Young Family Sample File

Razor Academy

Can Leo and Beth afford to support their two children in university and retire at age 60?

Leo & Beth Miller

Beth is 38 and her husband Leo is 39. Together they earn $206,000 a year and live in Alberta with their 2 children Sue age 12, and Guy age 10.

Although they have saved money in a RESP for their children’s education that will cover all tuition costs for 4 years, they want to provide an additional $15,000 each year for living expenses.

“We want to do everything we can to help our children get a great education, even if that means we have to delay our retirement by a few years,” Beth tells her advisor when they meet to discuss their financial plans.

Disclaimer: The results and recommendations outlined in this example are for illustrative purposes only. The recommendations made are designed to demonstrate functions within RazorPlan and are not intended to act as a guide or real client recommendation.

Note: Due to potential changes in the software or updates to math and taxation, your results may not exactly match the following outline.

Their assets include the following:

Their plan is simple, retire at Leo’s age 60 with a spending goal of $6,000 each month after tax to age 95 and if possible, spend an additional $18,000 each year on travel until age 75.

How To Build with RazorPlan:

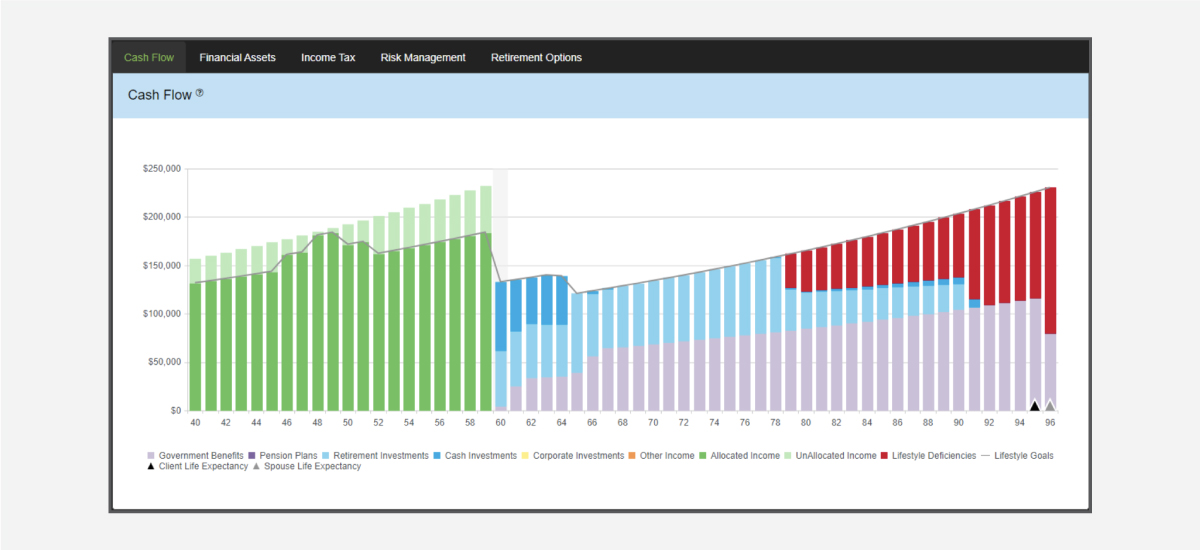

Review the Current Situation Scenario for an outline of their current situation. Based on what they are currently doing, using the Cash Flow Chart in RazorPlan you can clearly identify the opportunities and obstacles related to future cash flow.

First the good news, based on their income and expenses they should have no problem allocating $15,000 per year for 4 years to help their children pay for the additional expenses while in university. This additional education expense was added through Lifestyle Needs data entry, using the Drill-Down control and can be seen as the increase in lifestyle needs between ages 46 and 51 in the chart above.

Now the bad news, without making changes to their approach, they will run short of their planned retirement lifestyle by Leo’s age 79 as indicated by the lifestyle deficiencies (red) on the chart above.

Fortunately, they have unallocated cash flow pre-retirement that they can use to improve their financial situation. View the Cash Flow Allocation Scenario.

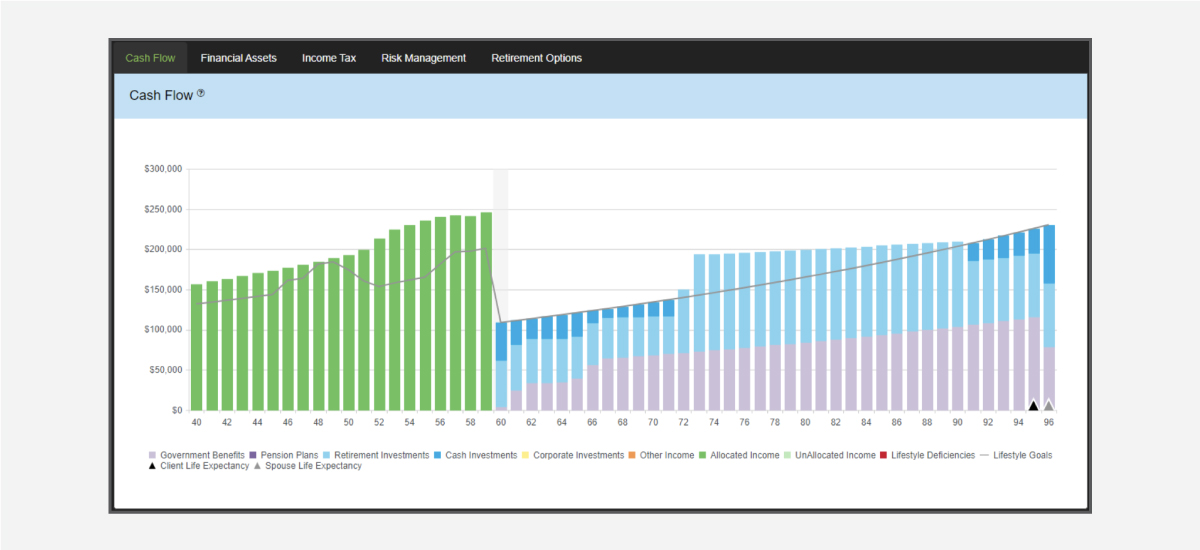

If they allocate this excess to paying down their mortgage, and increasing RRSP and TFSA contributions, they can now fully fund their basic retirement lifestyle.

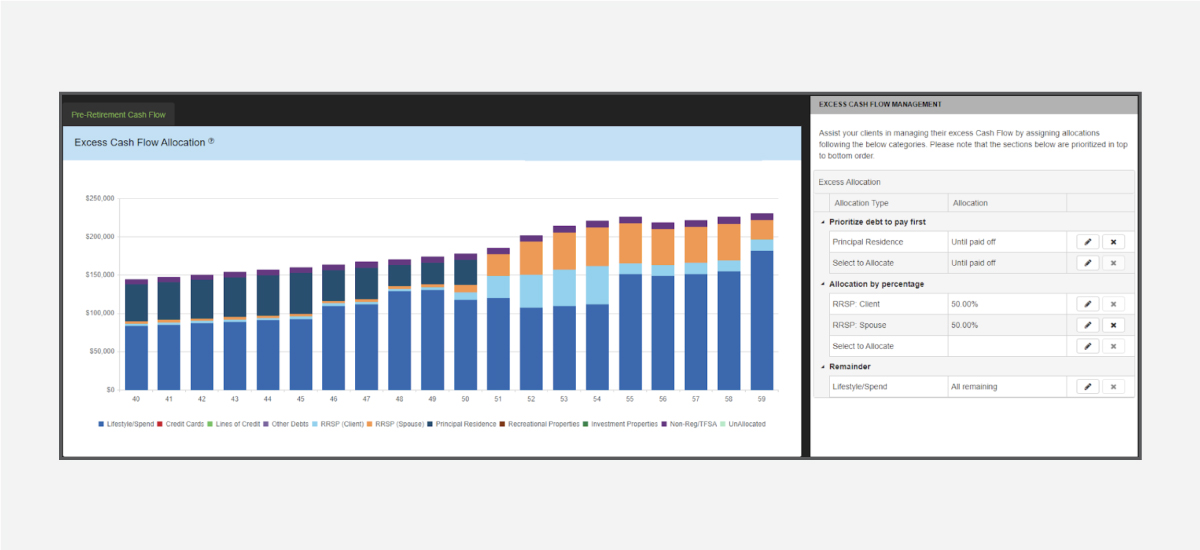

The Excess Cash Flow Management Tool will automatically reallocate any pre-retirement excesses to paying down debt, optimizing savings, or increasing lifestyle.

In this case, we’ve chosen to prioritize paying down the mortgage first. Once paid off, all remaining excesses will be split equally between the client and spouse RRSPs.

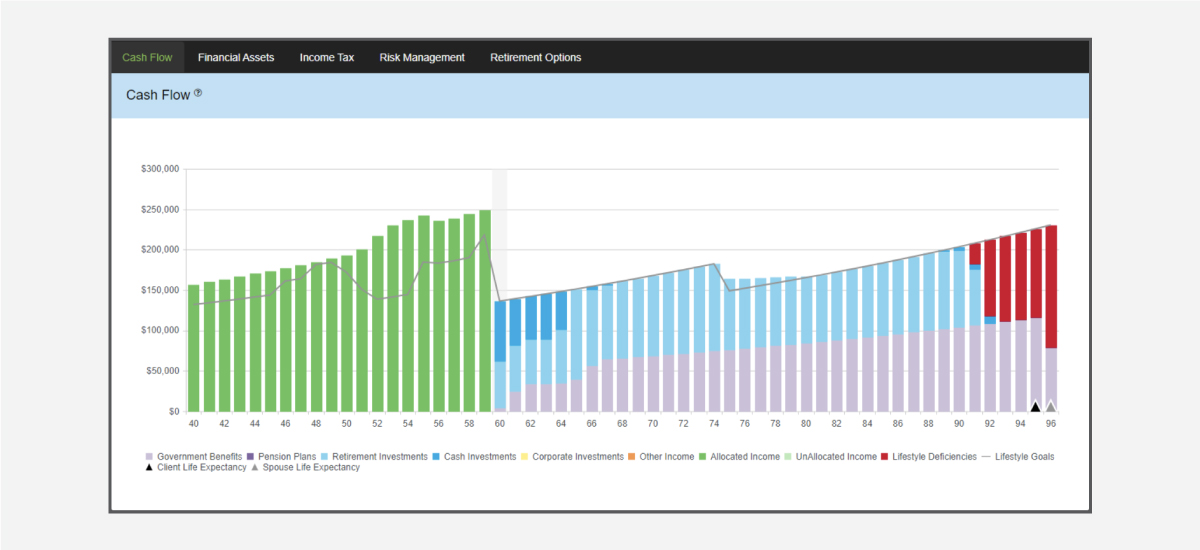

We’re still not done however, Leo and Beth have also indicated one of their goals is to spend an additional $18,000 each year on travel in retirement until age 75. By increasing their Active Retirement Lifestyle to $90,000 between the ages of 60 and 75, we have recreated a situation where the clients will run short of their planned retirement lifestyle by Leo’s age 91.

What other recommendations can be applied to help these clients fund their lifestyle goals without creating potential shortfalls? You can create any number of new scenarios to test out your solutions and create a plan that will work for Leo and Beth. Keep in mind, we have already optimized pre-retirement excess cash flow, so the potential to increase savings has already been utilized.

Some potential options could include reducing their lifestyle, delaying retirement, or earning a higher rate of return. Additionally, you could look at the impact of changing CPP/OAS start ages.