Planning as a Concept: Financial Management

By Dave Faulkner November 28, 2018

In part one of our six-part Planning as a Concept series, this post is focused on Financial Management. Download the ebook: Planning as a Concept.

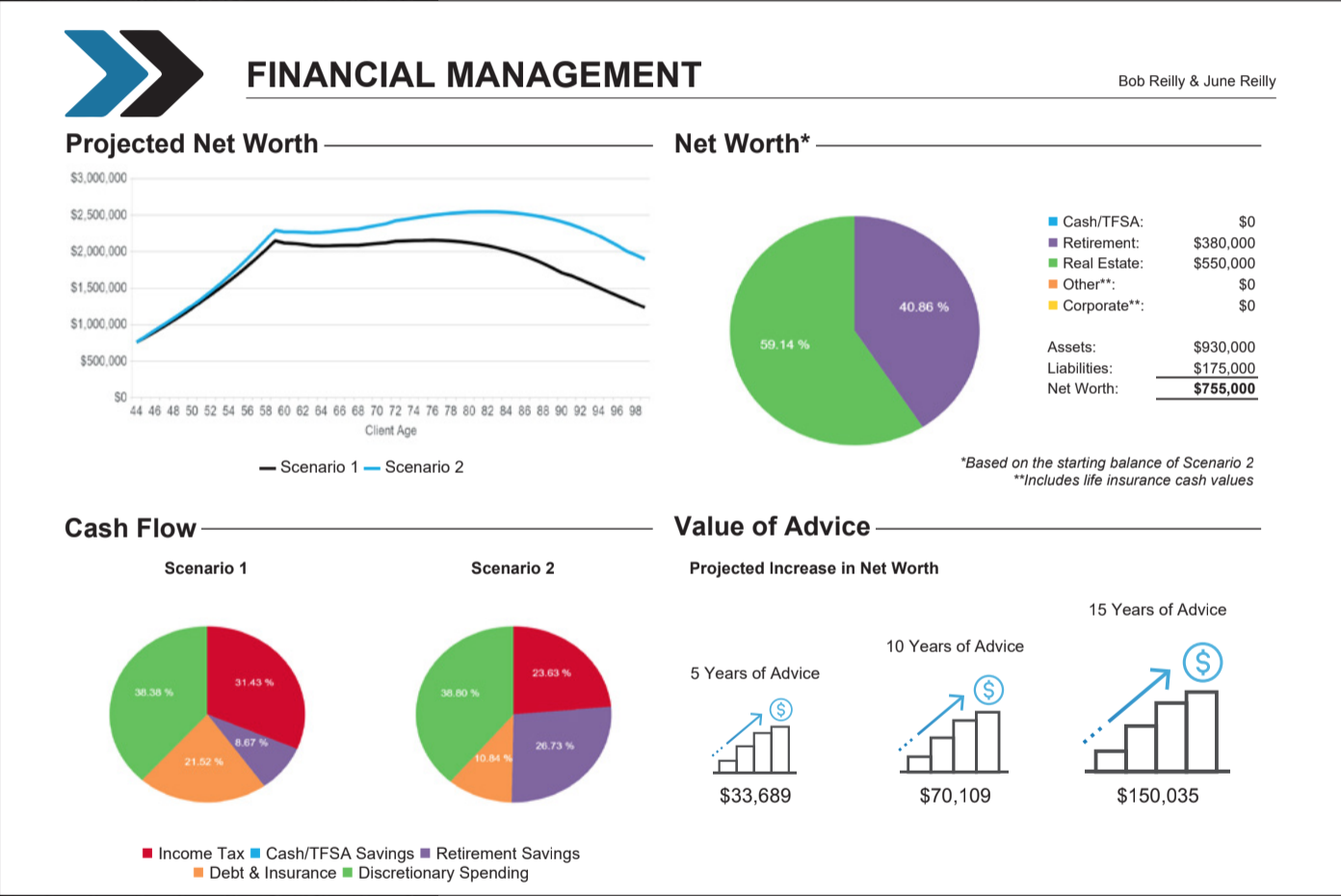

With a focus on budgeting, debt management and behavioral coaching, the Financial Management concept uses net worth as the key metric. Clients that have a personal desire to better manage their money are motivated to act due to the positive impact your advice has on their net worth. Common Financial Management concepts include RRSP vs. Mortgage, Retirement Cash Flow Planning, Budgeting, and Debt Management.

Financial Management is a key part of any comprehensive financial planning engagement. How a client manages their finances will play a significant role in determining if the recommendations you have helped them to implement. Included with the Financial Management concept are detailed Net Worth and Cash Flow statements, which together will help your clients focus on the financial resources they have, where their money comes from, and where they spend it.

This concept clearly communicates your Value of Advice by comparing the projected net worth of two scenarios using a line graph along with icons representing 5, 10 and 15 years of advice.

- Scenario 1 is the client’s current plan

- Scenario 2 is your recommendations

To illustrate the advantage of using the Financial Management concept over a product sales concept, we will examine the classic RRSP savings question, “Should I contribute to my RRSP or pay down my mortgage?”

RRSP vs. MORTGAGE: CLIENT PROFILE

Bob and June Reilly, age 45 & 41, have been insurance clients of yours for 5 years. Bob takes an active role in managing his finances and recently received a promotion that will increase his annual income from $100,000 to $125,000. This will net him an additional $1,250 each month after-tax which he plans to use to pay-down his mortgage.

With a mortgage balance of $175,000 and interest rate of 3.3%, the current monthly payment of $1,232 will have the mortgage paid off at his age 60 when they plan to retire. Using his bank’s mortgage calculator, Bob has determined that if he increases his monthly payments by $1,250 the mortgage will be paid off in just under 7 years at his age 52.

Once the mortgage is paid off, he plans to contribute the entire $25,000 raise to his RRSP until he retires. Bob and June have a total of $380,000 in RRSPs and contribute $1,000 each month. Bob used his bank’s RRSP calculator to estimate that at a 5% rate of return, their current RRSP savings along with the planned increase in contributions will grow to over $1.3 million by the time they retire in 15 years.

Product Advice

Having learned about Bob’s promotion, you arrange to do a review. During the meeting they informed you of their plans for the increase in salary. As a financial advisor, you know that investing in an RRSP with a projected rate of return of 5% will create more wealth than paying down a mortgage with a 3.3% interest rate.

To illustrate this using RazorPlan, you add 2 Scenarios to Bob & June’s plan; Scenario 1 prioritizes paying down the mortgage and Scenario 2 prioritizes contributing to the RRSP.

Using the summary page of the Financial Management concept (image above), you can see that investing in RRSP as opposed to paying down the mortgage, is projected to increase net worth over 5 years by more than $33,000. After 15 years, when Bob and June plan to retire, the increase in net worth is $150,000.

In addition to the change in net worth, their cash flow allocation validates that discretionary spending (lifestyle) is the same whether they pay down the mortgage or contribute to their RRSP.

Planning Advice

Although investing in an RRSP is clearly a better use of the increased income from a net worth point of view, your value is limited to a product sale. Providing additional planning recommendations related to the increase in income and the client’s retirement goals will create Value over ProductTM and help your clients better appreciate the financial advice, guidance, and products you recommend.

What if in addition to increasing the RRSP contributions, you add the following recommendations in Scenario 2?

- As Bob’s income increases in the future, contributions to his RRSP should also increase at the same index rate.

- Due to the size of the increase in wages, you have calculated that Bob’s RRSP contributions will be maxed-out within 2 years. When this happens, Bob should contribute the after- tax difference to a TFSA for additional investment growth and the flexibility associated with having tax-paid saving in retirement.

- When they retire, they should time the conversion from RRSP to RRIF to minimize the 30% withholding tax on income drawn from retirement savings.

Adding these additional recommendations to the RazorPlan Financial Management concept creates Value over Product™ by doubling the results of using a product sales concept alone (see image below).

In part 2 of our series, we will be discussing Investment Management.

Planning as a Concept™ is a feature of RazorPlan financial planning software and uses Value of Advice to validate your recommendations and instill confidence in you as a financial professional.

Leave a Reply

Want to join the discussion?Feel free to contribute!