Planning as a Concept: Retirement Planning

By Dave Faulkner February 5, 2019

In part five of our six-part Planning as a Concept series, this post is focused on Retirement Planning. Download the ebook: Planning as a Concept.

Retirement Planning is the process of helping a client manage their assets with the goal of achieving their vision of financial independence. Although all areas of financial planning will impact a client’s retirement plans, it is highly integrated with Financial Management and Investment Management due to the dependency on available cash flow and willingness to invest for the future. Included with the Retirement Planning concept is a ledger that displays the change in financial position for income producing assets, required savings and any excess or deficiency, which together will help your clients focus on the positive results they can expect from your recommendations.

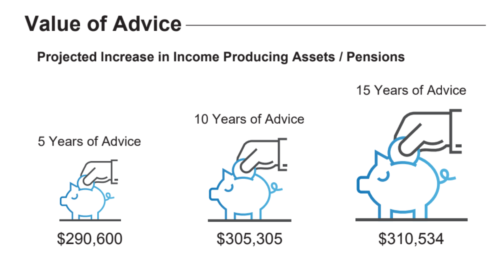

This concept clearly communicates your Value of Advice by comparing the projected value of income producing assets and pensions from two scenarios using a line graph along with icons representing 5, 10 and 15 years of advice.

- Scenario 1 is the client’s current plan

- Scenario 2 is your recommendations

To illustrate the advantage of using the Retirement Planning concept over a product sales concept, we will examine the difficult decision many people with a defined benefit pension are faced with at retirement; Pension Income vs. Commuted Value.

DEFINED BENEFIT PENSION PLAN: CLIENT PROFILE

Recently you were contacted by John Parry and his wife Sasha, age 62 & 61, to consult on his retirement package which offered him 2 options:

- Pension of $3,850 / month indexed at 75% of inflation with 75% survivorship.

- Commuted value of $710,000 ($485,000 in a LIRA and $225,000 taxable lump-sum)

John and Sasha estimated that if they took the commuted value there would be $52,000 in taxes assuming they contributed the maximum $73,000 to their RRSPs. The remaining value along with existing savings would give them total income producing assets of $859,000.

John estimated that CPP, OAS and Sasha’s small pension of $850 / month would provide $25,000 / year and their savings would provide another $35,000, assuming a 4% withdrawal rate. At $60,000 / year they felt this would be adequate to meet their income needs and their daughter would inherit the remaining balance.

RETIREMENT PLANNING CONCEPTS INCLUDE:

- RRSP vs. Non-Registered

- RRSP vs. TFSA

- Income Withdrawal Order

- Pension Optimization

Product Advice

Although a 4% withdrawal rate is a good rule of thumb, it will be difficult to duplicate the guarantees offered by an indexed pension and the lack of estate value can easily be handled with a permanent life insurance policy.

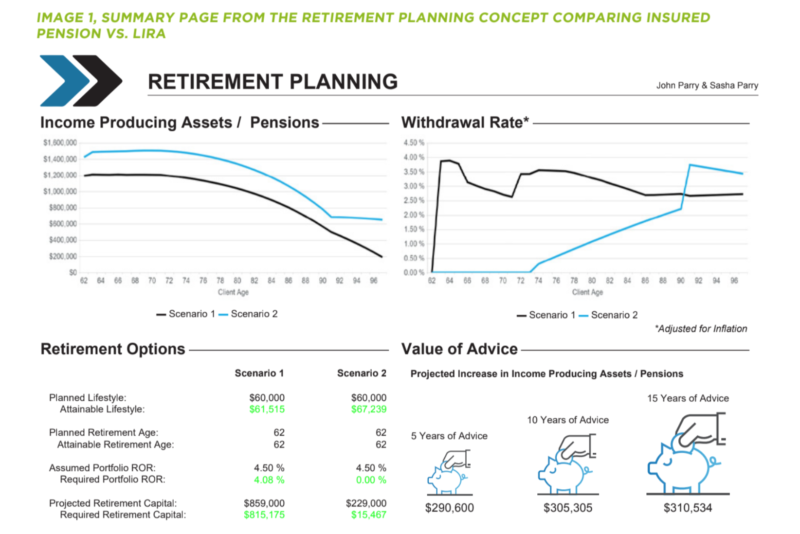

To illustrate this using RazorPlan you prepared 2 Scenarios; Scenario 1 illustrates the commuted value of the pension and Scenario 2 illustrates the pension income and $350,000 of universal life insurance with a minimum premium of $6,700 / year.

Using the summary page of the Retirement Planning concept (image 1), you can see that taking the monthly pension income and paying for life insurance, compared to the commuted lump-sum, increases the value of income producing assets and pensions by more than $290,000 over 5 years, and $310,000 over 15 years.

The summary page also displays the impact to retirement options and the withdrawal rate of the 2 scenarios, providing additional confirmation that the guaranteed monthly pension offers greater value.

Planning Advice

Although the monthly pension combined with life insurance for their daughter is clearly the best recommendation, your value is limited to a product sale. Providing additional planning recommendations related to optimizing retirement income will create Value over Product™ and help your clients better appreciate the financial advice, guidance and products you recommend.

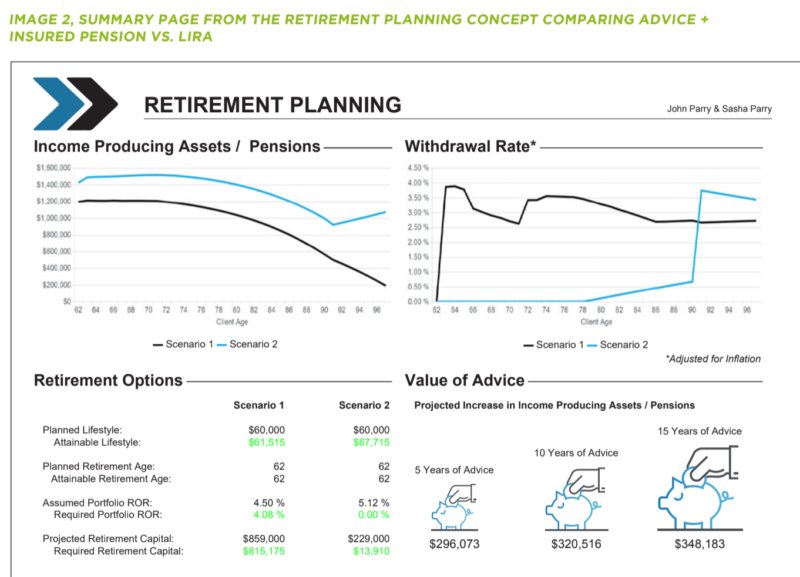

In addition to the insured pension income, what if you add the following recommendations in Scenario 2?

- The Parrys have made only one small contribution to their TFSAs in recent years. They should incorporate TFSAs into their asset allocation strategy using taxable investments and future excess income.

- Using a tax efficient low-cost ETF managed portfolio or digital investment platform could lower investment fees on non-registered investment, effectively increasing after-tax investment returns.

Adding these additional recommendations using the RazorPlan Retirement Planning concept creates Value over Product™ by improving the results an additional $6,000 over 5 years and $38,000 over 15 years compared to a product only recommendation.

In the final part of our series, we will be discussing Estate Planning.

Planning as a Concept™ is a feature of RazorPlan financial planning software and uses Value of Advice to validate your recommendations and instill confidence in you as a financial professional.

Leave a Reply

Want to join the discussion?Feel free to contribute!