RazorPlan with Decumulation – Getting Started

By Mike Howe, March 2023

The following video and blog article will walk you through the new decumulation tool, now available as an add-on to both RazorPlan and RazorPlan Advanced (contact support@razorplan.com to add this feature onto your account). The goal of this article is to get you familiar with using this new tool.

Working with an existing RazorPlan client file, the first step of using the new decumulation feature is to click the decumulation button ![]() on the RazorPlan toolbar. RazorPlan will then automatically run the decumulation calculations on the current file and display the results.

on the RazorPlan toolbar. RazorPlan will then automatically run the decumulation calculations on the current file and display the results.

By default the program optimizes for estate by looking at the withdrawal priority and the starting ages for government benefits. The results are displayed by measuring the Wealth at Risk between the optimal strategy versus strategies using Non-registered or RRSP/RRIF assets first.

Wealth at risk is the difference between either the estate or net worth values of the optimal strategy and those same values of the worst decumulation strategy. This value identifies how much assets could be lost by not implementing the correct decumulation strategy. The Overview tab will display the Wealth at Risk as both the actual difference in values between the strategies and as a percentage improvement of using the optimal strategy.

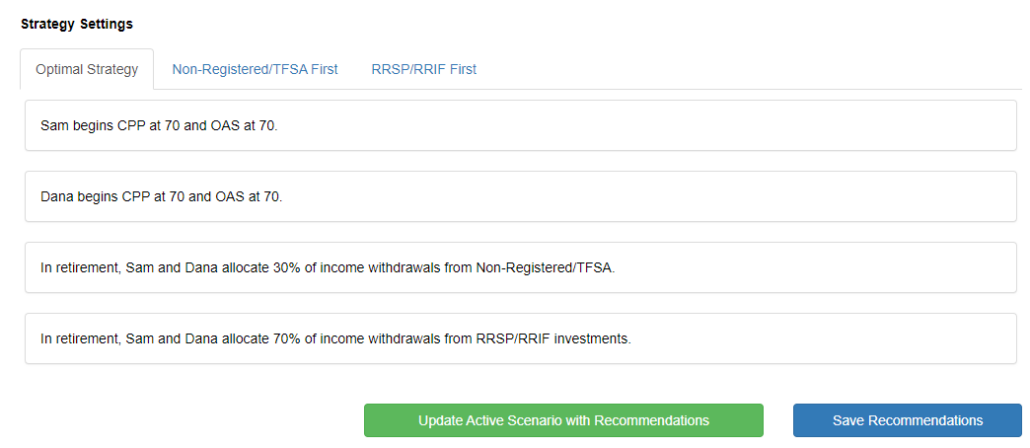

The Strategy Settings area at the bottom of the Overview tab shows the changes that have been made to the client’s CPP and OAS start ages, the spouse/partner’s CPP and OAS start ages, and the recommended allocation of the withdrawals from the Non-registered / TFSA assets and the RRSP / RRIF assets.

This area also provides buttons to update the active scenario with the optimal recommendations and to add text recommendations to the RazorPlan recommendations area. Once the analysis is complete, use the ![]() button to change the fields in the RazorPlan data entry screens to the recommended settings. This adjustment will be made to the active scenario so you may want to create a new scenario prior to clicking this button.

button to change the fields in the RazorPlan data entry screens to the recommended settings. This adjustment will be made to the active scenario so you may want to create a new scenario prior to clicking this button.

Use the ![]() button to add text recommendations to the retirement planning tab of the Recommendations screen. Once clicked, you will see a confirmation that the recommendations were added and you can view or change the text of these recommendations by clicking the Recommendations button (

button to add text recommendations to the retirement planning tab of the Recommendations screen. Once clicked, you will see a confirmation that the recommendations were added and you can view or change the text of these recommendations by clicking the Recommendations button (![]() ) on the toolbar.

) on the toolbar.

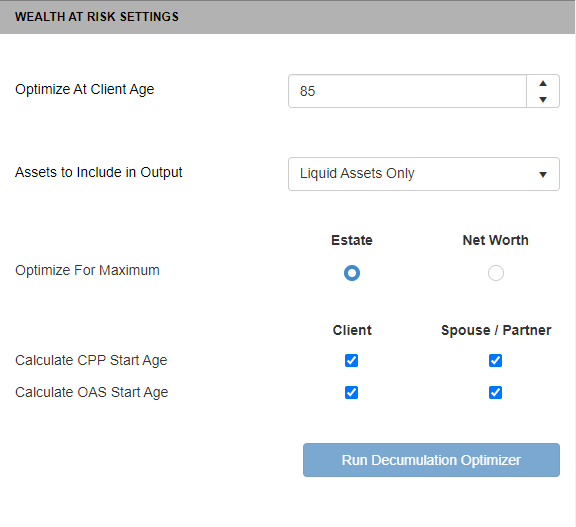

Advisors can choose to change the decumulation calculations using the controls in the Wealth Risk Setting panel. The first setting is to select the age of the client that you want to determine the optimal strategy for. Depending on the goals of the clients this age may be set to any age after the client’s retirement age. After selecting a solve age, choose whether the results will include Liquid Assets Only or both Liquid and Fixed Assets in the Assets to Include in Output dropdown. This option can change both the value and percentage shown on the overview tab.

This Wealth at Risk Settings area also lets you select whether you are optimizing to maximize the clients’ Net Worth or Estate, select the option that matches the goal of the client. Lastly, you are able to turn on or off the determination of starting ages for government benefits for both the client and spouse/partner. If any changes are made to any of the options in the Wealth at Risk settings then the solve will need to be re-calculated. Click the ![]() button to perform the decumulation optimization calculations with the new settings, the Overview tab will update once the calculations are complete.

button to perform the decumulation optimization calculations with the new settings, the Overview tab will update once the calculations are complete.

There are five tabs provided in the decumulation area for reviewing the calculations performed by the optimizer:

- The Overview tab gives a general overview of the results and outlines the strategy changes.

- The Results tab displays the Net Worth or Estate Value (whichever is selected in the settings) for the three drawdown strategies that the program analyzes. This chart allows you to see how each strategy has different advantages and disadvantages at different points of the plan.

- The Retirement Options tab outlines the four retirement options under each of the drawdown strategies and highlights where the options are better or worse compared to the current scenario loaded into RazorPlan.

- The Strategies tab shows the income sources for each year and you can choose which of the drawdown strategies is displayed. This tab also allows you to show the incomes as percentages.

- The Details tab shows the year by year incomes and withdrawals for a selected strategy. Both the Details and Strategies tabs allow you to select the strategy being shown using a dropdown menu provided above the chart.

RazorPlan with Decumulation is a powerful tool that will help you determine if your clients can be more efficient in their decumulation phase. This tool can also be used to identify the potential to create more net worth or estate with the decisions they make during this period. Ultimately, using this tool will give you the ability to better help clients achieve their financial goals.

Additional Resources

-

RazorPlan User Guide – Decumulation

-

RazorPlan with Decumulation Introduction Webinar (below)