Planning as a Concept: Risk Management

By Dave Faulkner January 8, 2019

In part three of our six-part Planning as a Concept series, this post is focused on Risk Management. Download the ebook: Planning as a Concept.

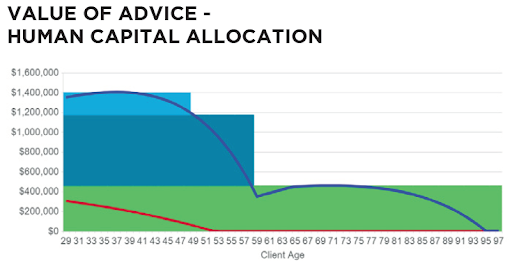

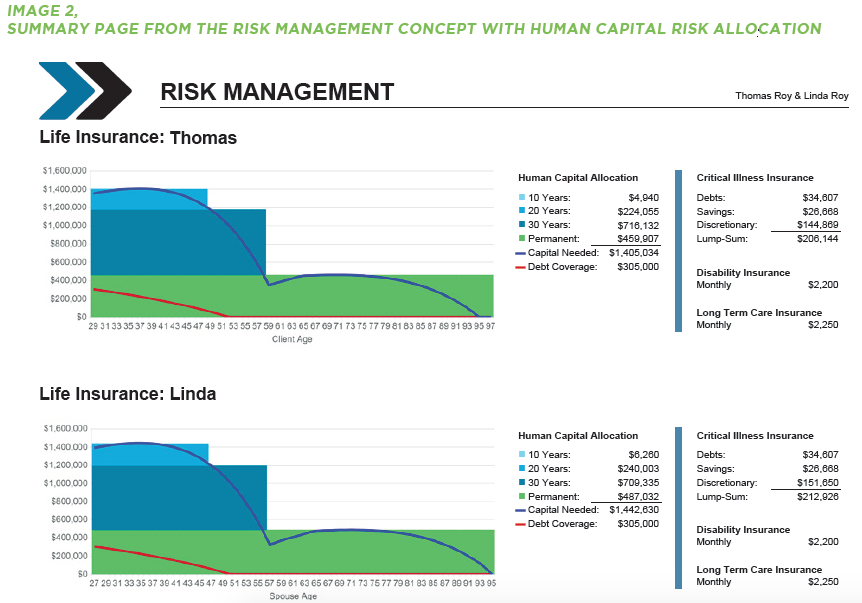

With a focus on current and future earning power, the Risk Management concept measures value by using human capital as the metric. By viewing their human capital value as a tangible asset that should be insured, client that have a personal desire to give their family the best lifestyle they can are motivated to act. Risk Management concepts include Cost of Waiting, Term vs. Permanent, and Layered Rider Allocation.

Risk Management is a required part of a comprehensive financial planning engagement. Without risk management, a client’s financial plans would be at risk due to events out of their control. Financial loss involving property damage is easily managed using an insurance policy to replace the tangible value of the property in question. Events involving your ability to earn an income are more difficult to manage due to a lack of tangible value.

The Risk Management concept uses the client’s Human Capital to create a tangible financial loss due to death, disability, critical illness and long-term care. This concept enhances your Value of Advice by comparing the present value of lost income to 2 primary needs:

- Mortgage and debt repayment

- Savings and discretionary spending (lifestyle)

The report clearly communicates the client’s Human Capital and allocates this value in relation to various types of life and living benefit insurance policies. To illustrate the advantage of using the Risk Management concept over a product sales concept, we will examine the industry standard Insurance Needs Analysis.

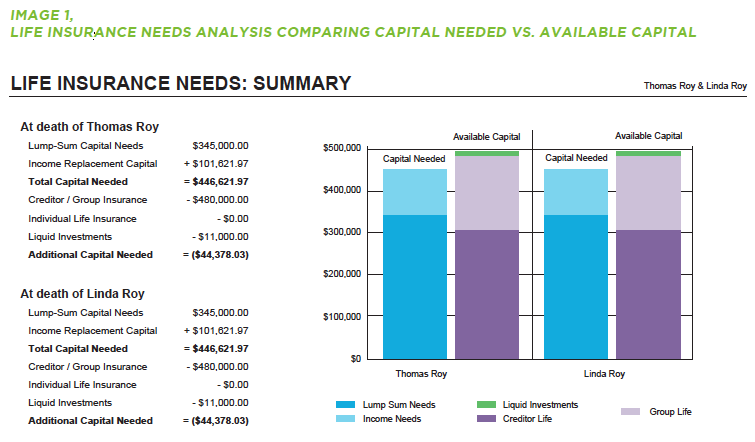

INSURANCE NEEDS ANALYSIS: CLIENT PROFILE

Thomas and Linda Roy, age 30 & 27, found you in a Google search for life insurance. Married for 2 years, they recently purchased their first home and were searching for quotes on $300,000 of mortgage insurance.

They both work in IT for different tech companies and have stable positions that pay them a combined $154,500 in salary. Together they have saved $40,000 in their RRSP & TFSA, and make monthly contributions totaling $1,300. With no immediate plans to start a family, they feel that should one of them die, insuring the mortgage plus the value of their group insurance and investment savings will be more than adequate for the surviving partner.

Product Advice

You arranged a meeting with Tom and Linda in your office to complete a life insurance needs analysis. After entering their lump-sum needs which include the mortgage, 2 small car loans and final expenses, you asked them how much each of them would need monthly to maintain their lifestyle. After a moment of thought, they replied zero.

After explaining to them how important it is to include an amount of monthly income for the surviving partner, they reluctantly agreed to consider replacing only $1,000 / month for 10 years.

The report prepared by the insurance needs analysis confirmed what Tom and Linda believed, mortgage insurance along with their savings and group insurance would be adequate for the surviving partner. They also agreed that should they decide to have children in the future, they would likely need to purchase more insurance, but that could wait.

Using a traditional insurance needs analysis will help to sell an amount of insurance needed today should the client die, but does it go far enough in helping the client understand their future needs?

RISK MANAGEMENT CONCEPTS INCLUDE:

- Cost of Waiting

- Term vs. Permanent

- Layered Rider Allocation

Planning Advice

Although the insurance needs analysis will compare available capital to capital needed in the event of death today, it is based on paying for an expense rather than replacing the tangible value of an asset. In the case of mortgage insurance, the amount purchased is equal to the debt owed. This is much different than fire insurance where the amount purchased is equal to the tangible value of the asset, regardless of how much other wealth the client may have. There is no consideration to reduce coverage by their current savings, or for the question “What type of house do you need if this one is destroyed in a fire?”

When you make recommendations for insurance based on the client’s Human Capital, you create Value over Product™ and help your clients better appreciate the financial advice, guidance and products you recommend.

Using Human Capital in place of a traditional needs analysis offers 3 main advantages:

- Human Capital converts the client’s future earning power into a tangible asset that can be applied to all forms of insurance needs; life, disability, critical illness and long-term.

- Human Capital is a lifetime calculation that incorporates all types of income that could be disrupted including employment income, pensions and government benefits.

- Human Capital can be allocated to all types of coverage and terms offered, so that you can make an insurance recommendation that is the most efficient in both amount of coverage and premiums.

Calculating insurance needs using the RazorPlan Risk Management concept increases your Value of Advice by illustrating the tangible value of future earnings in a way the client will appreciate.

The Risk Management concept begins a conversation about the future and introduces living benefits as a valuable part of any insurance portfolio.

By using Human Capital, it was easy for Tom and Linda to see the role life insurance would play in their future financial plans, and they agreed to additional coverage above the mortgage balance. They also agreed to purchase critical illness insurance equal to one year’s income as added protection against financial loss.

With Human Capital it is not about selling 100% of the amount illustrated, it is about creating Value over Product™ by educating the client on the future need and purpose of the various types of insurance coverage you offer.

In part 4 of our series, we will be discussing Tax Planning.

Planning as a Concept™ is a feature of RazorPlan financial planning software and uses Value of Advice to validate your recommendations and instill confidence in you as a financial professional.

Have been waiting for info like this for quite a while, as I’ve challenged explaining HCV to clients and prospects. Excellent!