Planning as a Concept: Tax Planning

By Dave Faulkner January 22, 2019

In part four of our six-part Planning as a Concept series, this post is focused on Tax Planning. Download the ebook: Planning as a Concept.

By focusing on income tax and tax efficient retirement income strategies, the Tax Planning concept uses annual and cumulative tax paid as the metric of value. Clients that have a personal desire to pay less income tax are motivated to act due to the positive impact your advice will have on their annual tax bill. Tax Planning concepts include Insured Retirement Plan (IRP), Insured Annuity, and Social Security Optimization.

Tax Planning impacts all areas of financial planning. Every decision your client makes involving their income, the purchase or sale of an asset, the investments they select and when they plan to retire, all play a key role in how much income tax they will have to pay in the future. Included with the Tax Planning concept is a ledger that displays the change in financial position for basic income tax payable, OAS clawback, and average tax rate, which together will help your clients focus on the positive results they can expect from your recommendations.

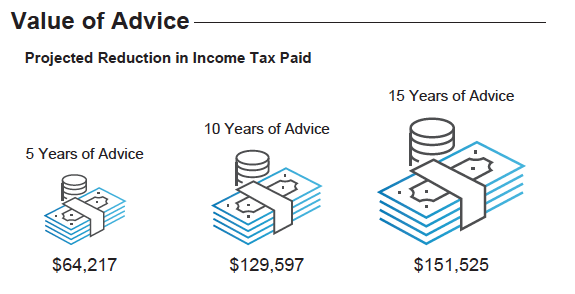

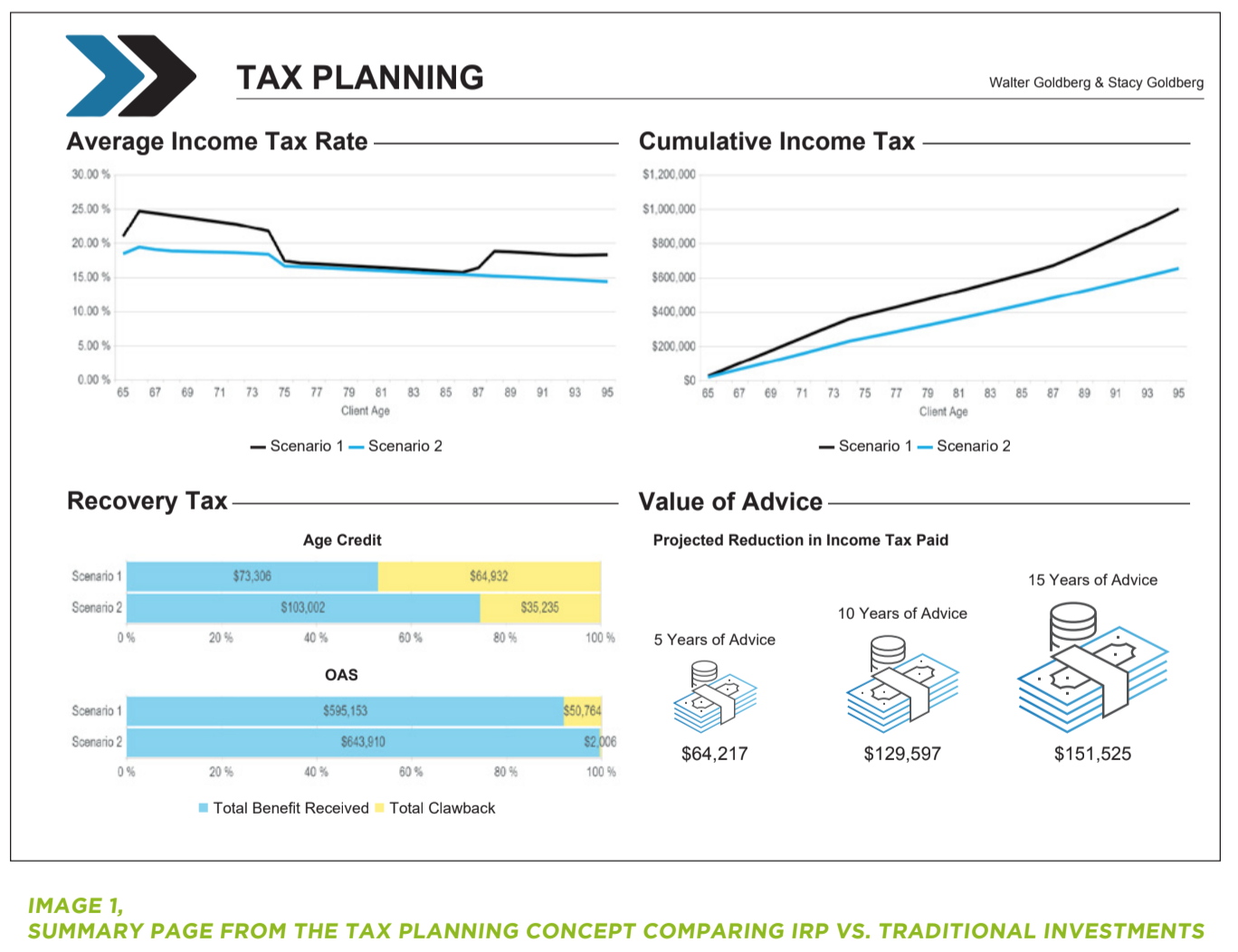

This concept clearly communicates your Value of Advice by comparing the projected income tax paid from two scenarios using a line graph along with icons representing 5, 10 and 15 years of advice.

- Scenario 1 is the client’s current plan

- Scenario 2 is your recommendations

To illustrate the advantage of using the Tax Planning concept over a product sales concept, we will examine a popular insurance sales concept, Insured Retirement Plan (IRP).

INSURED RETIREMENT PLAN (IRP): CLIENT PROFILE

The Goldbergs, Walter and Stacy, both age 65, were referred to you as an orphan policyholder by an insurance company you are contracted with. After meeting with them to provide some basic policy service, you discovered that they recently retired when Walter sold his fencing company in an asset sale.

After paying all associated taxes, they netted $1.2 million invested in a holding company and $400,000 in personally owned investments. Walter owns 90% of the holding company and 100% of the personal investments in addition to $375,000 in an RRSP. Stacy owns the remaining 10% of the company and has $325,000 in an RRSP.

In the meeting, Walter expressed unhappiness that after paying tax on the sale of the company’s assets he must pay more tax to get the money out. When you asked if he would be interested in looking at a strategy that would let him draw income from his corporate investments more tax efficiently, he agreed to meet with you again to discuss it.

Product Advice

Based on the Goldbergs financial situation you decided to suggest the Insured Retirement Plan (IRP) concept to them. Using RazorPlan to illustrate the tax advantages of the IRP concept, you create a planning file with 2 Scenarios.

Scenario 1 uses a traditional investment strategy and their limited income splitting with a lifestyle need of $120,000 reducing to $90,000 at age 75. Scenario 2 incorporates the IRP concept using a corporate owned $750,000 joint last permanent life insurance policy with annual deposits of $50,000 for 20 years.

TAX PLANNING CONCEPTS INCLUDE:

- Insured Retirement Plan (IRP)

- Insured Annuity

- Social Security Optimization

Using the summary page of the Tax Planning concept (image 1), you can see that by implementing the IRP concept the average income tax rate is reduced each year and the value of advice by the 5th year exceeds $64,000 in tax savings. After 15 years the cumulative tax savings is over $151,000.

In addition to illustrating total tax saved, recovery tax (Age Credit and OAS clawback) is also compared adding additional validation for the IRP concept.

Planning Advice

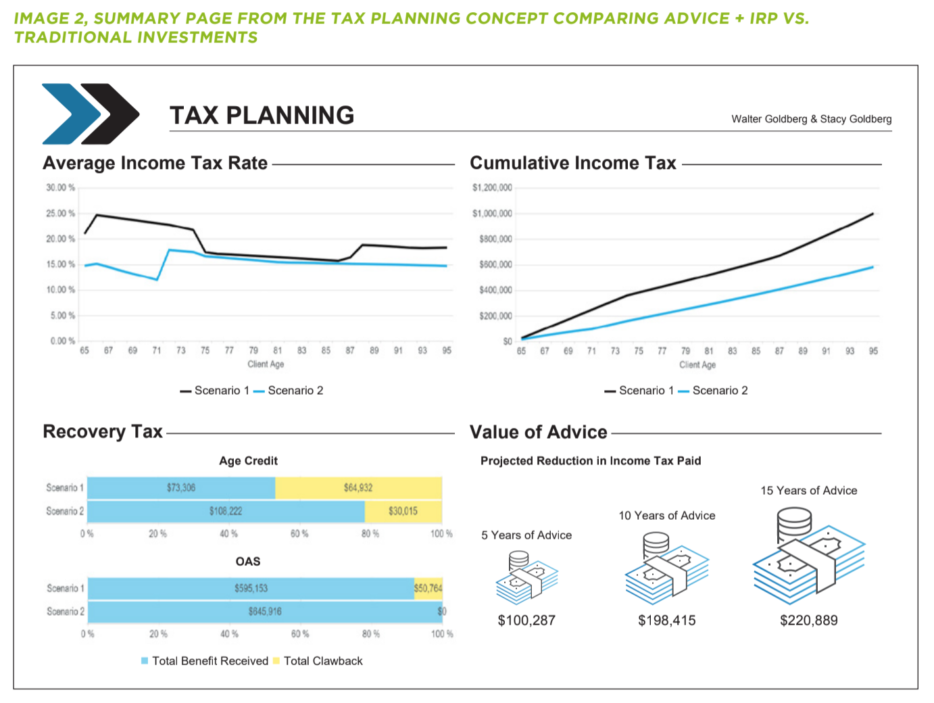

Recommending the IRP concept on its own significantly reduced the annual income taxes by reducing the amount withdrawn from corporate investments, but your value is limited to a product sale. When you include other recommendations aimed at minimizing income tax, you create Value over Product™ and help your clients better appreciate the financial advice, guidance and products you recommend.

In addition to the IRP strategy, what if you add the following recommendations in Scenario 2?

- Delaying the conversion of the RRSPs to a RRIF until age 71 creates an opportunity to use some of the tax-paid investments for lifestyle, further reducing the amount of taxable income until age 72.

- The Goldbergs have not contributed to their TFSAs in the past, as their focus was on corporate growth and RRSPs. Incorporate TFSAs into their asset allocation strategy to include TFSA contributions using taxable investments this year and each year in the future.

- Implement income splitting strategies to split investment income from the taxable investments. In addition, modify corporate share structure to allow more of the corporate dividends to be paid to Stacy.

Adding these additional recommendations using the RazorPlan Tax Planning concept creates Value over Product™ by improving the results by an additional $35,000 over 5 years and $70,000 over 15 years compared to the product only recommendation.

In part 5 of our series, we will be discussing Retirement Planning.

Planning as a Concept™ is a feature of RazorPlan financial planning software and uses Value of Advice to validate your recommendations and instill confidence in you as a financial professional.

Leave a Reply

Want to join the discussion?Feel free to contribute!