5 Data Entry Tips For Better Plans

The biggest variable for any software program is the data entered. Even small discrepancies in client data can result in large variations in the output.

Below we have put together a list of the top 5 most common mistakes made by RazorPlan users. Being familiar with each of these items will help to ensure that the analysis delivered to your clients accurately reflects the analysis you mean to deliver.

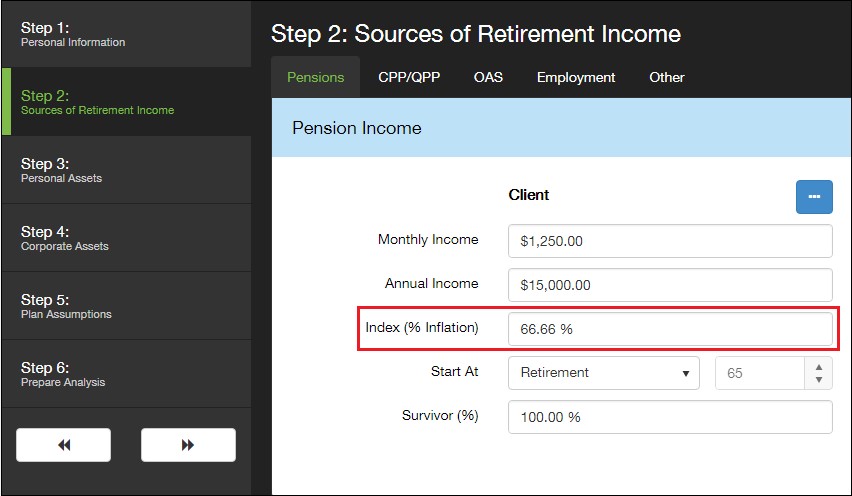

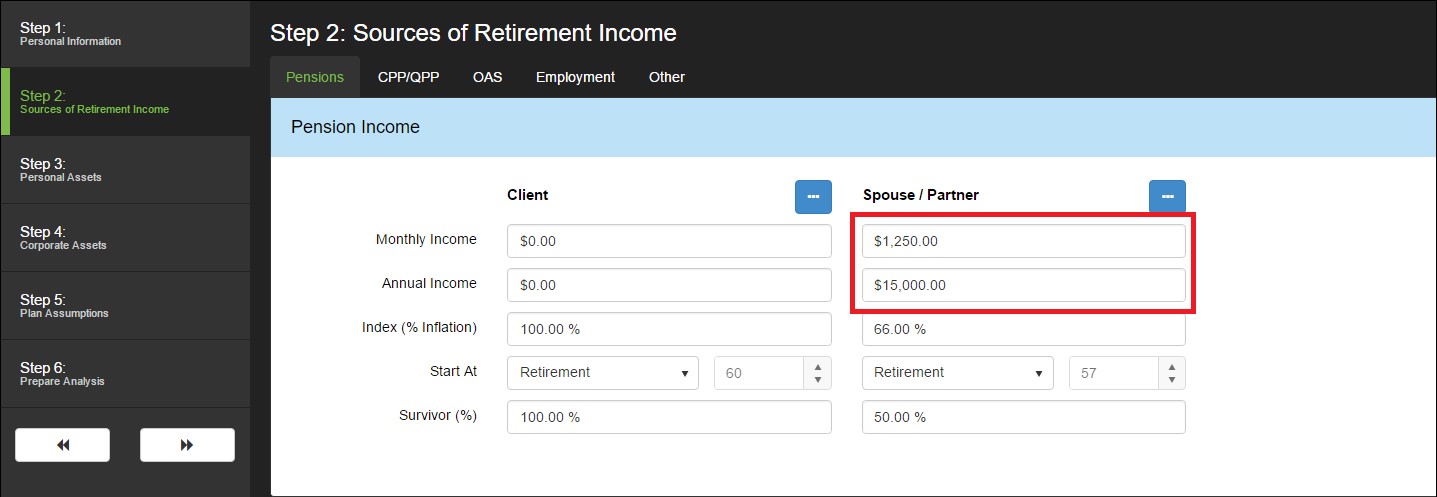

Index (% Inflation)

While RazorPlan uses a global inflation rate for the whole plan, which is found in step 5 of data entry wizard, certain data points in the program give you the ability to adjust the percentage of inflation applied to a given value. These fields are used to control the rate of inflation that you wish to use by applying a portion of the global inflation rate entered.

For example, if global inflation is entered as 3% and you only wanted to apply a 2% index to a client’s pension income, you would not enter 2% in the Index (% Inflation) field but rather 66.66%. This would result in an index of 2% (3% x 66.66% = 2%).

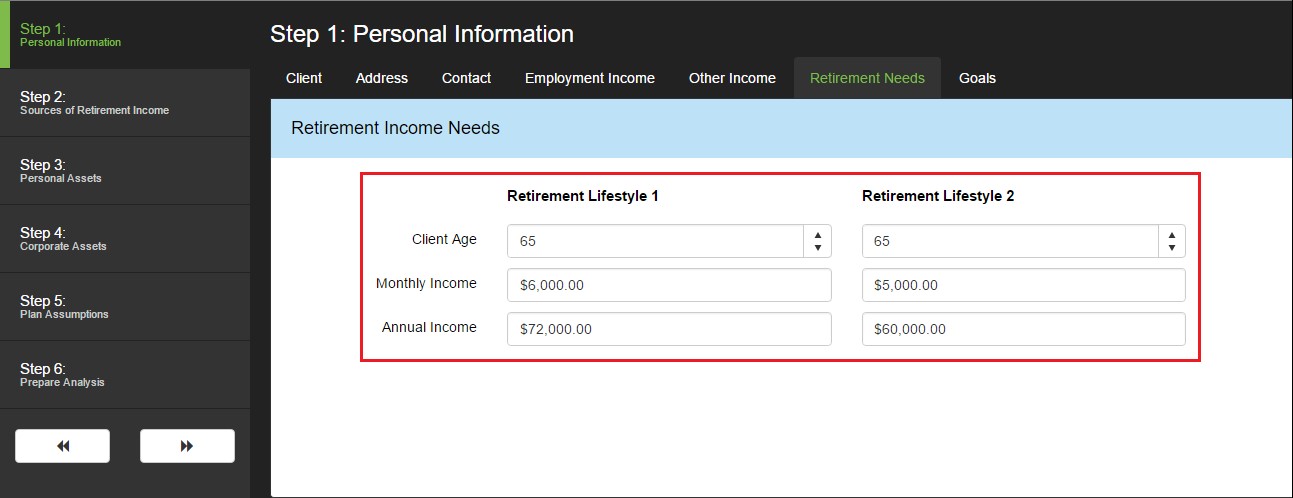

Retirement Lifestyle 1 and Retirement Lifestyle 2

When dealing with retirement income needs, RazorPlan allows a user to model two distinct stages in retirement; Retirement Lifestyle 1 and Retirement Lifestyle 2. This gives the user the ability to increase or decrease the income needed in retirement for two different life stages based on client needs.

These two retirement lifestyles are not a direct comparison but rather represent 2 different lifestyles as the clients’ age. Retirement Lifestyle 1 will begin at retirement and continue until the start of Retirement Lifestyle 2. Retirement Lifestyle 2 will then continue until the end of the analysis.

If you want to compare two different lifestyle needs, an you would need to run two different RazorPlan projections. An easy way to do this is through the Copy feature provided in the Open Client window.

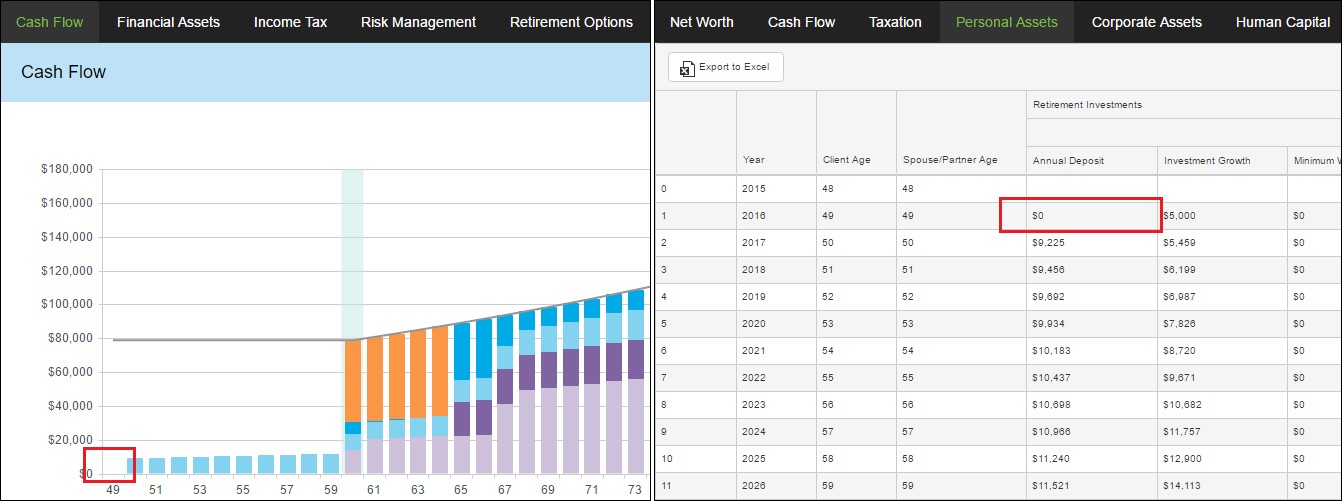

RRSP Contribution Limit

One of the enhancements we made with the launch of our HTML5 version is the inclusion of RRSP Contribution Limit. This new data point will limit your ability to enter RRSP contributions by the available room.

If no contribution room is entered, the software will not have the ability to make RRSP contributions until the room exists based on future employment income. This may result in a contribution of $0 in the first year. This can be avoided by ensuring that you have entered the clients existing RRSP contribution limit based on the last year’s notice of assessment. You can enter this value through Step 3 / RRSP/RRIF.

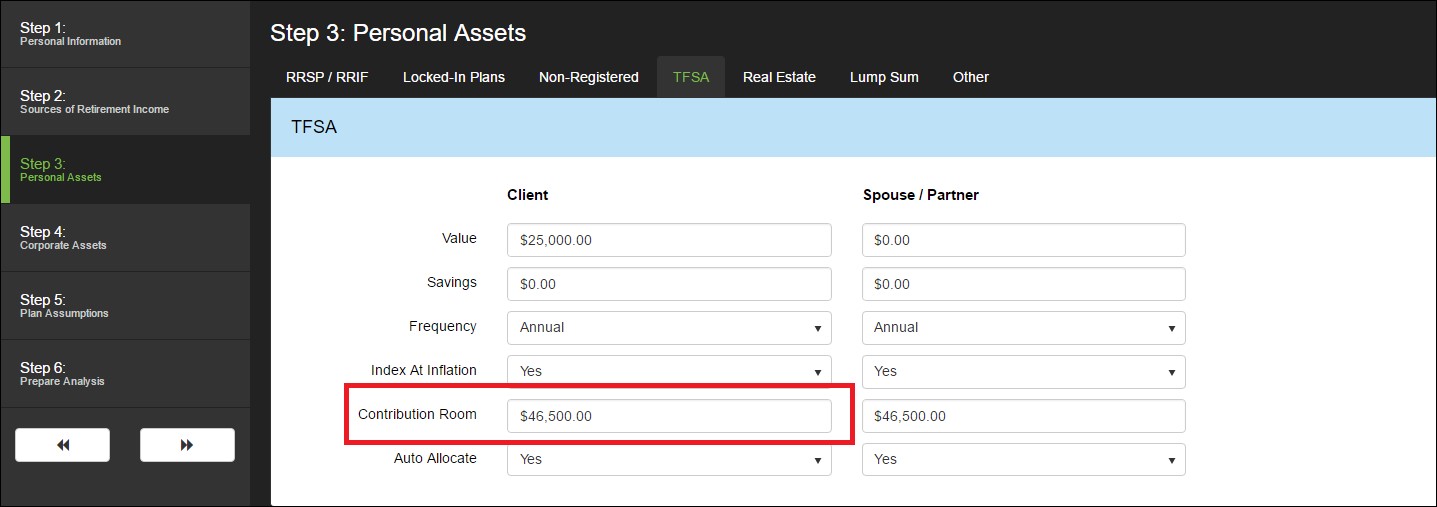

Contribution Room TFSA

Similar to the inclusion of RRSP Contribution Limit, we have also added TFSA Contribution Room. This field is where you would enter any available contribution room the clients have based on the most current tax year.

Contribution Room will control the software’s ability to deposit to the TFSA assets. You can enter this value through Step 3 / TFSA.

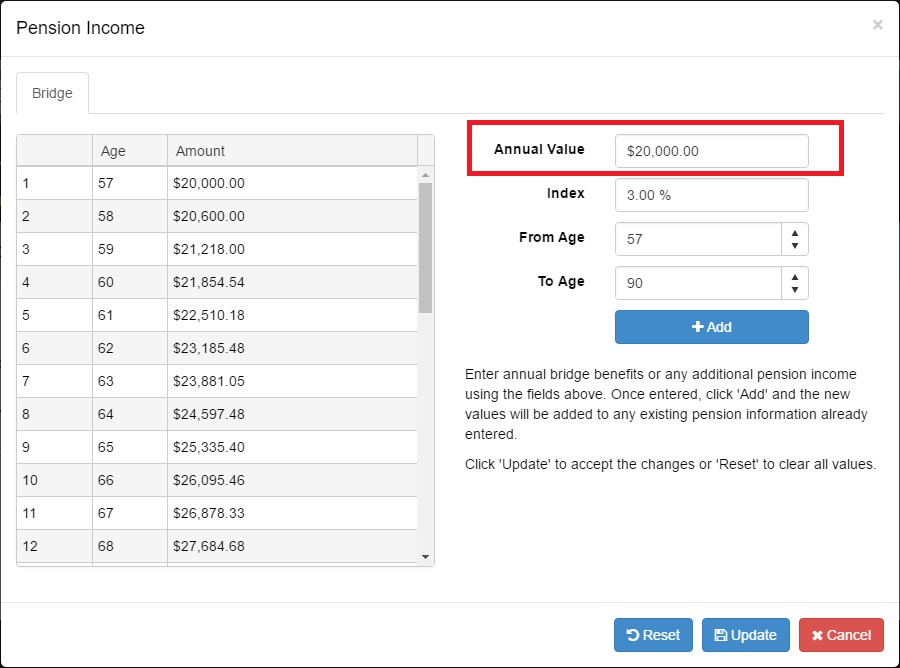

Pension Income – Today’s Dollars vs. Future Dollars

Defined Benefit Pension income is entered in today’s dollars through Step 2 / Pensions. If the clients’ are not yet retired the software will increase the expected future pension income based on the inflation value set under Step 5 / Plan Assumptions. RazorPlan takes this approach as employment income will likely increase with inflation as the client moves towards retirement.

Alternatively, any values entered through the Drill-Down window ( ) are considered to be annual future-value. This area can be used to enter a bridge benefit or addition pension income.

Ultimately these two options will allow you to enter a pension amount using Today’s Dollars or Future Dollars.

Understanding the five data entry tips outlined above will result in you getting the data entered properly the first time and being more efficient in using the program.

Leave a Reply

Want to join the discussion?Feel free to contribute!