Planning as a Concept: Estate Planning

By Dave Faulkner February 19, 2019

In this final chapter of our six-part Planning as a Concept series, this post is focused on Estate Planning. Download the ebook: Planning as a Concept.

Estate Planning is the process of arranging for the orderly disposal of a client’s estate to eliminate uncertainties over administration and probate. Although your client’s Estate Planning is impacted by all areas of financial planning, it is highly integrated with Tax Planning, as all capital property is deemed to be disposed of immediately prior to death, triggering any deferred capital gains. Included with the Estate Planning concept is a ledger that displays the change in financial position for net worth, deferred taxes and life insurance, which together will help your clients focus on the positive results they can expect from your recommendations.

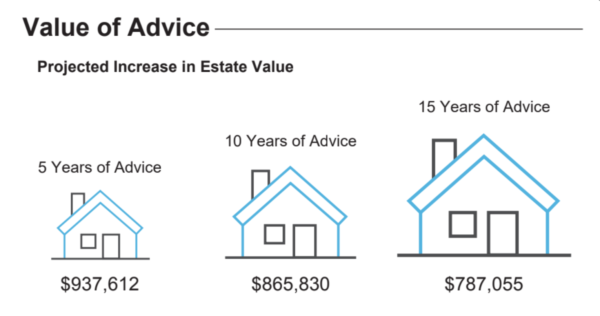

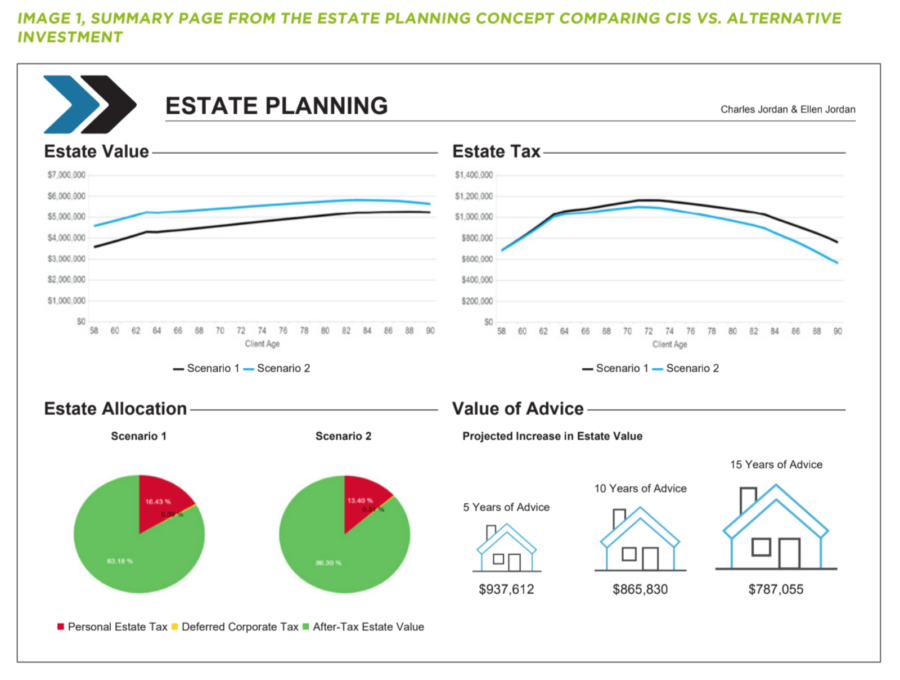

This concept clearly communicates your Value of Advice by comparing the projected estate value from two scenarios using a line graph along with icons representing 5, 10 and 15 years of advice.

- Scenario 1 is the client’s current plan

- Scenario 2 is your recommendations

To illustrate the advantage of using the Estate Planning concept over a product sales concept, we will examine a popular insurance sales concept Corporate Investment Shelter.

CORPORATE INVESTMENT SHELTER (CIS): CLIENT PROFILE

Charles and Ellen Jordan, age 59 & 57, were referred to you by an investment advisor in your professional network. They have a small industrial service business and are looking for some advice to help them minimize the taxes payable on their estate.

The business has a FMV of $1 million which will be sold when Charles retires at age 65, and the after-tax value will be added to the $1.2 million of corporate investments they have today. With growth, annual saving of $50,000, and the proceeds from the sale, they are projected to have close to $2.6 million in corporate investments at retirement.

Charles also has $525,000 in his RRSP and is contributing the maximum each year. Ellen has $175,000 and contributes her maximum of $9,000 each year. Together they own a home worth $850,000 and a cottage worth $500,000 and have no personal debt.

ESTATE PLANNING CONCEPTS INCLUDE:

- Estate Bond

- RRIF Insurance

- Asset Protection

- Investment Shelter

Product Advice

Prior to meeting with the Jordans, you sent them a comprehensive client questionnaire which they completed and returned to you the following week.

Using RazorPlan you prepared a financial analysis that incorporated their retirement income goal of $8,000 / month. This allowed you to estimate that they will have a net worth greater than $6 million at life expectancy, and taxes of approximately $1 million.

To illustrate the CIS concept, you created a second scenario and added a $1,000,000 joint last, minimum premium universal life policy funded from the corporate investments.

Using the summary page of the Estate Planning concept (image 1), you can see that by implementing the CIS concept the estate value is increased each year and the value of advice in the 5th year is a $937,000 increase in estate value.

In addition to illustrating the change in estate value, the percentage of the estate allocated to paying income taxes has reduced from 16.4% to 12.3%, further validation of the CIS concept.

Planning Advice

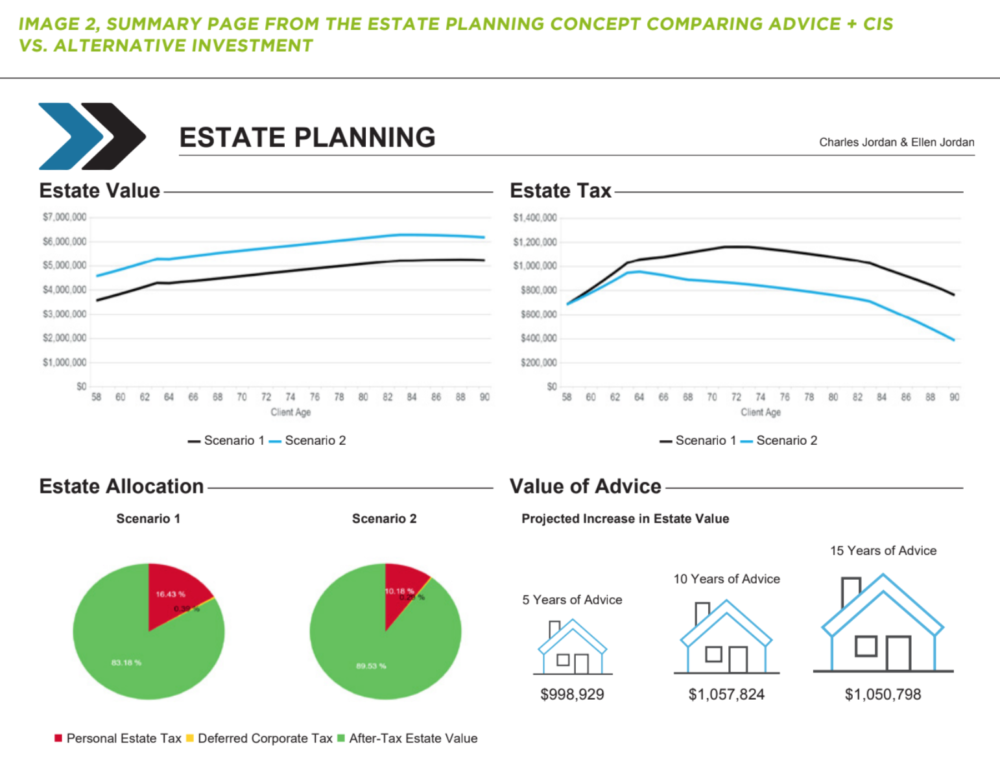

Recommending the CIS concept on its own can significantly increase estate value, but your value is limited to a product sale. When you include other recommendations aimed at minimizing estate tax, you create Value over Product™ and help your clients better appreciate the financial advice, guidance and products you recommend.

In addition to the CIS concept, what if you added additional estate planning strategies to Scenario 2?

- To take advantage of the tax-sheltered investment account in the universal life policy, you recommend maximum deposits of $60,000 / year for 10 years.

- Implement income splitting strategies that would allow more of the corporate dividends to be paid to Ellen at a lower marginal tax rate.

- To reduce taxes related to their RRSP investments at death, they should implement a modest RRSP melt-down with minimum RRIF withdrawals starting at age 65 instead of waiting until age 71.

Adding the above recommendations using the RazorPlan Estate Planning concept creates Value over Product™ of $248,000 over 15 years compared to a product recommendation alone.

Planning as a Concept™ is a feature of RazorPlan financial planning software and uses Value of Advice to validate your recommendations and instill confidence in you as a financial professional.

Leave a Reply

Want to join the discussion?Feel free to contribute!