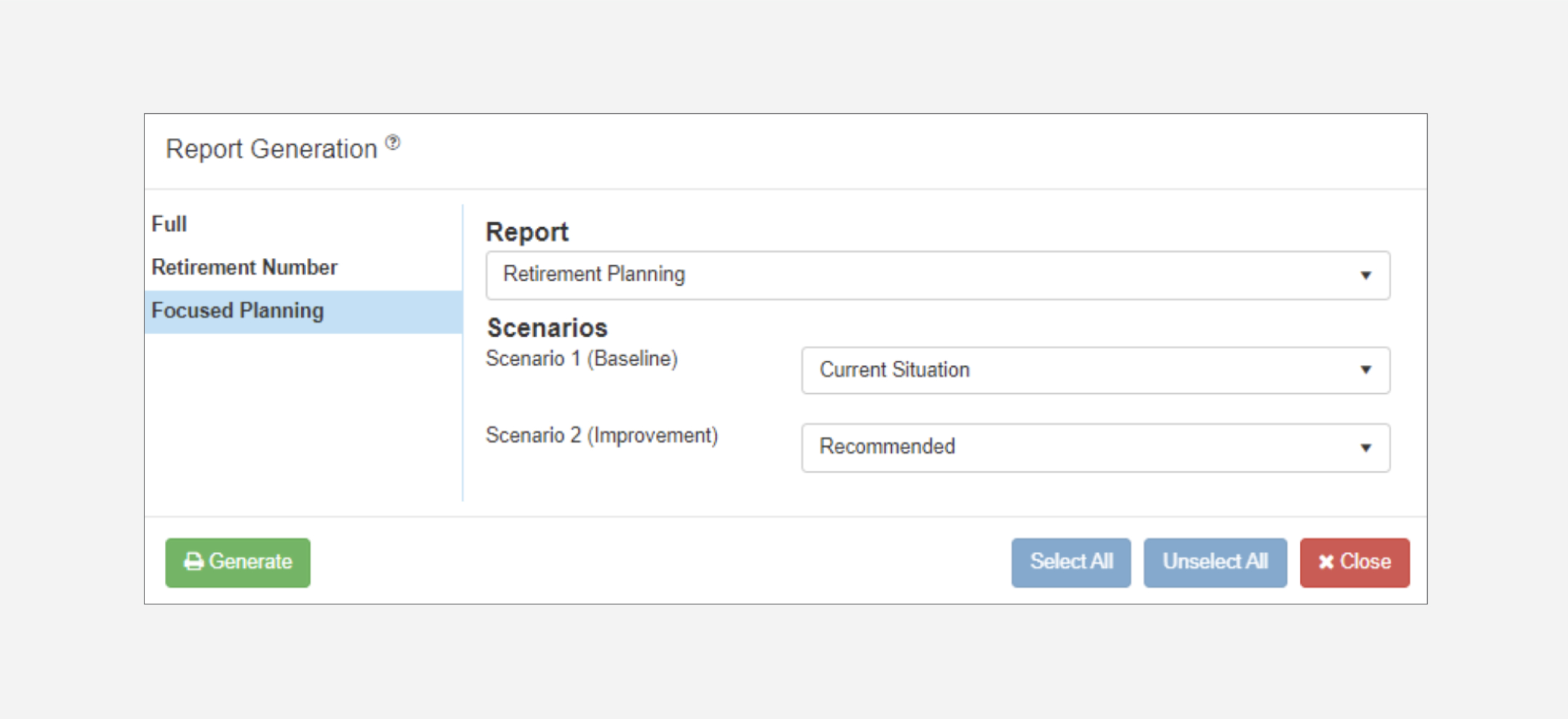

For a client-friendly comparison of each scenario, generate a Focus Planning report. These reports are designed to speak to a specific planning focus and the recommendations you are making.

To generate a Focus Planning report, click the Printer icon from the RazorPlan toolbar and choose Focus Planning. From here you can select the type of report and scenarios to use. For this example, the Retirement Planning version will be the most appropriate because of the retirement-focused nature of this case.

When selecting the scenarios to use, Baseline should represent your starting point (Current Situation) and Improvement should represent your suggested solution (Recommended). After generating the report, you’ll be able to identify both the impact of your recommendations and the value of your advice.