Introduction to RazorPlan with Decumulation

By Mike Howe, March 2023

Clients within 10 years of their desired retirement age or in their first 10 years of retirement, are commonly referred to as being in the retirement risk zone. Clients in the retirement risk zone have many questions, including:

- Which of my assets should I use when funding my retirement?

- When should I apply for the Canada Pension Plan?

- When should I apply for Old Age Security?

- How can I minimize my taxes?

- How can I maximize my retirement income?

Answering these questions can be overwhelming for clients and requires proper planning. Preparing a decumulation plan on how assets are going to be used in retirement is an added value that financial advisors should be offering clients. However, many advisors approach this type of planning using simple rules of thumb and conventional logic of drawing down one asset class at a time.

When planning the decumulation of assets in retirement, advisors need to understand what their clients truly want in their retirement years and their estate goals. Typically, clients are interested in one of the following goals:

- Maximize their after-tax estate value and pay the least amount of taxes.

- Maintain, and in some cases grow, their investments to support future discretionary lifestyle expenses.

- Reduce the risk of outliving their capital while maintaining their planned retirement lifestyle.

Often these goals do not work in harmony, and many decisions made early in retirement can impact the client’s ability to achieve their long-term goals. In some situations, a withdrawal plan that maintains their investments and provides a higher net worth at life expectancy may not create the most after-tax estate value compared to an alternative strategy.

To make the process of planning the drawdown of assets in retirement easier, we created RazorPlan with Decumulation; a bias-free optimization tool providing recommendations on how clients can reduce the risk of outliving their money while achieving their after-tax estate goals.

RazorPlan with Decumulation lets an advisor select which of the above goals their client wants to achieve and then analyzes the optimal way of withdrawing from investment accounts, including their:

- Registered investments (RRSPs / RRIFs),

- Non-registered investments and,

- Tax Free Savings Accounts (TFSAs).

In addition to determining the optimal withdrawal strategy between investment assets, RazorPlan with Decumulation also analyzes the starting ages for both Canada Pension Plan (CPP) and Old Age Security (OAS). By looking at all aspects of the clients’ financial plan, RazorPlan with Decumulation is able to determine how much of an improvement can be made by using the optimal decumulation strategy to help clients meet their goals.

By automatically comparing multiple asset drawdown scenarios and tracking net worth and estate value for every year in the planning period, this tool can chart the trade offs of each strategy. RazorPlan with Decumulation then identifies the difference in either net worth or estate values when the optimal strategy is compared to the least optimal strategy, identifying if any wealth is at risk in their decumulation years.

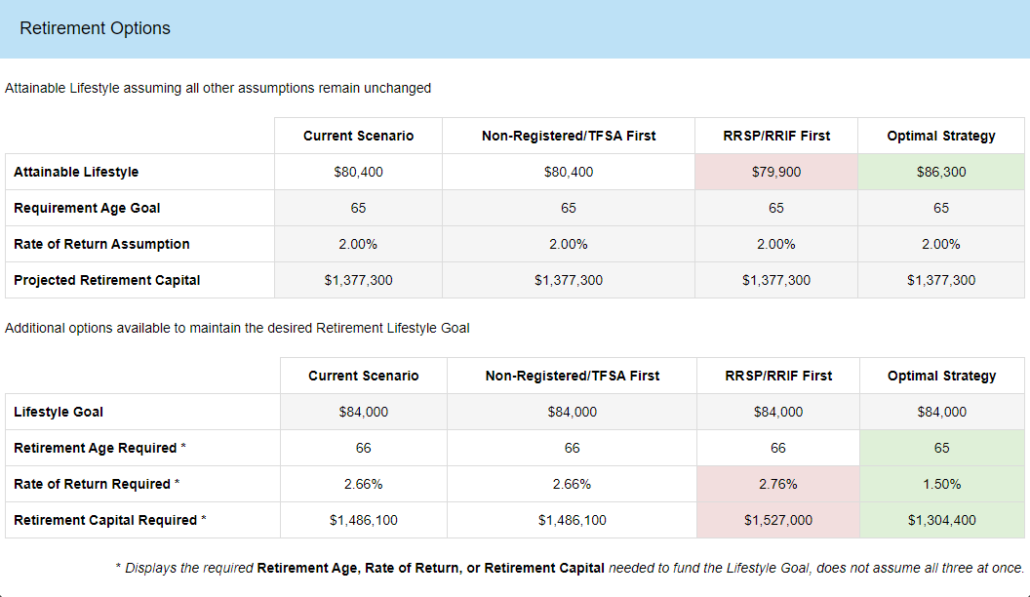

In addition to identifying the wealth at risk, RazorPlan with Decumulation easily shows your clients that each drawdown strategy has pros and cons when considering retirement options. You can show that proper planning today may lead to them being able to spend more in retirement or even retire earlier. Alternatively, the system also looks at their required retirement ages, rates of return, and retirement capital under the different strategies to show impact of proper decumulation planning.

As your clients approach retirement, providing a decumulation plan becomes increasingly more important. RazorPlan with Decumulation helps you answer your clients many questions about this phase of life and makes it easy for the clients to see the value of having a proper plan.

See RazorPlan with Decumulation in Action

Below is a video from the webinar announcing the launch of RazorPlan with Decumulation, presented by RazorPlan founder Dave Faulkner.

See How it Works – Free 30-Day Trial

Click here to sign up for a free 30-day trial of RazorPlan with Decumulation and see firsthand how it will help you get the most value for your client’s retirement.