Razorplan has always tracked the client’s retirement cash flow, now you can also track their pre-retirement lifestyle and plan their cash flow. For clients that are still in the accumulation phase of their life and are planning for their retirement, putting together a pre-retirement cash flow plan goes beyond budgeting. See it in action in the video below.

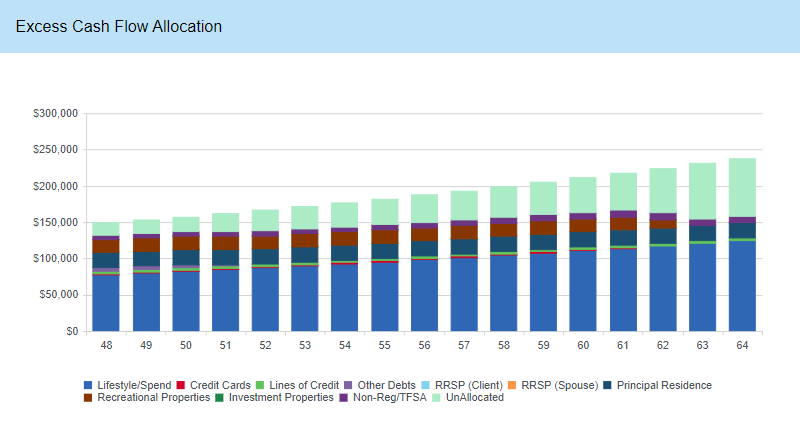

RazorPlan quickly identifies if income is allocated towards lifestyle expenditures, planned savings and/or planned debt repayment. Income that is unallocated is identified and advisors can then manage this excess cash flow to help meet retirement goals.

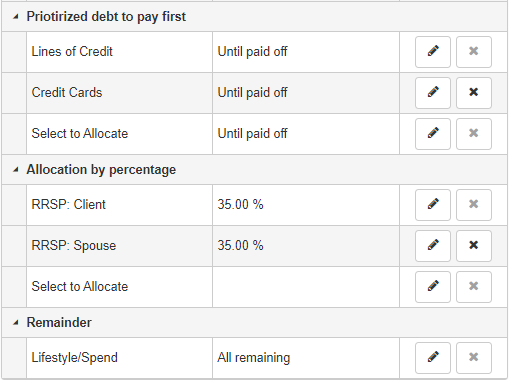

The new Excess Cash Flow Management Tool makes it easy to control where excess cash flow is directed, to make the client’s plan optimal. Using this tool advisors will be able to:

- Prioritize Debt – Find the best order to pay down credit cards, lines of credit, mortgages and other debts.

- Save – Determine the best way to save excess cash flow to RRSPs, TFSAs, and Non-registered assets.

- Spend – Adjust the client’s pre-retirement lifestyle spending in the future.

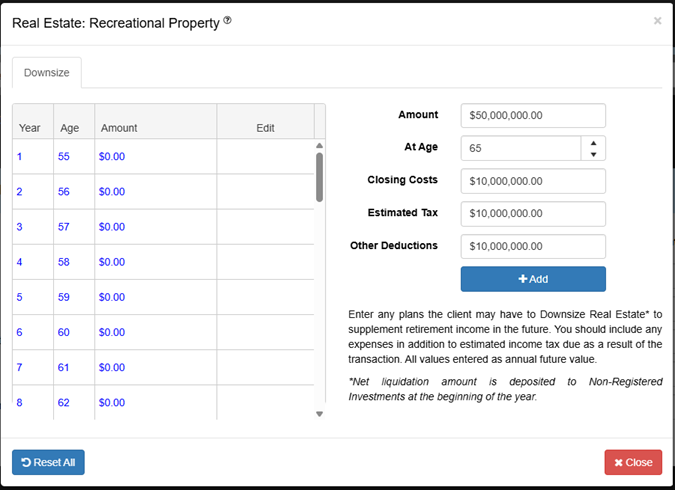

RazorPlan Plus users have the additional ability to model Capital Needs that seamlessly integrate into the client’s financial plan. Now future asset purchases and one time expenses can be entered and identified in the plan. Advisors can also show the impact of financing these capital needs by using either cash flow, debt or investment assets.

These new cash flow planning features are now available in RazorPlan.

Hi there, It’s posts like this that keep me coming back and checking this weblog regularly, thanks for the info!