Will That Investment in Your Child’s Business Endanger Your Retirement?

Your son or daughter just asked you for a short-term loan to help them start a business. If everything goes well, they will pay you back with interest in a few years. But what if they never pay you back? How much will it impact your ability to enjoy your retirement?

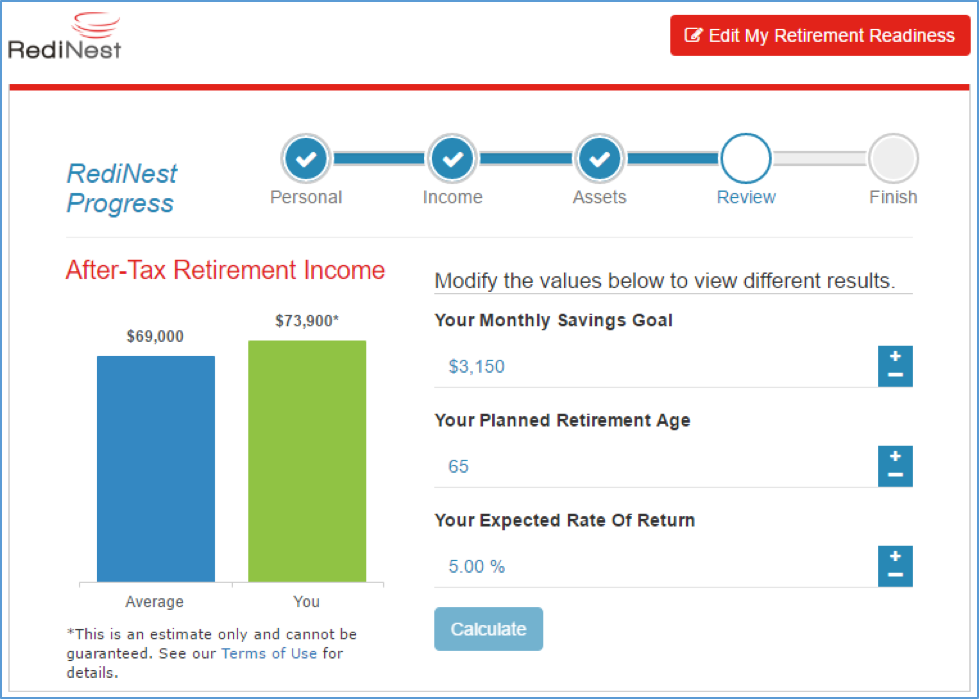

RediNest is a personal financial planning application that you can use to get answers to your retirement planning questions.

Let’s take a look at how RediNest can help.

John and Joan plan to retire in 10 years. Although they do not have a pension plan, they have $300,000 in RRSP and $100,000 in TFSA investments. With no mortgage, they are able to contribute the maximum each year to both RRSP and TFSA.

Using RediNest they calculated their Retirement Potential™ at $73,900 of after-tax retirement income, slightly more than the Canadian average* of $69,000.

Their son has asked them to invest $100,000 in his business. He has prepared a business plan, and expects to repay the full amount over 5 years. John and Joan want to fully understand the risks before loaning their son the money, so they modified their RediNest plan and reduced their TFSA balance to zero.

Assuming a worst case scenario where they never get their money back, John and Joan re-calculated their Retirement Potential™ to be $67,800, a reduction of over $6,000 / year for life! A significant amount when you consider it is after-tax and fully indexed for inflation. If they never get their money back, John and Joan want to understand the options available to them to restore their Retirement Potential™, as they do not want to have less disposable income in retirement.

Using RediNest, John and Joan discovered they would have to increase their monthly savings by over $900/month for the next 10 years – something that they feel they cannot do.

Next, they considered adjusting their retirement age from 65 to 66. Deferring their retirement one year means an additional year of savings and one less year of spending is needed to give them the income they want. Not ideal, but they would consider it.

Finally, they modified their estimated return on investment and found they would have to earn an additional 1% every year from now until life expectancy to be able to enjoy the standard of living they had planned on. Given their investment allocation and risk tolerance, this increase in expected return is unlikely.

After weighing all the facts, John and Joan decided that they would loan their son the money, and should he be unable to repay the full amount, they would delay their planned retirement date by as many months as needed.

Do you know what your Retirement Potential™ is and the options available to you? Get your free report at RediNest.

*Canadian average represents the average Retirement Potential™ of financial analysis prepared by financial advisors in the past 12 months using RazorPlan† financial planning software, excluding people with corporate assets.

†RazorPlan software is the analytical engine used by RediNest.com to calculate Retirement Potential™. Total sample exceeds 10,000 professionally prepared analyses.

Leave a Reply

Want to join the discussion?Feel free to contribute!